Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

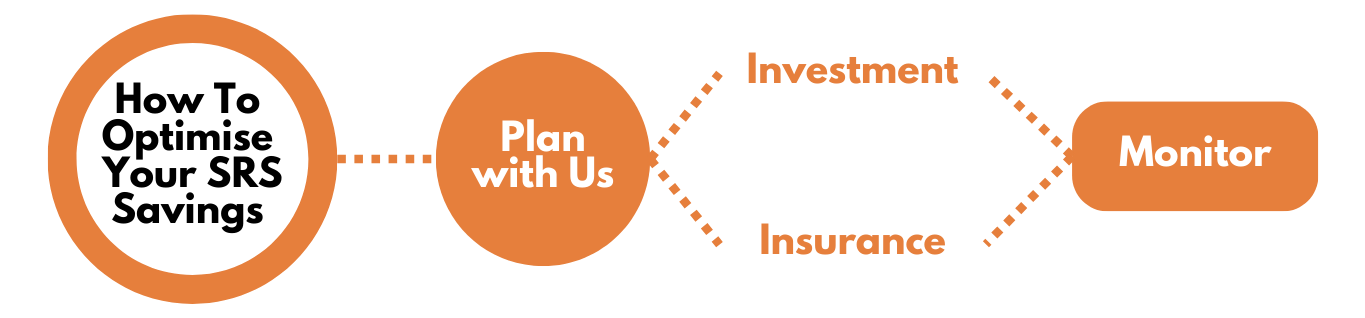

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

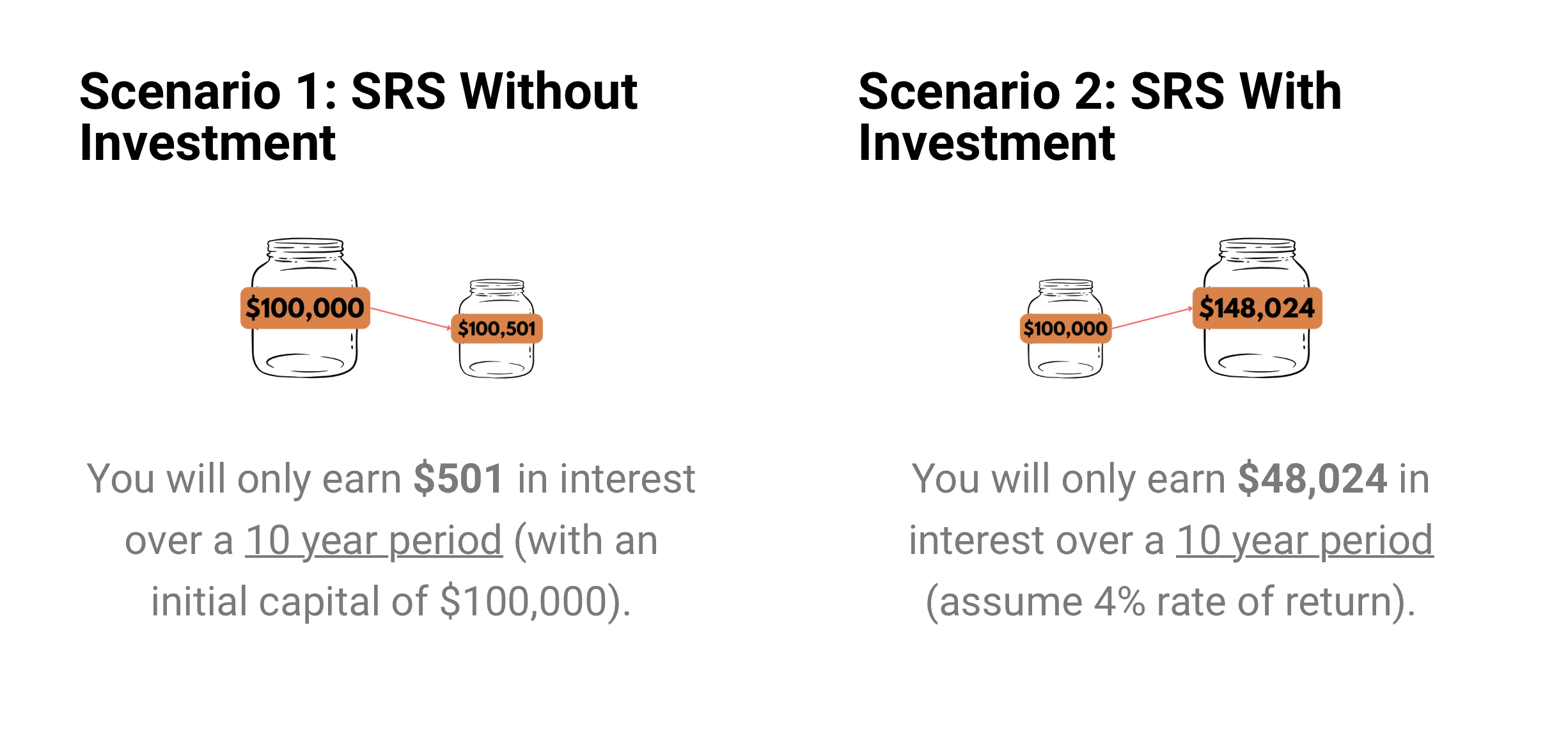

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

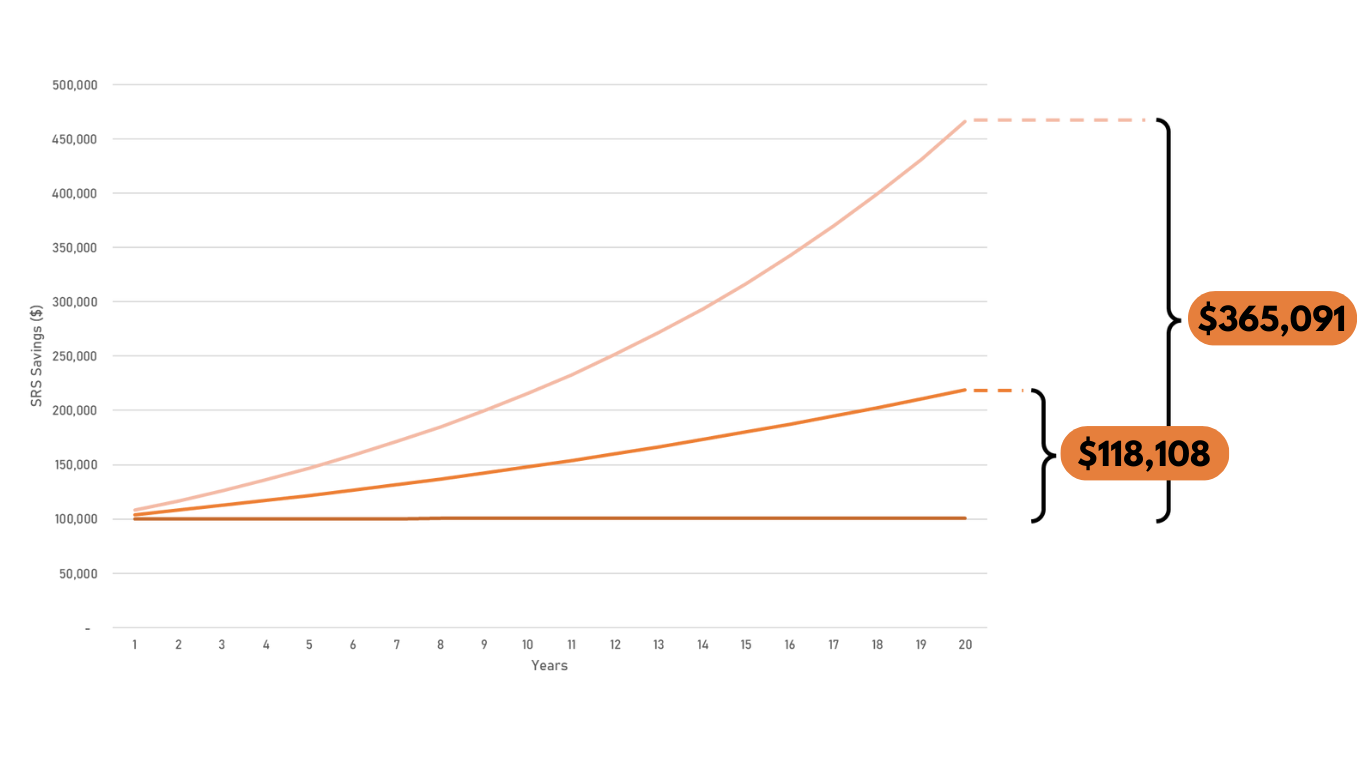

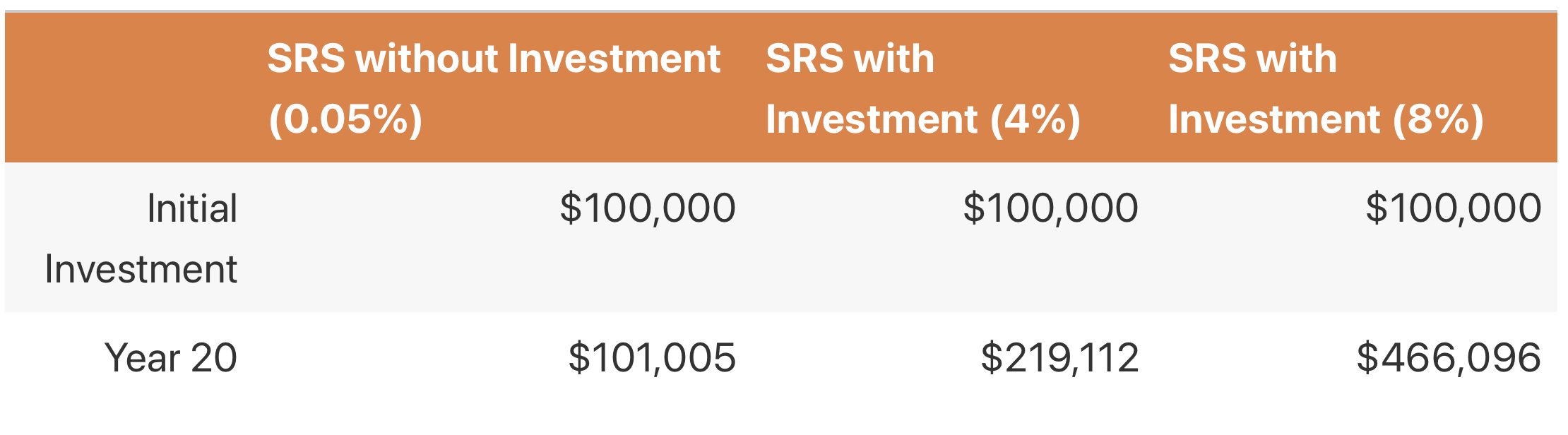

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

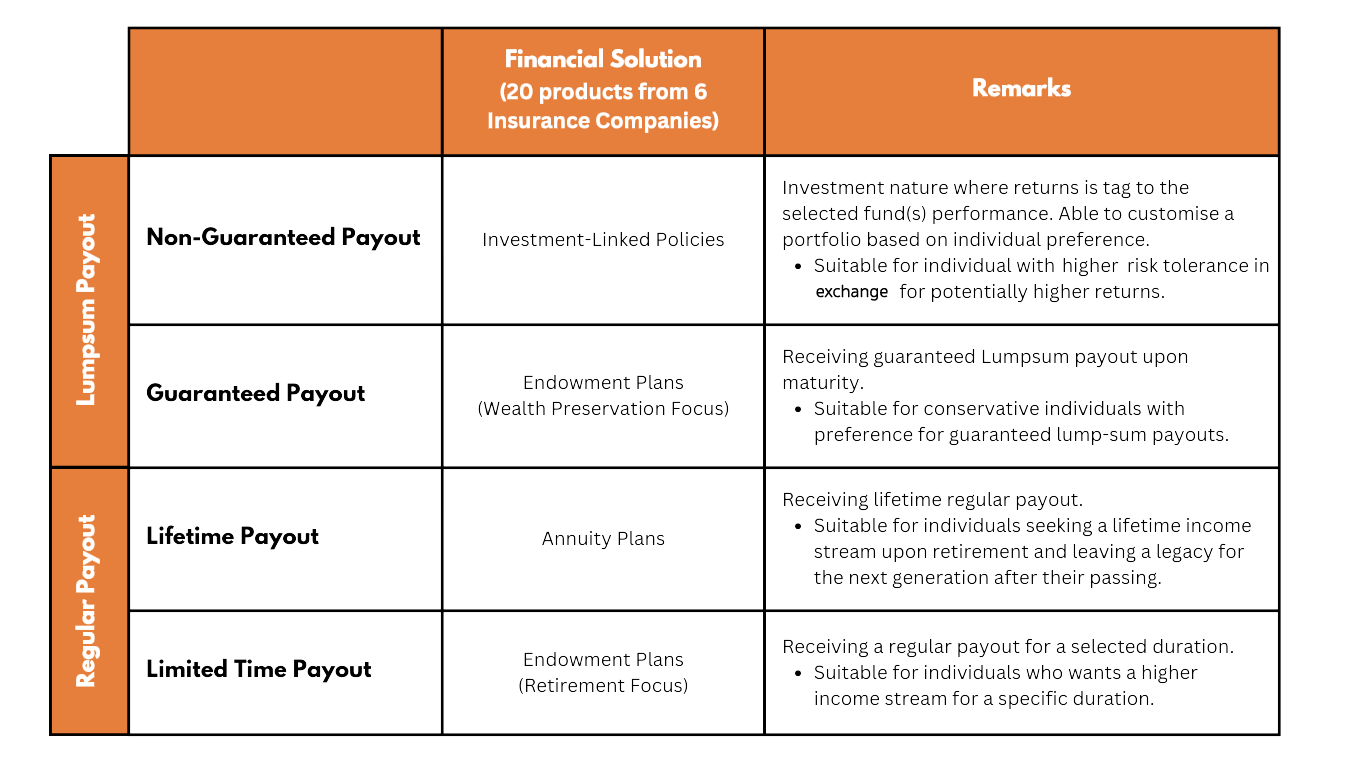

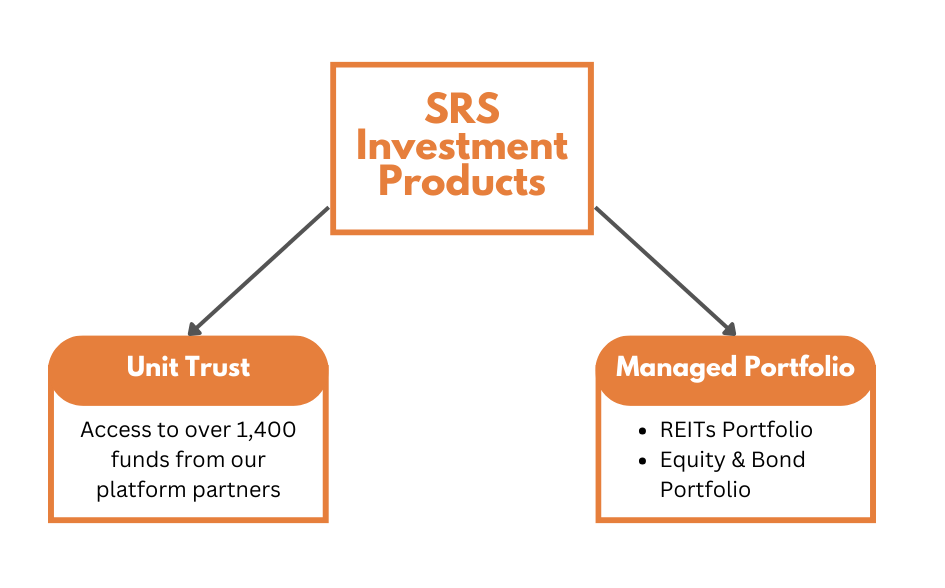

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

INDEPENDENT FINANCIAL ADVISOR (IFA)

By being “INDEPENDENT”, Lee offers impartial financial advice that is in the clients’ interest instead of providing biased advice that is unduly influenced by his business/insurer partners’ sales quotas or higher commissions.

As an independent financial advisory (IFA) firm, we have stuck to this principle from day one so that our clients benefit fully from impartial advice and put in place the best-suited financial plans.

With over a decade of experience in the finance industry, Lee has a wealth of knowledge and expertise that he brings to every client interaction. He has helped individuals and families achieve their financial goals and has earned a reputation as the go-to financial adviser for his clients.

What sets Lee apart is his ability to simplify complex financial concepts and make them easy to understand for his clients. As Lee believes that "Education is a Powerful Medicine", he is committed in educating his clients on all aspects of personal finance and takes the time to explain the pros and cons of different options in the market with no biasness to any of his business/ insurers partners. He empowers his clients to make informed financial decisions that are in line with their goals and ideals.

Lee is also known for his exceptional customer service. He has a team of dedicated professionals who work with him to provide his clients with the highest level of support and guidance. He believes in building strong, long-lasting relationships with his clients.

Lee is currently managing portfolio of clients from the US, China, India, Italy, Japan and ASEAN profiles.

独立理财顾问(IFA)

作为“独立”的理财顾问,李提供的是符合客户利益的公正理财建议,而不是被他的业务/保险公司合作伙伴的销售配额或高佣金所过度影响的有偏见的建议。作为一家独立理财顾问(IFA)公司,我们从一开始就坚持这一原则,使我们的客户能够完全受益于公正的建议,并制定最适合的理财计划。

凭借在金融行业超过十年的经验,李拥有丰富的知识和专业技能,并将这些带到每一次与客户的互动中。他帮助了个人和家庭实现他们的财务目标,并赢得了高净值客户的首选财务顾问的声誉。

李的与众不同之处在于他能够简化复杂的金融概念,使客户容易理解。因为李相信“教育是一剂强有力的药方”,他致力于在个人理财的各个方面教育客户,并花时间解释市场上不同选项的优缺点,而不偏袒任何商业或保险公司合作伙伴。他赋予客户做出符合其目标和理想的明智财务决策的能力。

李还以其卓越的客户服务而闻名。他有一支敬业的专业团队,与他一起为客户提供最高水平的支持和指导。他相信与客户建立强大且持久的关系。

李目前管理着来自美国、中国、印度、意大利、日本和东盟的客户组合。

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.