Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

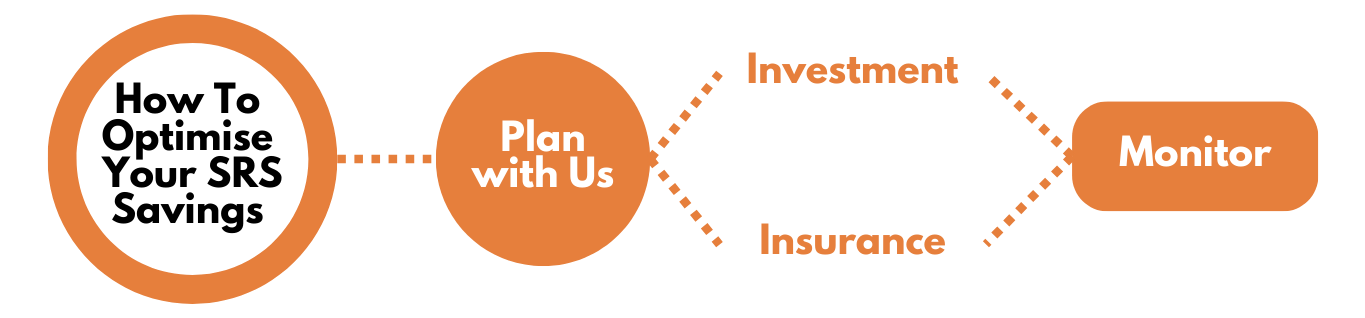

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

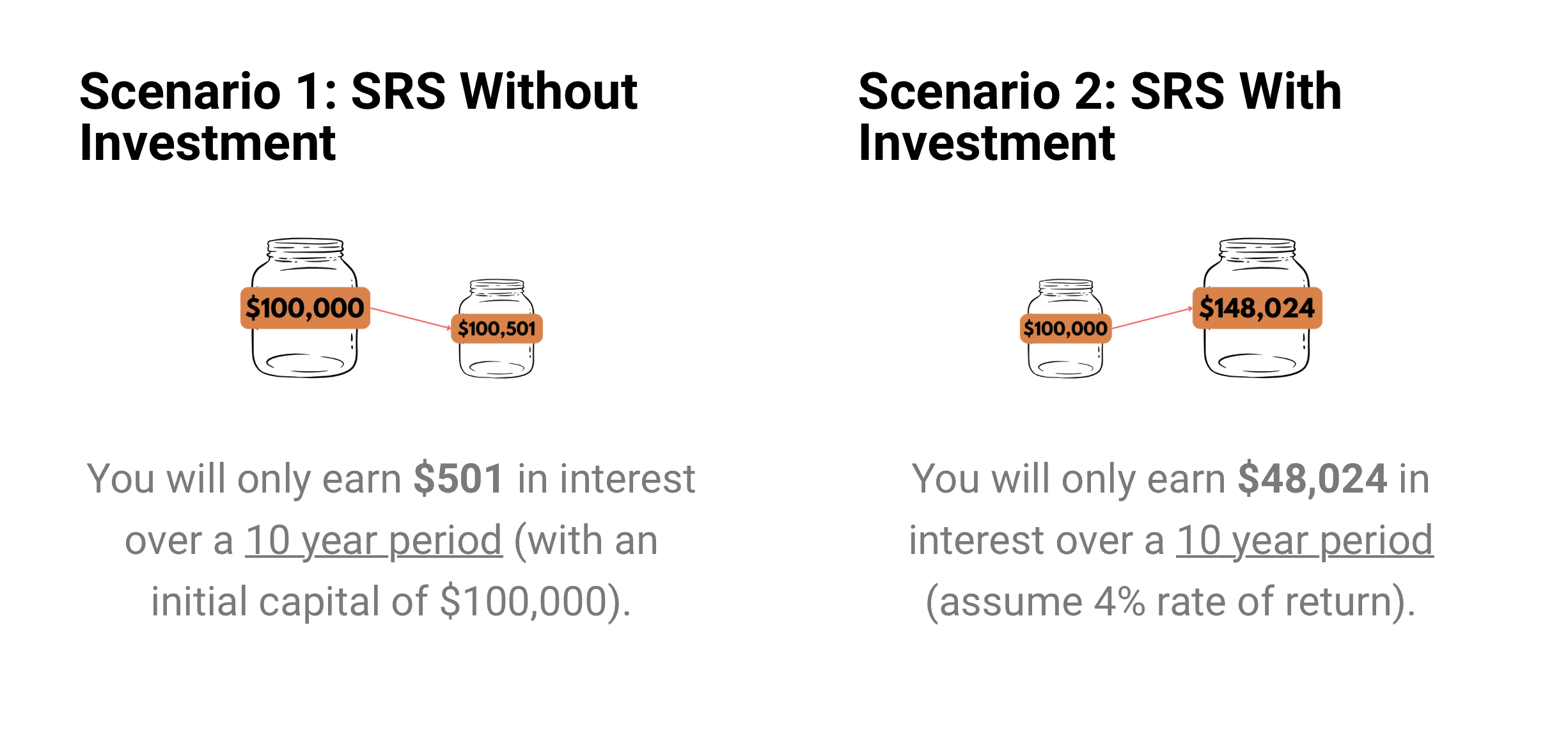

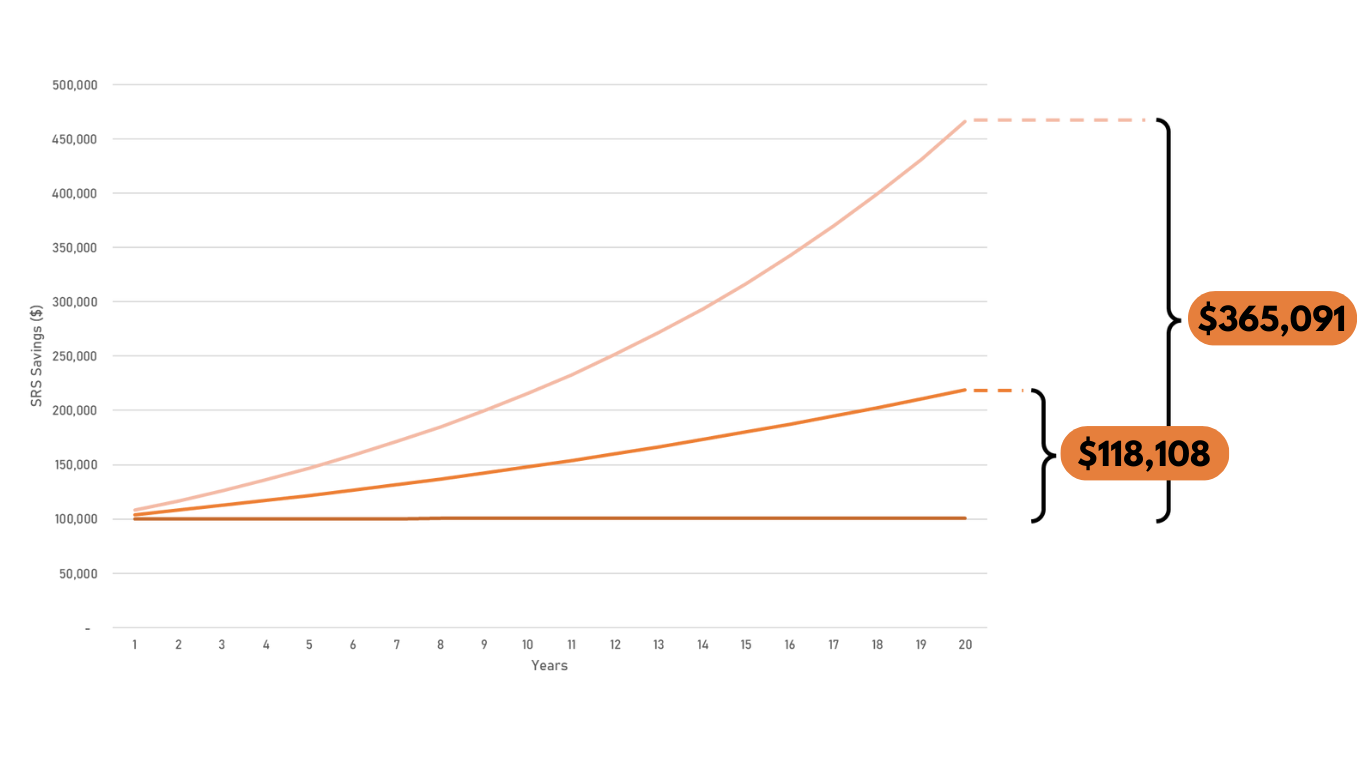

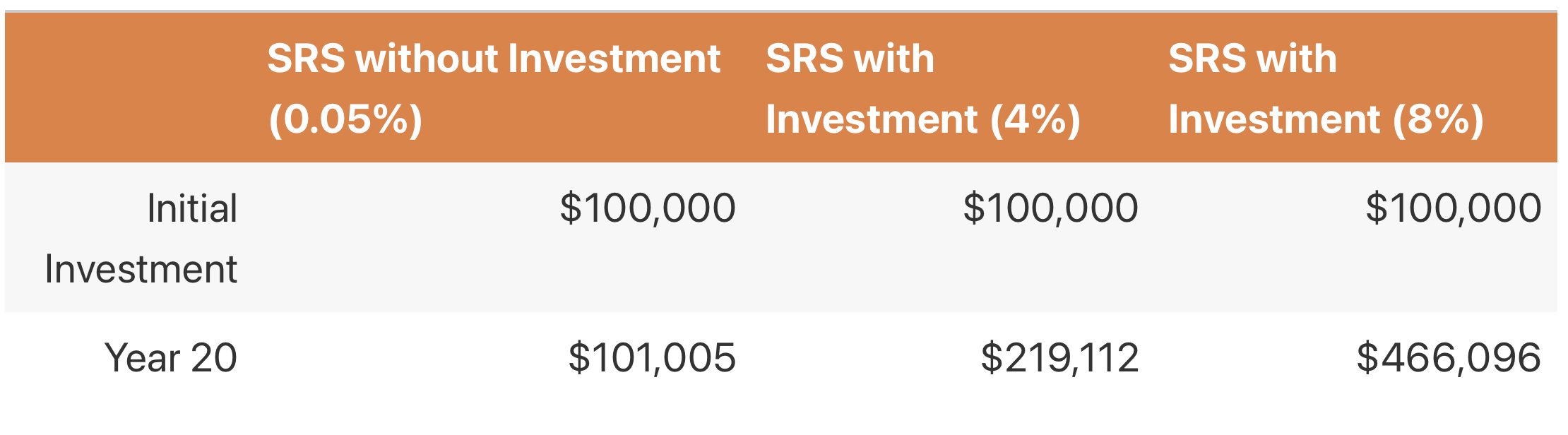

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

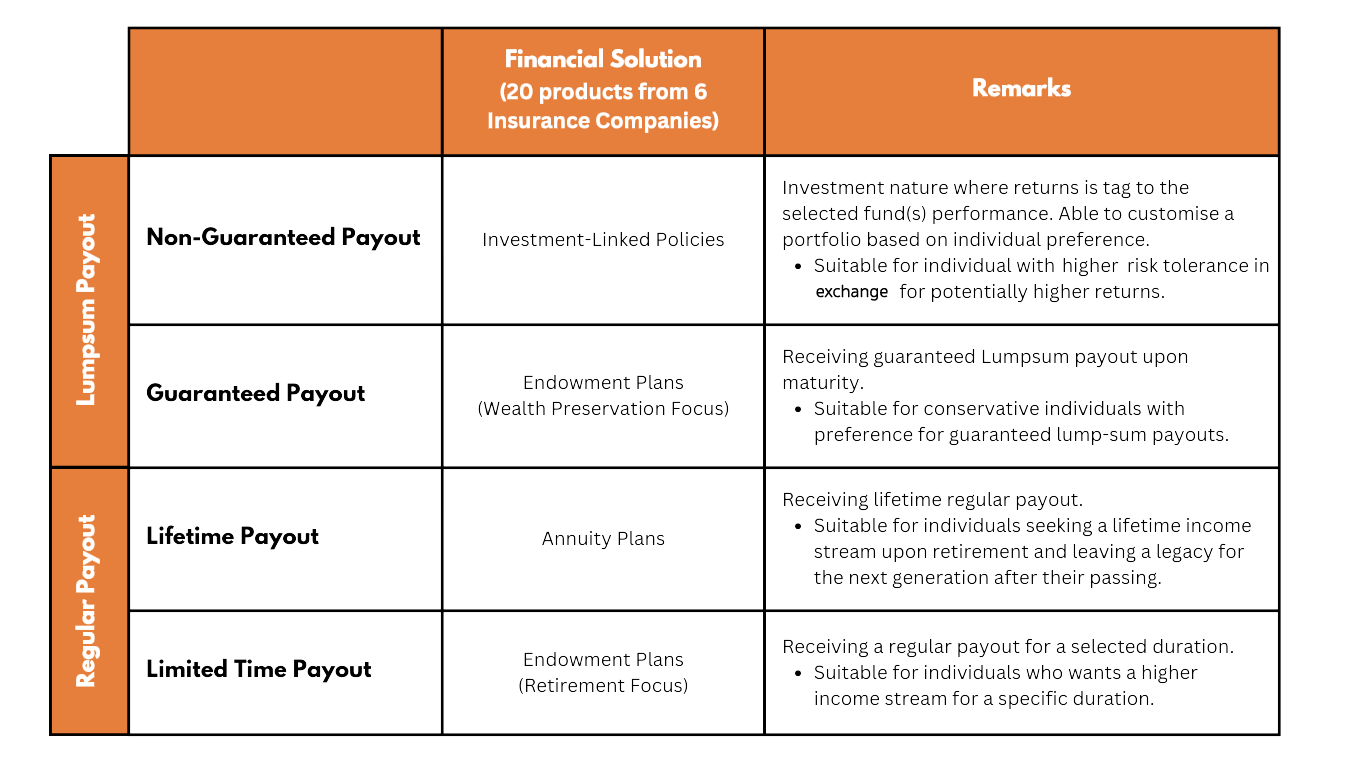

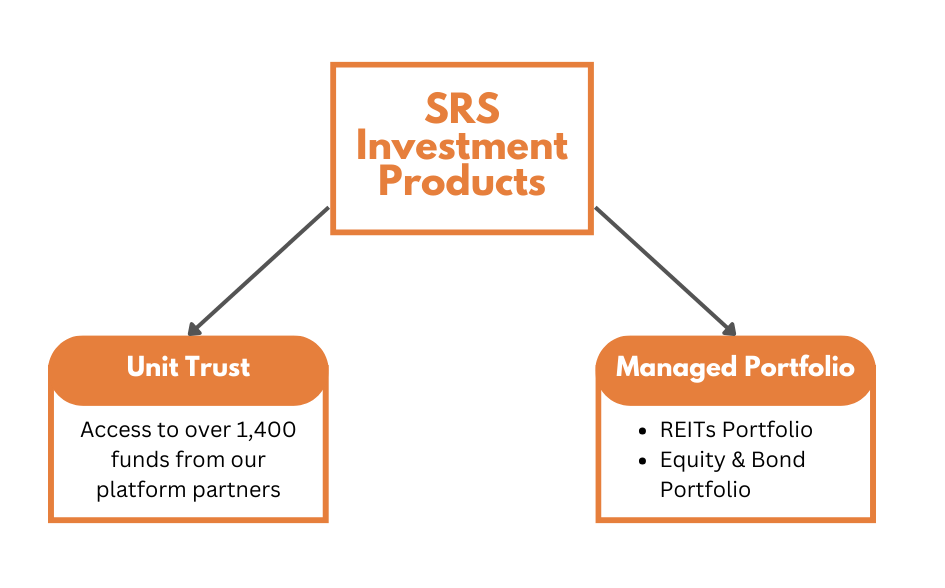

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

在我国,高净值人群对理财的需求日益增强,但大多数人面临理财知识匮乏的挑战。传统的理财机构,如私人银行和第三方理财公司,虽然在一定程度上满足了高净值客户的需求,但由于管理环节繁琐和效率低下,往往无法提供最佳的解决方案。此外,这些机构的理财经理受到销售业绩压力,可能会向客户推荐不适合的理财产品,这使得客户在理财过程中面临诸多痛点。 针对这一现状,我致力于提供全面、以客户为中心的独立理财规划服务,旨在解决高净值人群在理财中遇到的问题。我擅长的领域包括新加坡各类保险规划,退休规划、基金投资建议、房贷介绍、遗嘱及家族信托安排、家族办公室服务以及传承规划等。通过一站式服务,我能够为客户量身定制合适的理财方案,确保他们的财富能够得到合理配置和有效传承。 我的目标是帮助客户建立全面的理财规划体系,让每位高净值客户都能享受到专业、高效且透明的理财服务。

In China, the demand for wealth management among high-net-worth individuals is on the rise, yet many face the challenge of insufficient financial knowledge. Traditional financial institutions, such as private banks and third-party wealth management firms, partially meet the needs of high-net-worth clients. However, their complex management processes and inefficiencies often prevent them from providing optimal solutions. Additionally, financial advisors in these institutions may face pressure to meet sales targets, leading them to recommend products that may not be suitable for their clients, thus creating several pain points in the wealth management process.

In response to this situation, I am committed to offering comprehensive, client-centered independent financial planning services aimed at addressing the challenges faced by high-net-worth individuals in managing their wealth. My areas of expertise include various insurance planning in Singapore, retirement planning, fund investment advice, mortgage introductions, estate planning and family trust arrangements, family office services, and legacy planning. Through a one-stop service approach, I am able to tailor appropriate financial solutions for my clients, ensuring that their wealth is effectively allocated and preserved for future generations.

My goal is to help clients establish a comprehensive financial planning system, allowing each high-net-worth individual to enjoy professional, efficient, and transparent wealth management services.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.