Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

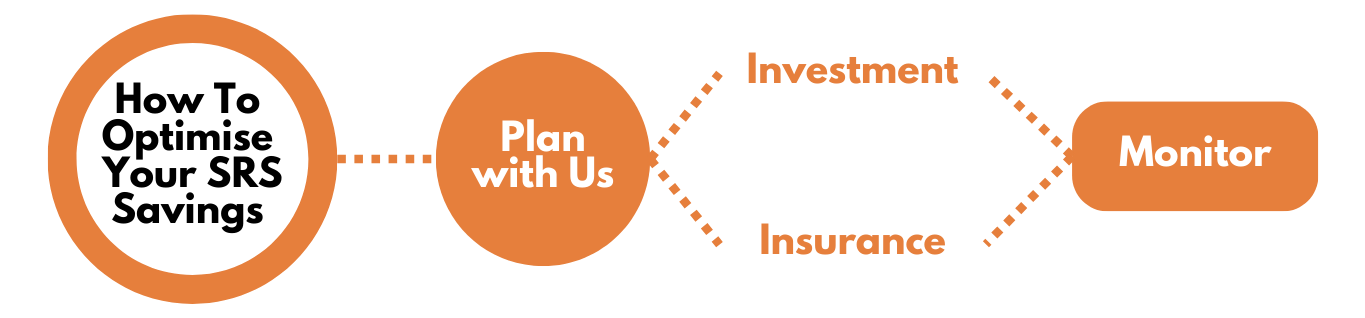

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

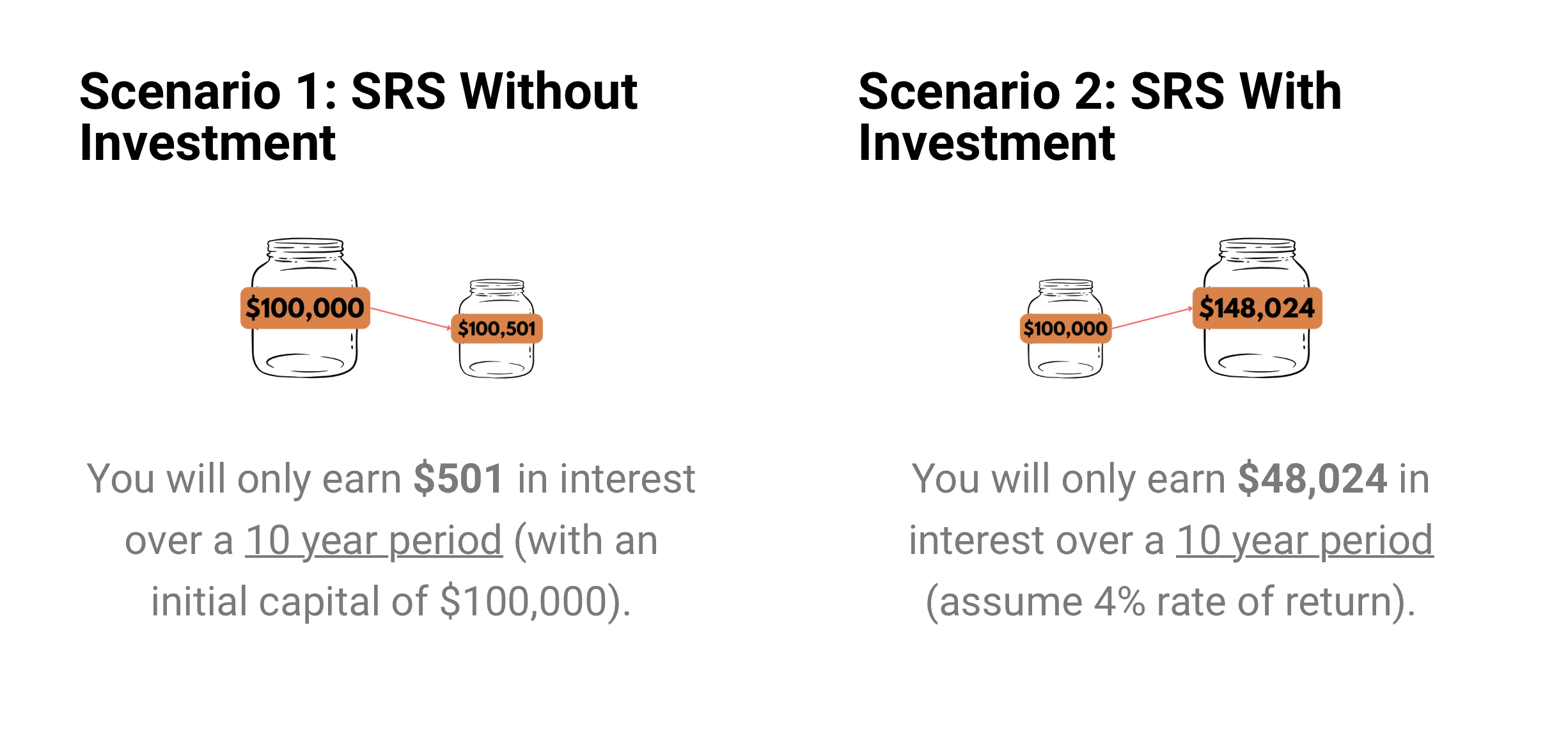

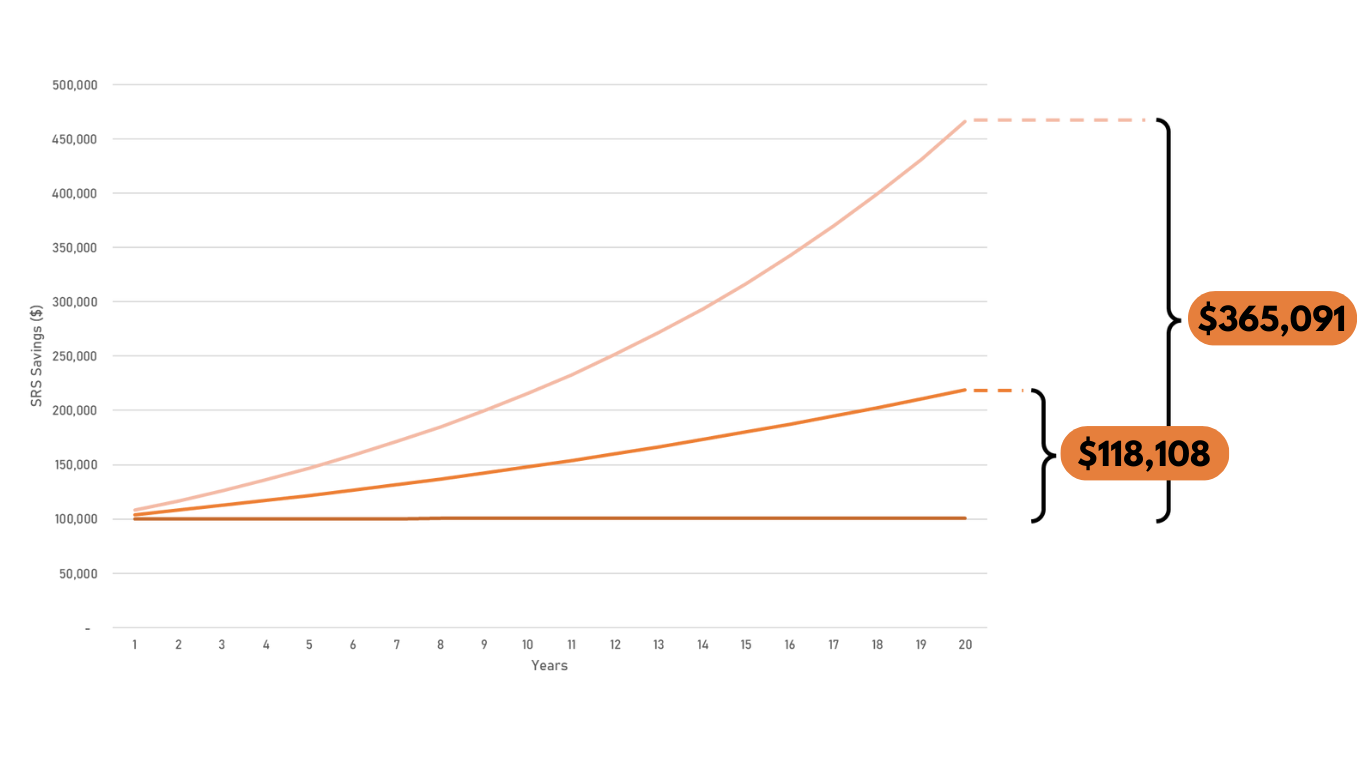

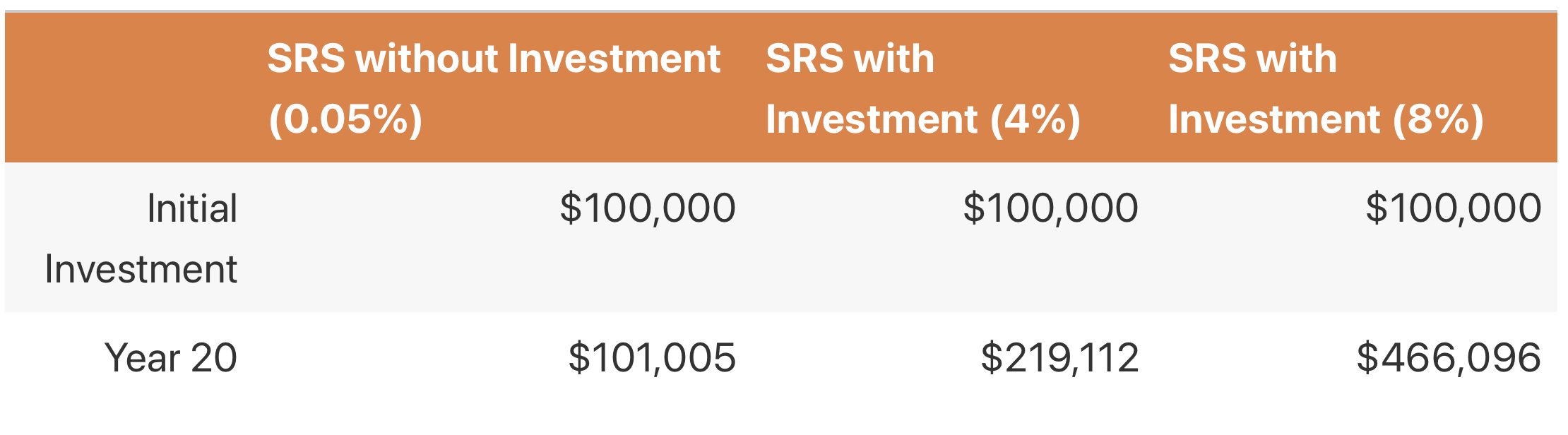

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

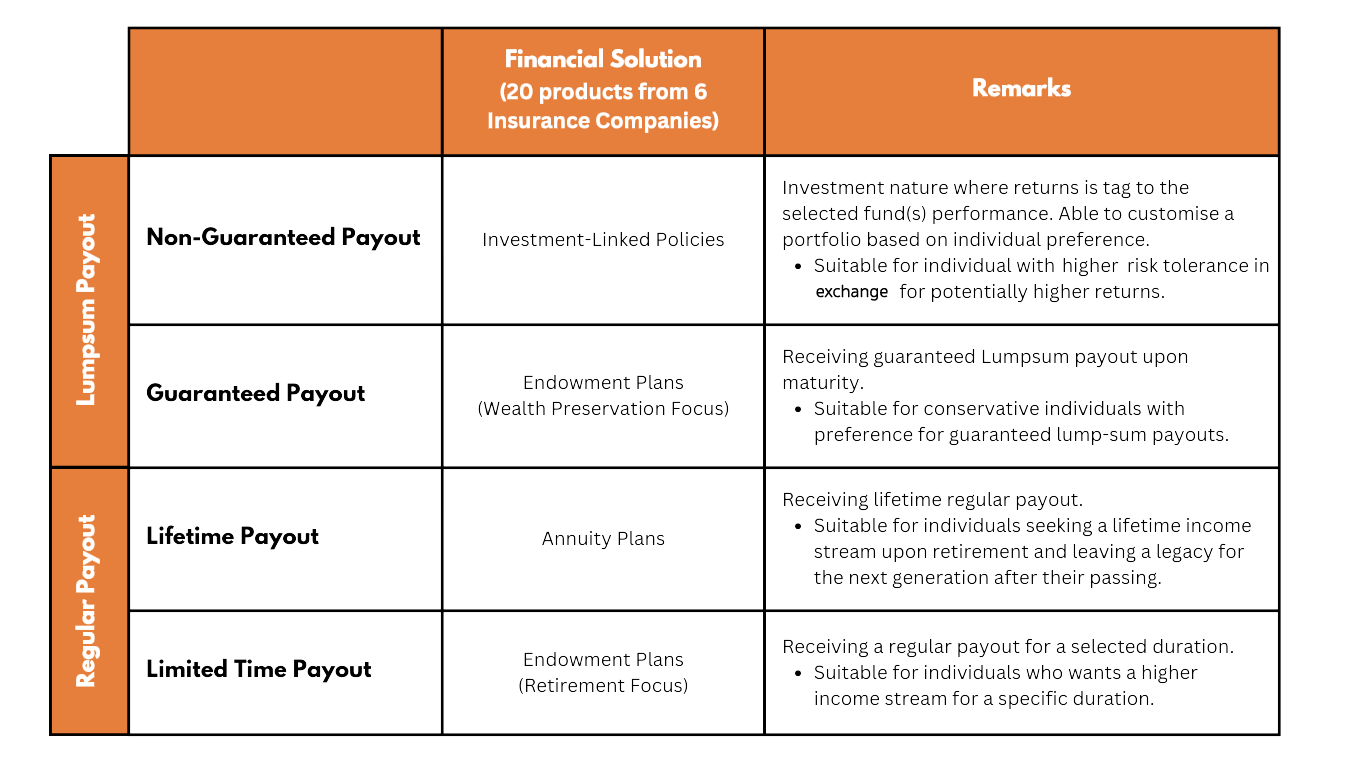

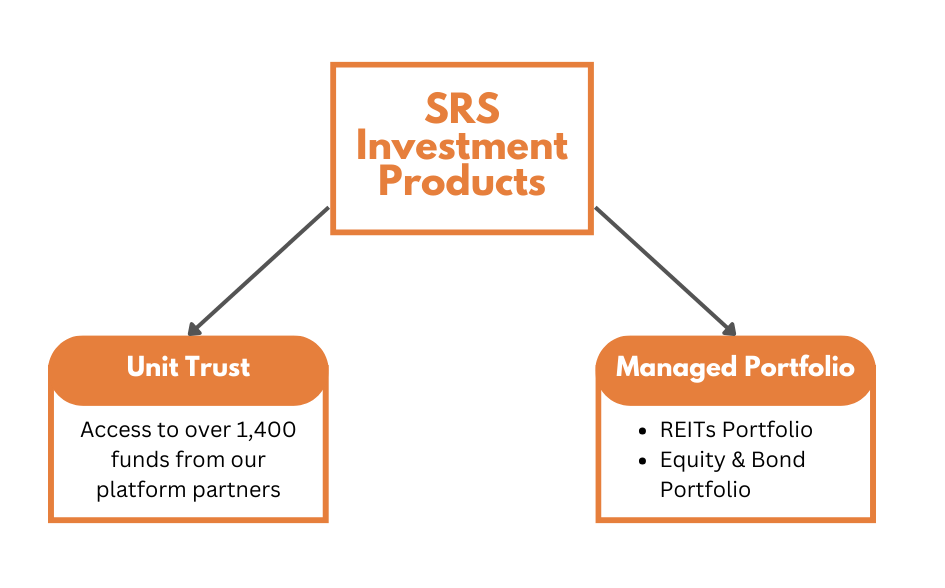

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

After experiencing the transformative impact of financial planning, I transitioned from accounting into a financial advisory career. My mission now is to support busy accounting professionals in building a secure and prosperous financial future. I understand the unique challenges and demands of your career and am here to help you balance them with long-term financial security.

With the support of Singapore's largest independent financial advisory firm, I prioritize building relationships that go beyond transactions. I make it my priority to understand each client's financial goals in depth, creating tailored solutions that respect their time and knowledge.

How I Can Help Professionals

Risk Management with Expertise: Accountants know the importance of risk mitigation. I apply that same rigor to ensure your personal wealth is protected, helping you identify and manage financial risks to safeguard your assets.

Tax-Efficient Savings Optimization: With a focus on tax efficiency, I craft strategies that maximize your savings potential without complicating your financial situation. As an accountant, you’ll appreciate the fine-tuned approach I take to minimize tax burdens and grow your wealth.

Income Streams for Sustainable Wealth: Building stable, passive income streams is key to a comfortable retirement. I develop strategies that work alongside your goals to create reliable income, letting you focus on your career now while securing financial stability for the future.

Let’s Secure Your Future Together

If you’re ready to start planning for a secure, fulfilling retirement, let’s connect today. I look forward to helping you build a strategy that aligns with both your professional life and personal aspirations.

💡 在我担任会计的15年里,我从未认真审视过我的保险政策,直到我遇到了一位出色的经理。他不仅帮助我审查了现有的保险政策,还让我节省了保险费,增强了保障。通过这次经历,我意识到定期审查保险是多么重要!现在,我希望帮助更多的人实现同样的目标,甚至创造额外的被动收入!如果你也在寻找更好的保障和投资方案,不妨考虑一下哦!✨

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.