Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

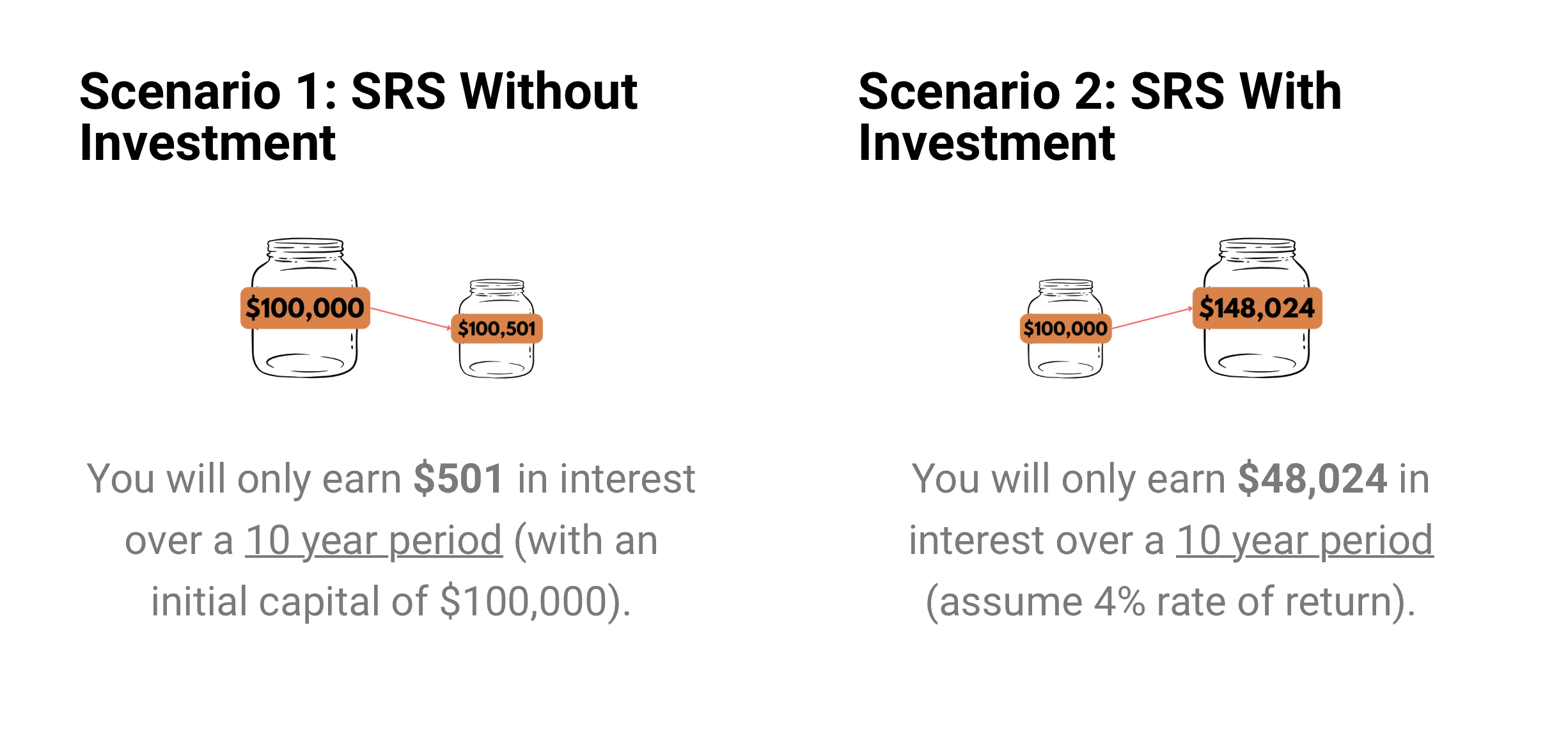

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

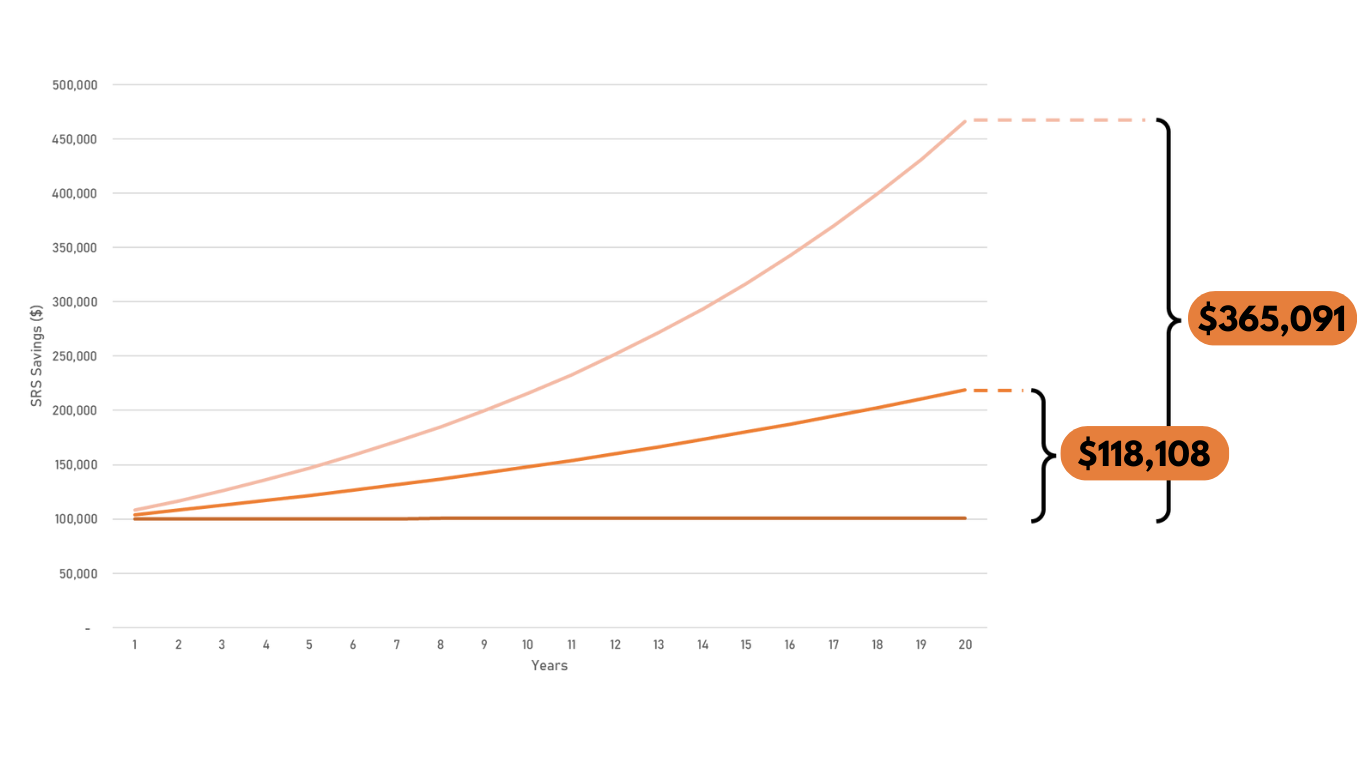

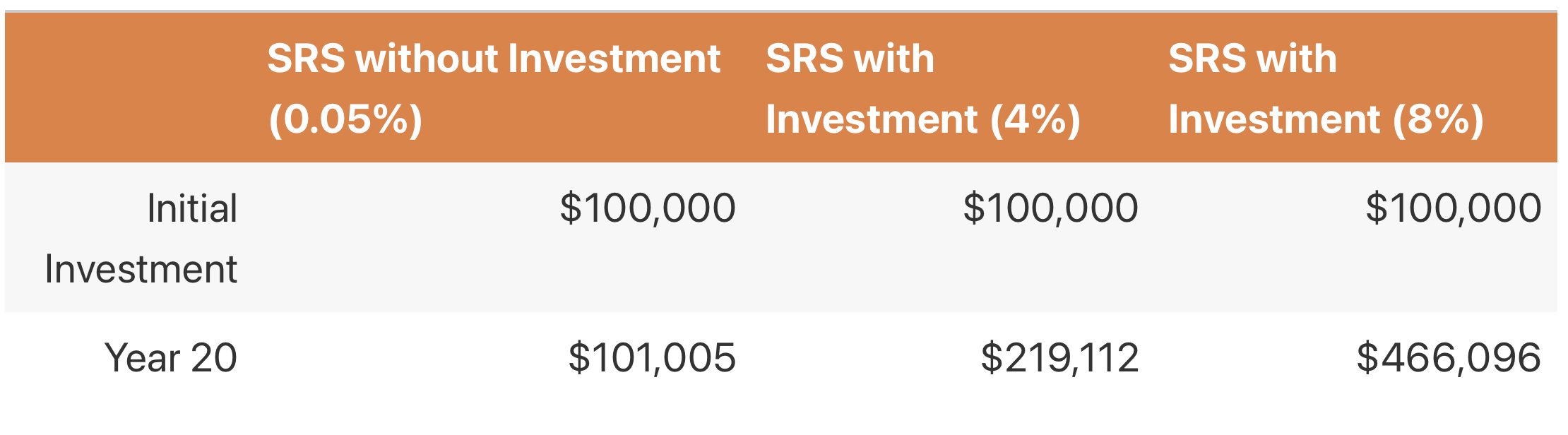

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

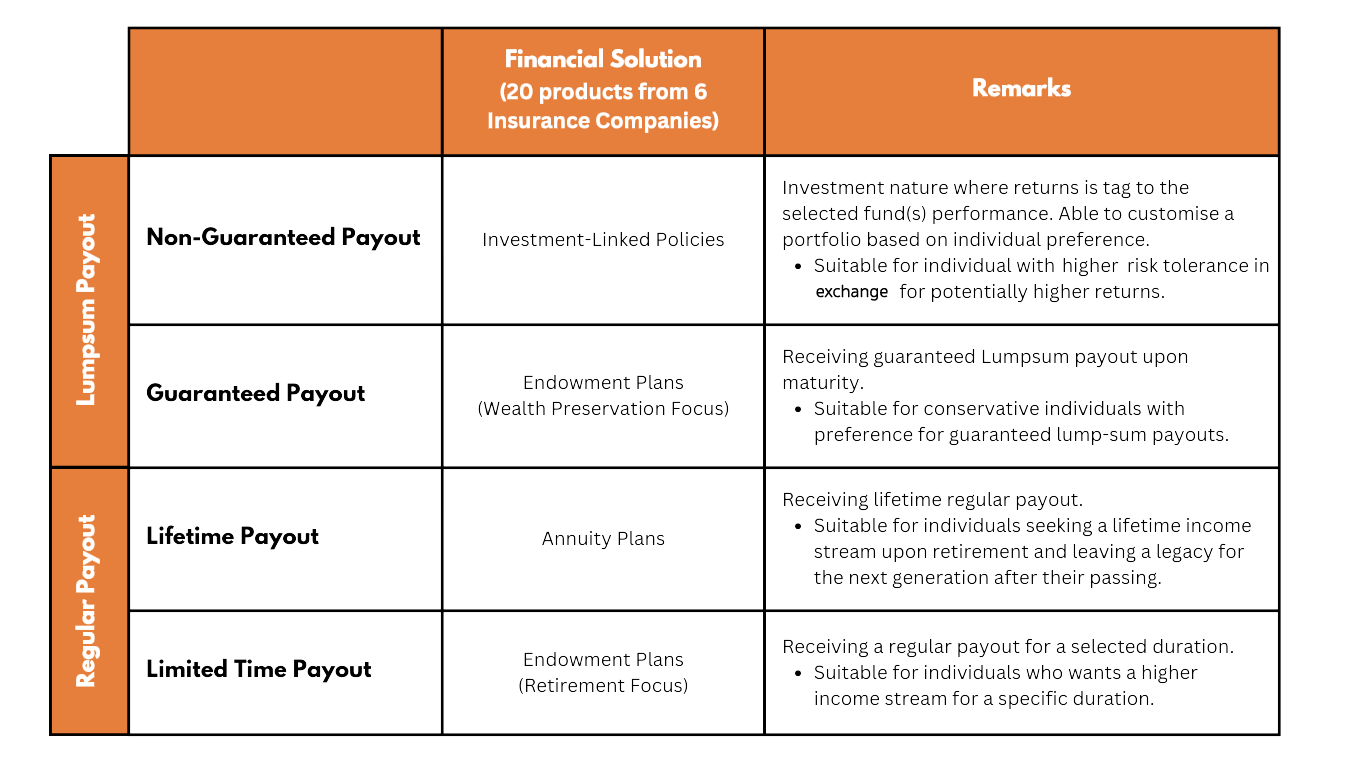

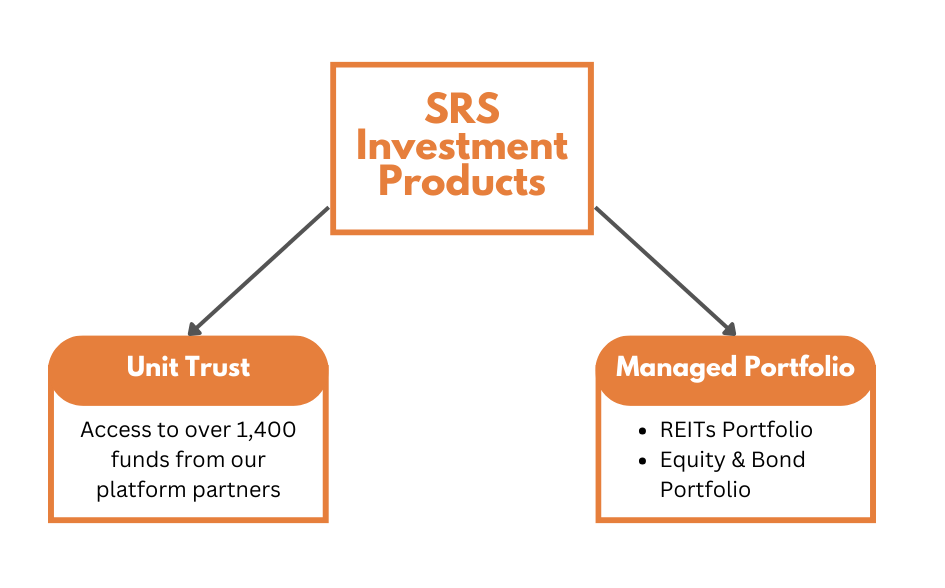

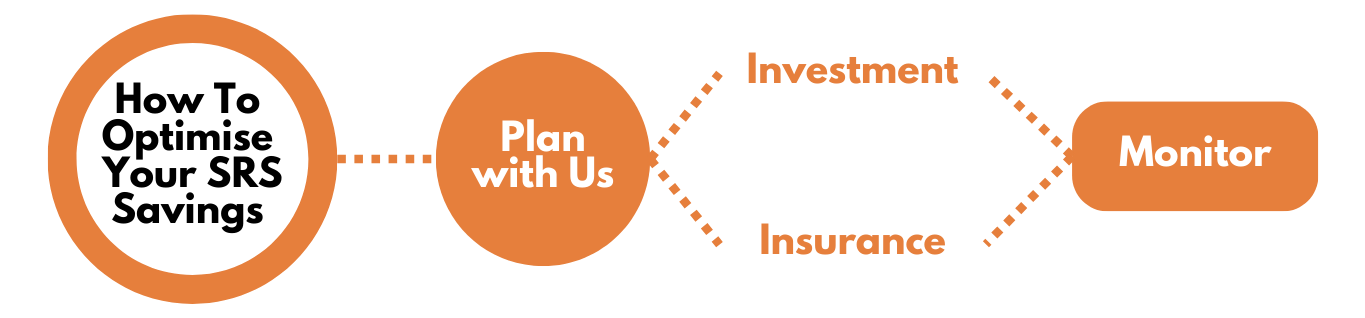

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

Welcome. For over seven years, I've been dedicated to empowering individuals and families in Singapore to achieve their financial aspirations through comprehensive, holistic financial planning. As a consultant with Financial Alliance, I leverage in-depth market knowledge and a client-first approach to develop personalised strategies that encompass all aspects of your financial well-being, ensuring a clear path towards your goals.

My experience involves conducting thorough financial analyses across a diverse range of financial institutions and products, enabling me to provide well-rounded and unbiased advice. Having successfully partnered with over 100 valued clients, I understand that true financial planning is more than just numbers; it's about understanding your unique circumstances, concerns, and dreams, and then crafting a tailored roadmap to navigate your financial journey with confidence.

My core motivation is simple: to elevate your life through meticulous and thoughtful wealth planning. I believe that sound financial strategies are foundational to achieving not just your monetary targets, but also the peace of mind and freedom to pursue what truly matters to you. I am committed to building lasting relationships based on trust and transparency, guiding you towards a more secure and prosperous future.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's most progressive financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are fully MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreBy definition, a FA firm is one that sells the products from more than one insurer or business partner.

However, you should consider whether the FA firm can ensure that financial advice given is free from the undue financial influence.

Ever since our founding more than two decades ago, Financial Alliance is committed to offer impartial and client-centric financial advice.

We have your best interest at heart and will leave you to make your decision.

If suitable and impartial financial advice is what you seek, then you should only engage a trusted FA firm.

At Financial Alliance, we are dedicated to offering our clients the best financial advice.