Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

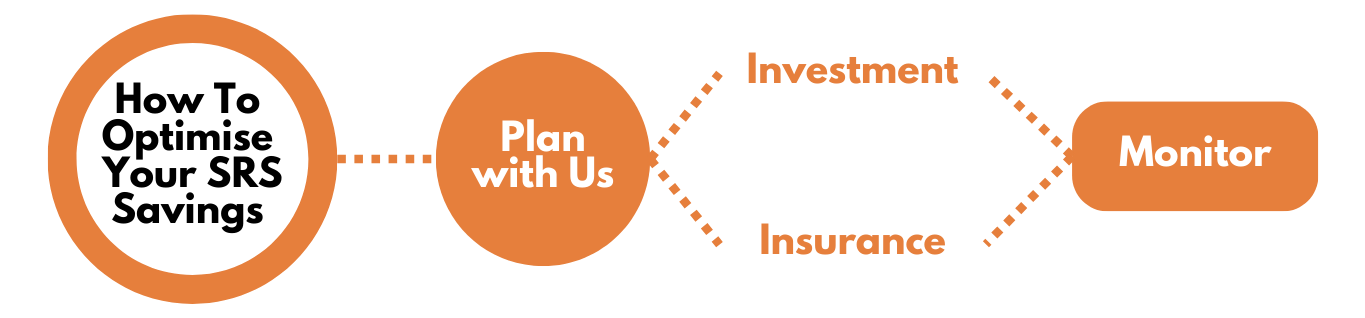

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

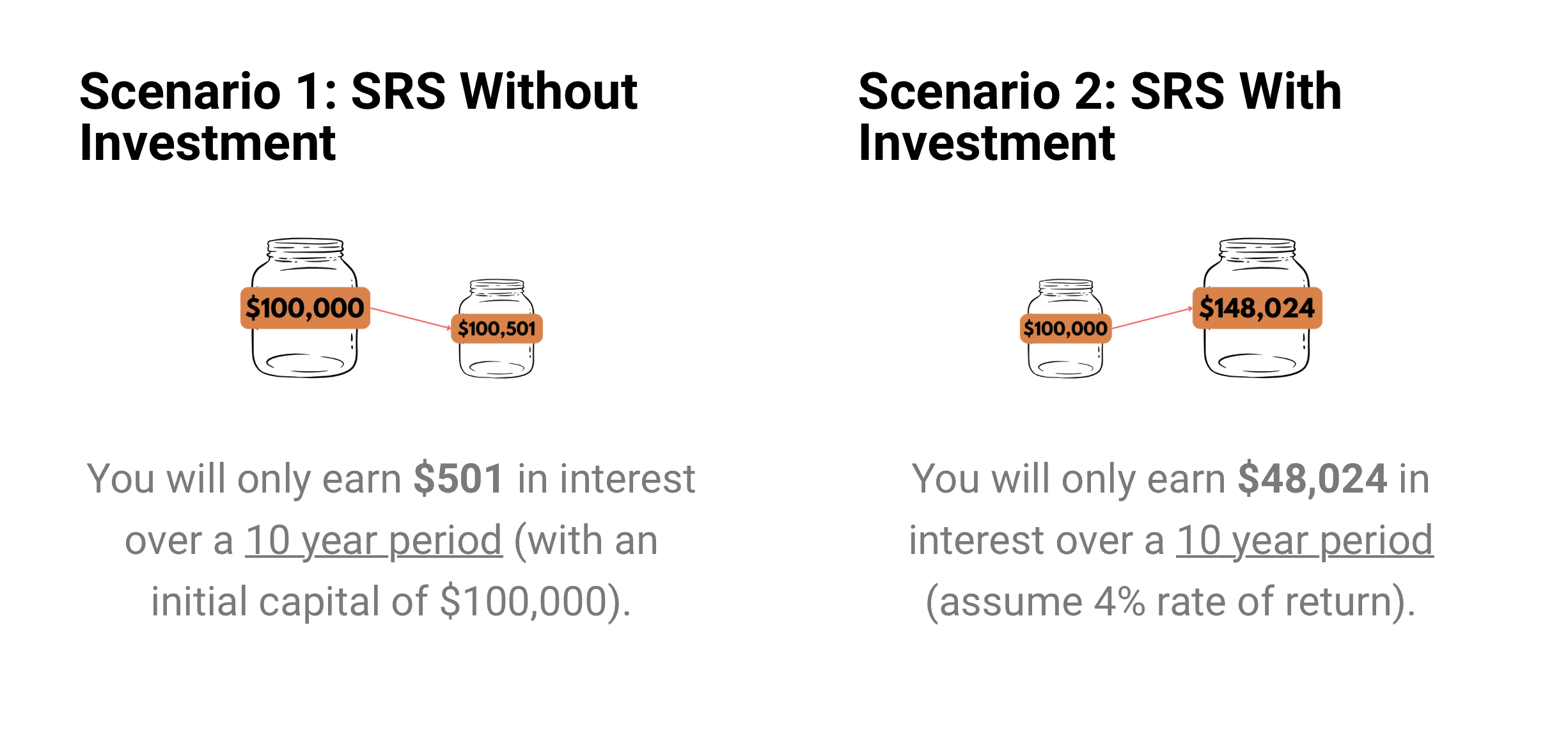

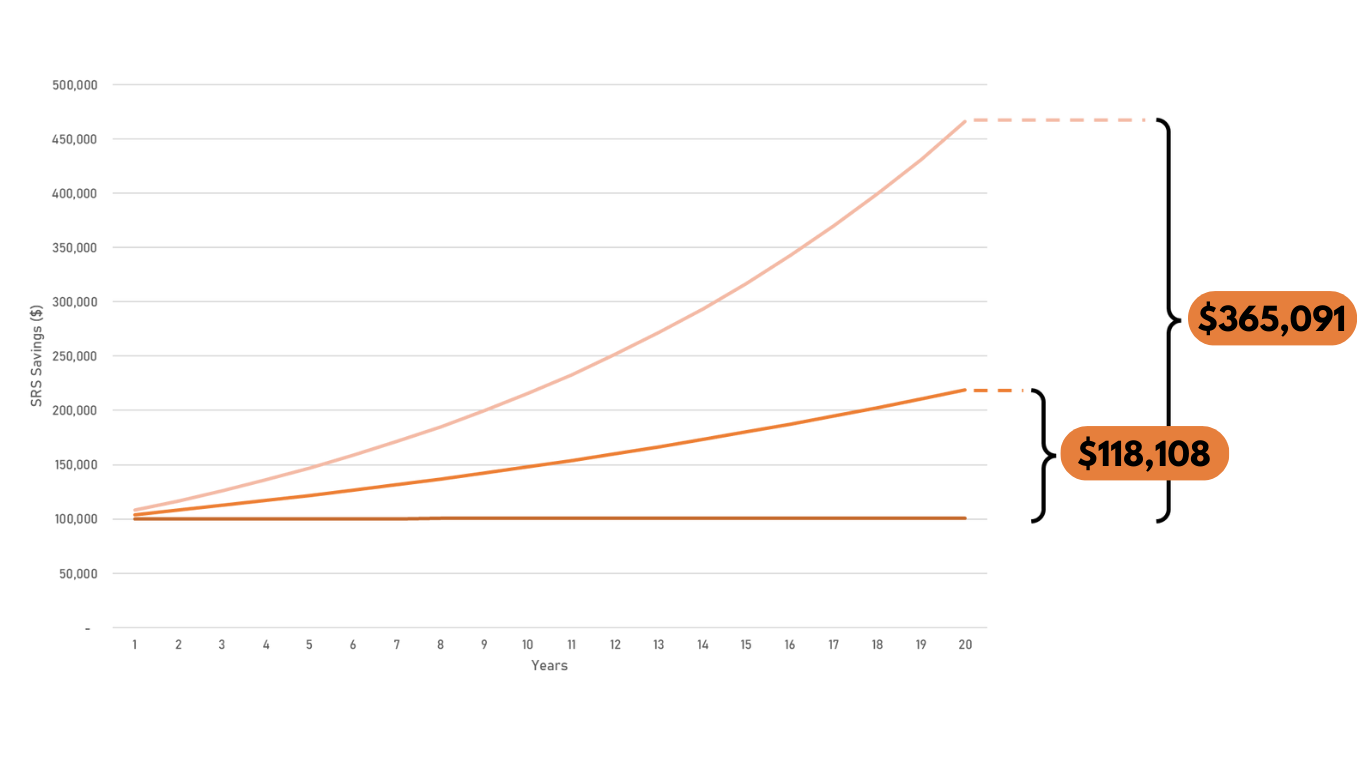

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

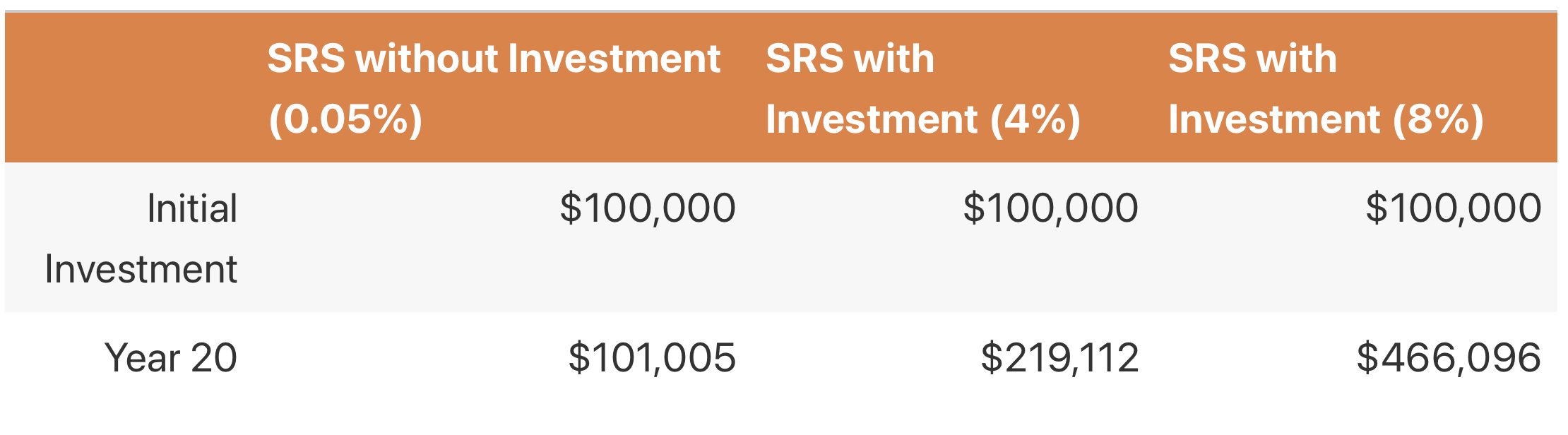

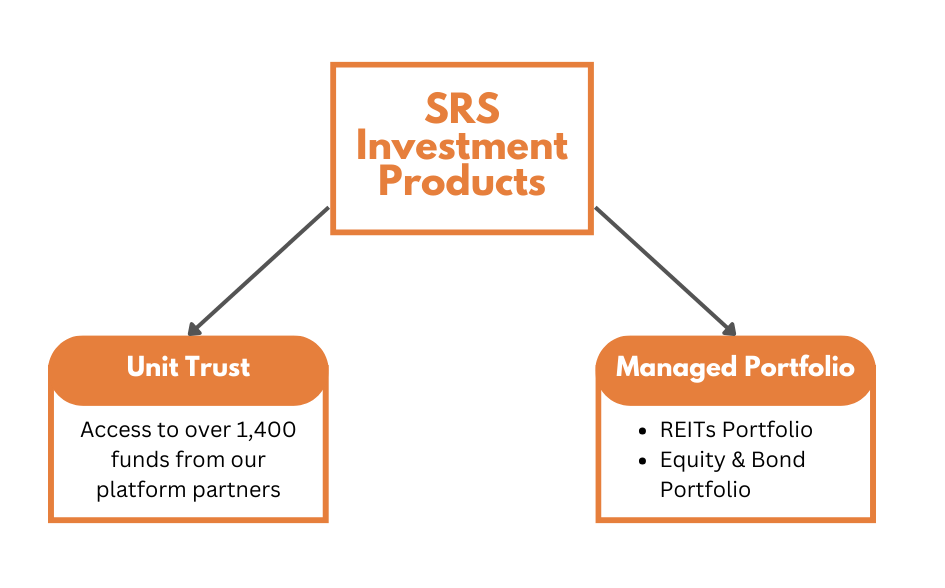

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

Rooted in character growth, continuous learning, and meaningful relationships, Cedric Lim strives to make a positive impact in the lives of others. Every challenge he’s faced has strengthened his belief in living with honesty, integrity and striving for excellence.

Graduating with a Bachelor's degree in Computer Engineering from Singapore Institute of Technology, Cedric took a leap of faith into the financial industry with Financial Alliance. He now applies his analytical and problem-solving skills to help clients simplify and take control of their financial lives.

He believes that the right advisor is someone who walks alongside his clients through every stage of life, not just today, but for the long haul. Financial planning is a lifelong partnership, and finding the right guide can make all the difference.

Cedric focuses on helping graduates and young professionals who are navigating similar stages of life, believing that shared experiences foster deeper understanding and greater trust.

His mission is to effectively help others reach their financial goals.

If you're a young professional seeking financial guidance, Cedric's confident that you are at the right place.

By transforming uncertainty into clarity, Cedric empowers his clients to take control of their financial future — minimizing stress and eliminating guesswork.

To find out more about Cedric, click HERE!

Drop me a text to schedule a one-to-one consultation session!

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's most progressive financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are fully MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreBy definition, a FA firm is one that sells the products from more than one insurer or business partner.

However, you should consider whether the FA firm can ensure that financial advice given is free from the undue financial influence.

Ever since our founding more than two decades ago, Financial Alliance is committed to offer impartial and client-centric financial advice.

We have your best interest at heart and will leave you to make your decision.

If suitable and impartial financial advice is what you seek, then you should only engage a trusted FA firm.

At Financial Alliance, we are dedicated to offering our clients the best financial advice.