Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

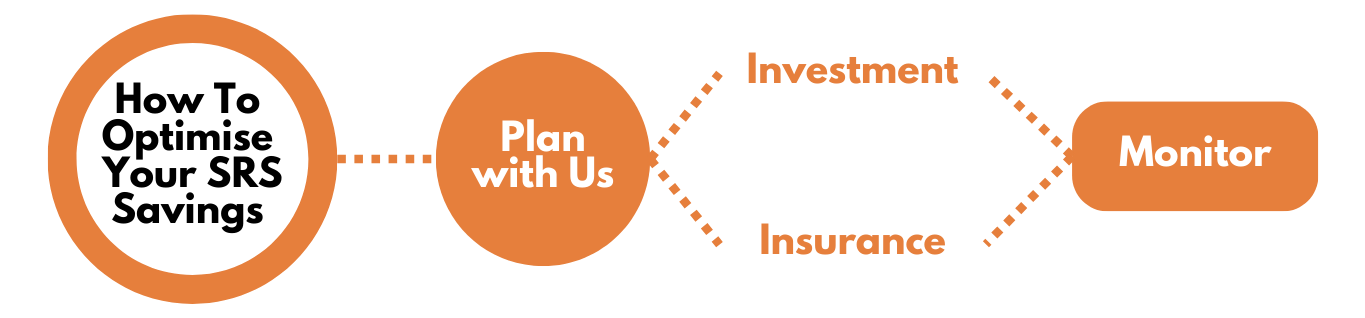

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

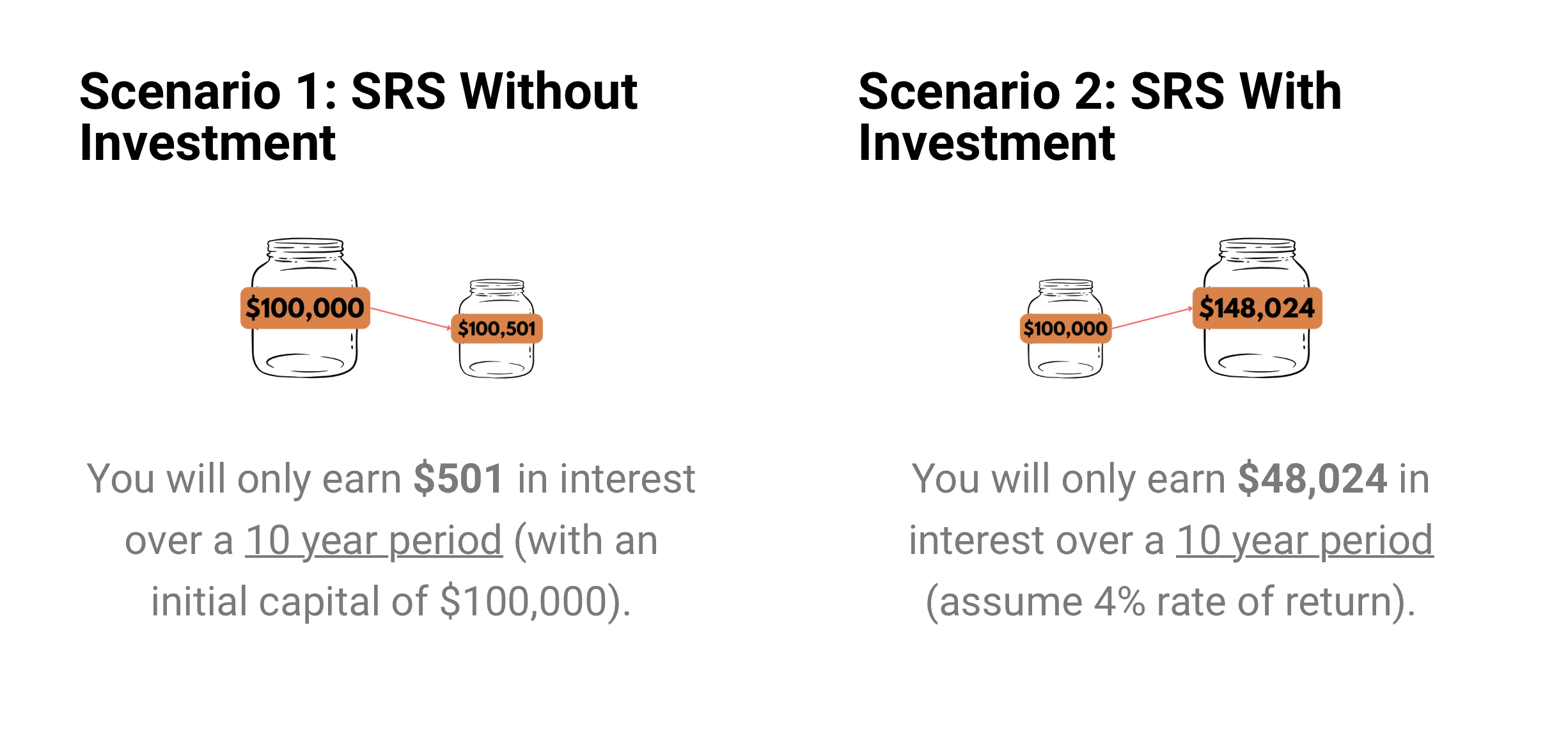

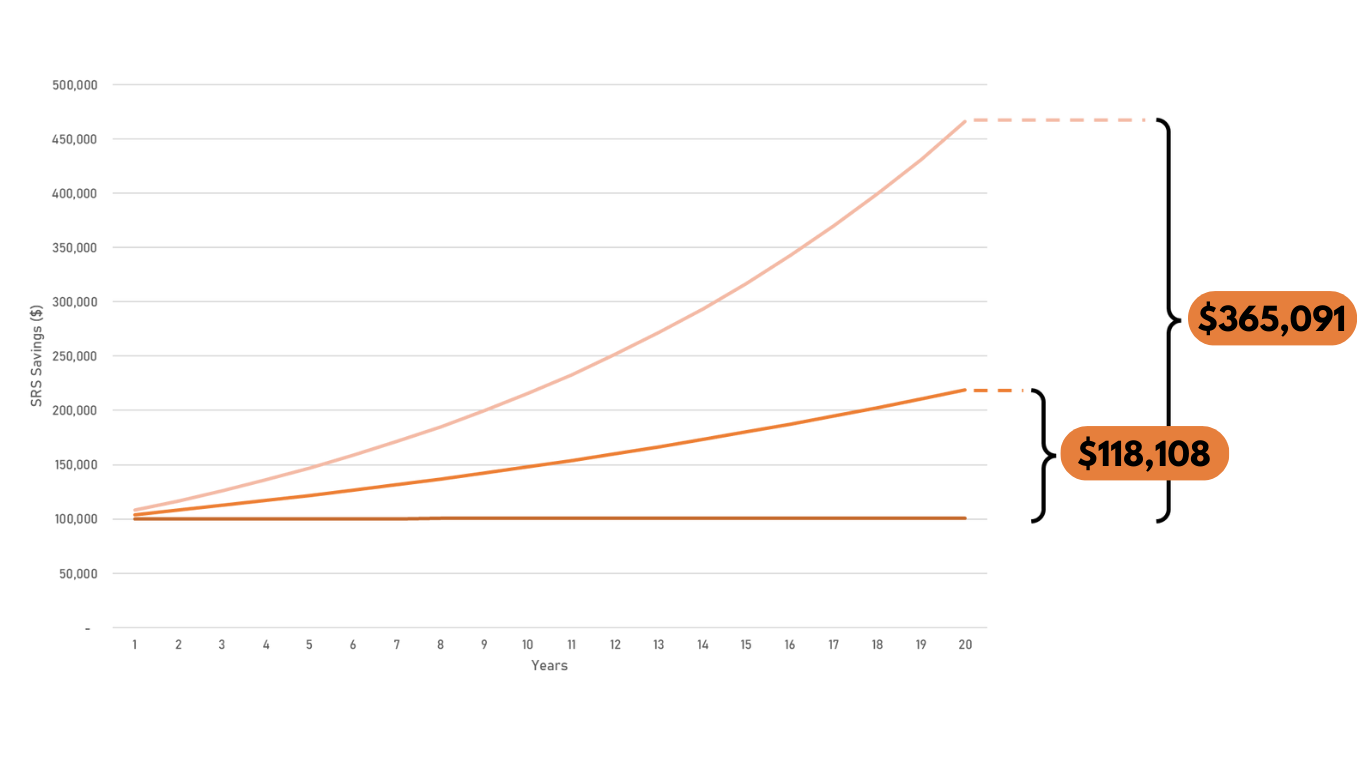

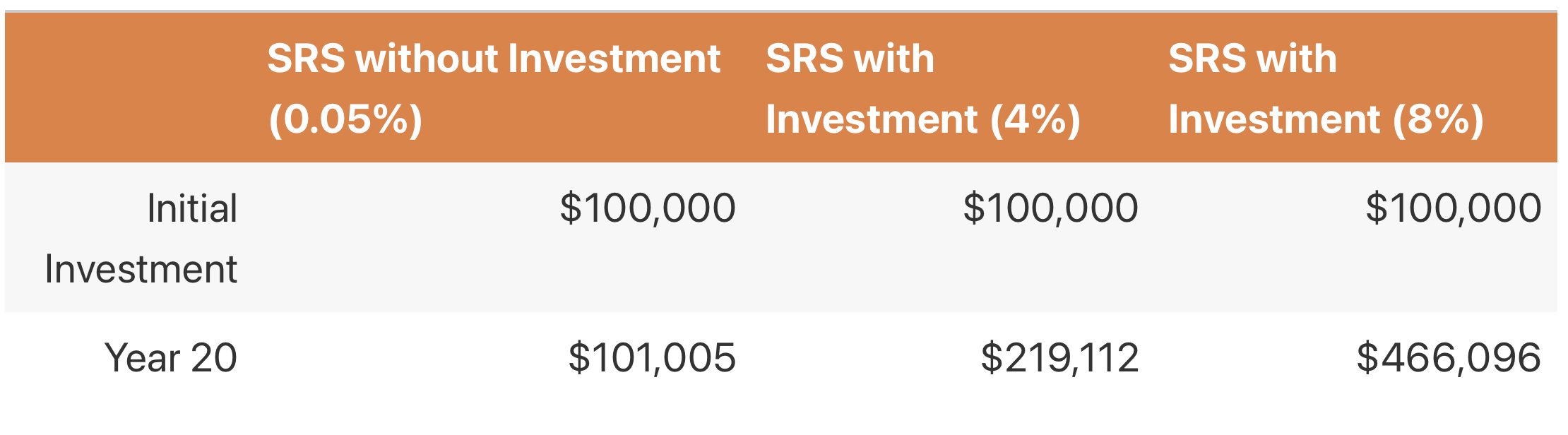

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

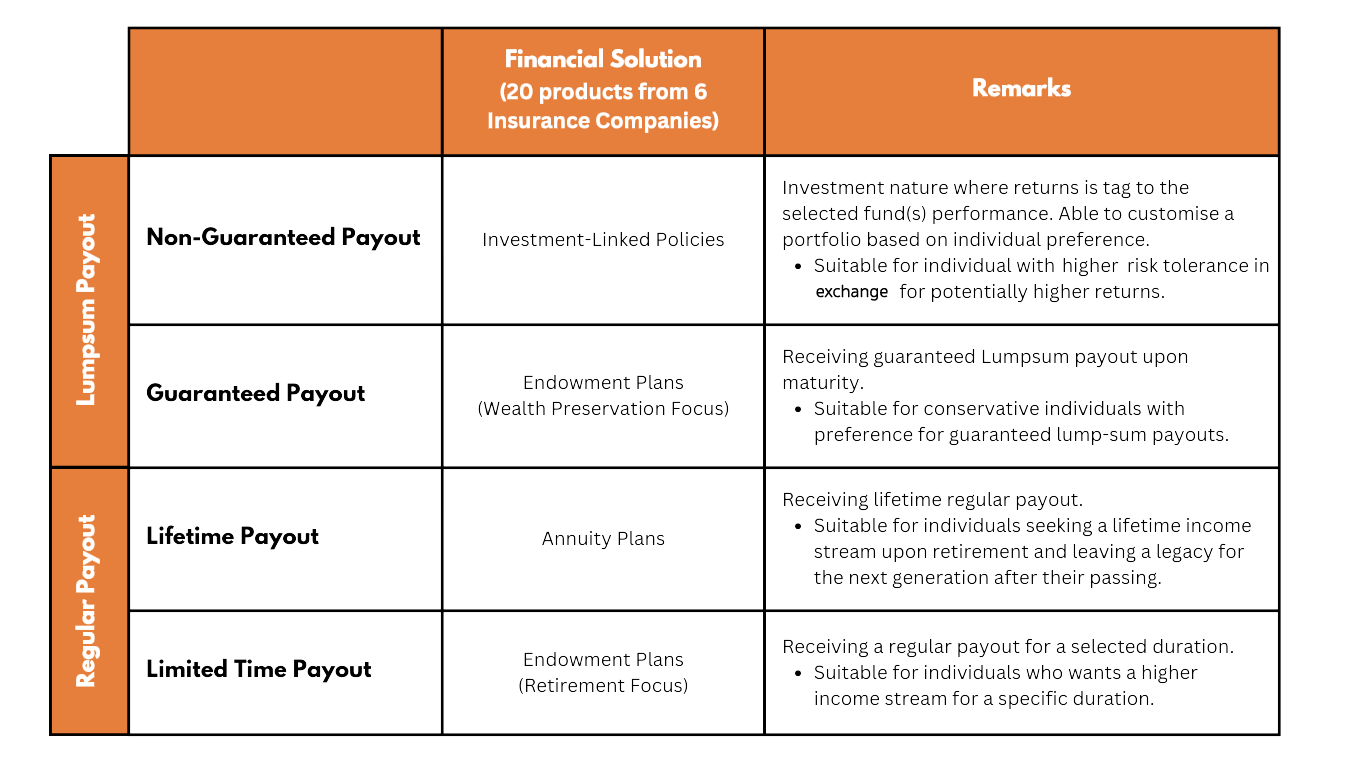

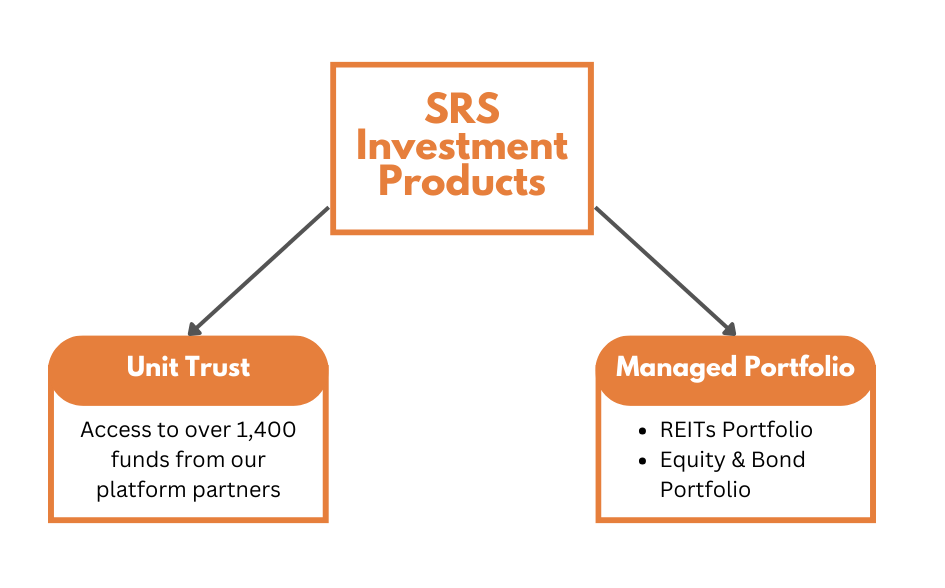

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

Chenise Lim is committed to provide quality advice to her clients. She believes very strongly that a financial plan goes a long way to helping clients achieve their lifestyle dreams, “I know that financial planning done right will make a positive difference in people’s lives”. More importantly, she builds relationships through understanding and overseeing clients’ concerns.

Chenise’s passion for financial planning for clients was the impetus that made her move out of corporate insurance to financial advisory in 1998. Since then, she has worked with various advisory firms in which she applied her financial planning skills in cash flow management, risk management, Investment planning, tax planning and estate planning with great success. Along the way, and with different firms, she picked up key performance awards such as the “Top Revenue” recipient, the “Top Consultant” award and “Top in acquiring client transfer” in her first 3 months with IPAC. Moreover, she constantly achieves being in the top 5% in overall performance. She also has prior experience in setting up her own practice that had a full Financial Advisory licence from MAS. Currently, she is working with Financial Alliance as an Wealth Advisory Director, managing clients’ comprehensive needs analysis; corporate schemes such as investment planning, employee benefits, medical insurance, pension and risk management strategies. She also assists in advising, guiding and mentoring some consultants in the organization with respect to the different skill sets required to build a successful career.

Some of the past workshops Chenise has conducted are: “Women & Investing”; “Medical Insurance required for students going to study overseas”; “Seminar for the 30s”; “Retirement Planning”; “Smart Women” and “Financial Planning for school teachers/staff”.

Chenise was also one of the formally selected consultants to work with DBM – an outplacement specialist who helps their clients (mainly MNCs) go through financial needs matters during their transition.

Valuing a balanced lifestyle and understanding there’s more to life than just work, Chenise has always been active in associations outside of work. She was heavily involved with the Insurance and Financial Practitioners Association of Singapore (IFPAS). Chenise previously held the role of Vice President in Public Relations for the Toastmasters Club in 2000 and played an active role in creating workshops for girls in the Toa Payoh Girls Home with UWAS, where she held the role of Secretary. Chenise has also contributed to articles to the newspapers and magazines (including Her World) and appeared on TV to discuss various financial planning topics. She appears on Vodcast on “Women & Finance” occasionally and is actively servicing in her cell group.

In her leisure time, Chenise enjoys reading, travelling and handicraft work. She holds a Bachelor of Business in Financial Planning from the Royal Melbourne Institute of Technology (RMIT) and obtained her Master of Business (Personal Financial Planning) from University of Southern Queensland (USQ) in 2010.

Chenise is competent in providing Comprehensive Financial Planning, including Cashflow Management, Tax Planning, Investment Planning, wealth Planning, General Insurance as well as Group and Life Insurance schemes. Her vast clientele is made up of different age groups and different levels of net-worth. Chenise also works alongside some families in the region on their estate and trust matters.

Some of her corporate clientele include MNCs and SMEs as she administers and advises on their group employee benefits and staff retention schemes.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

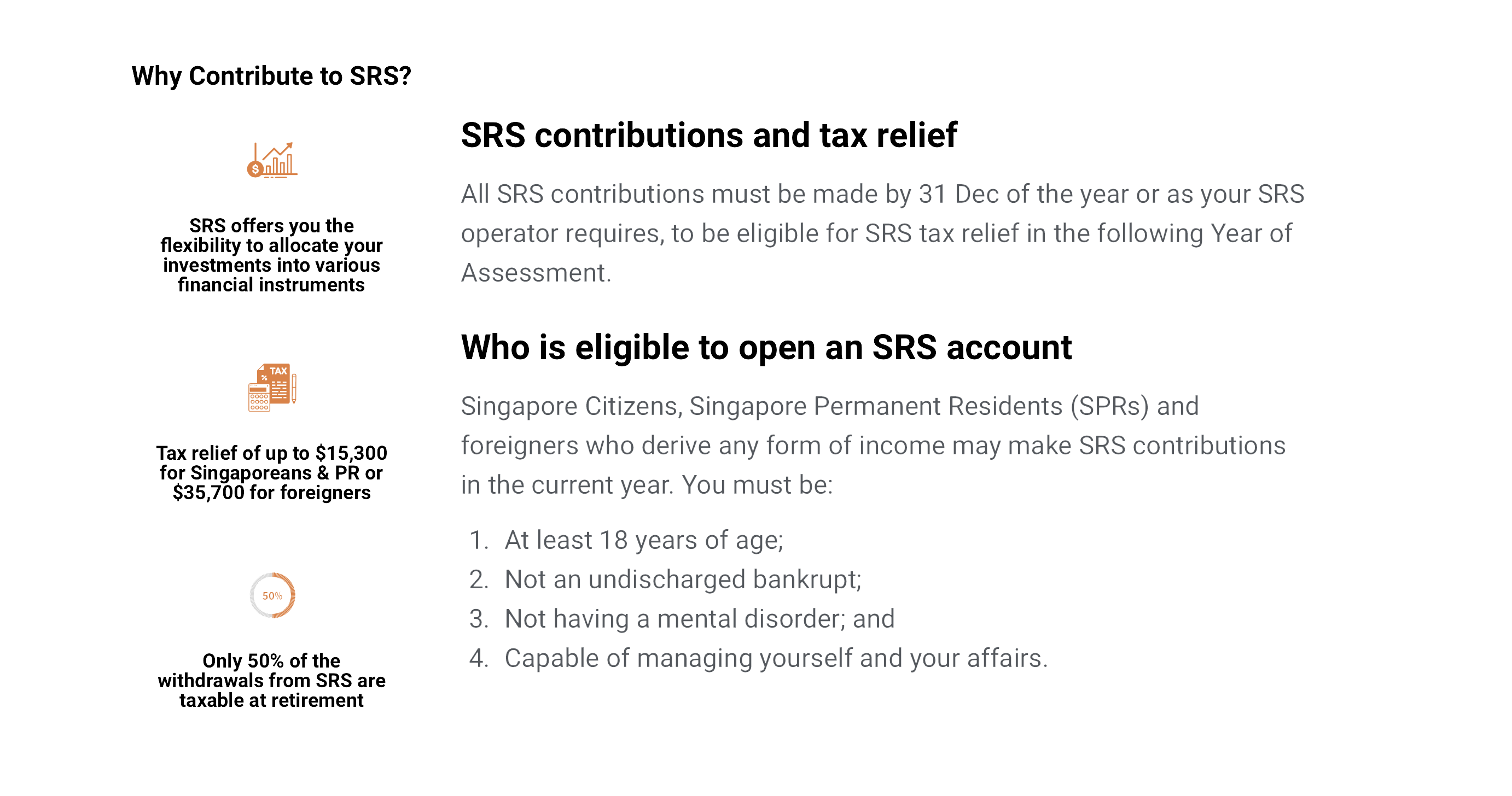

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.