Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

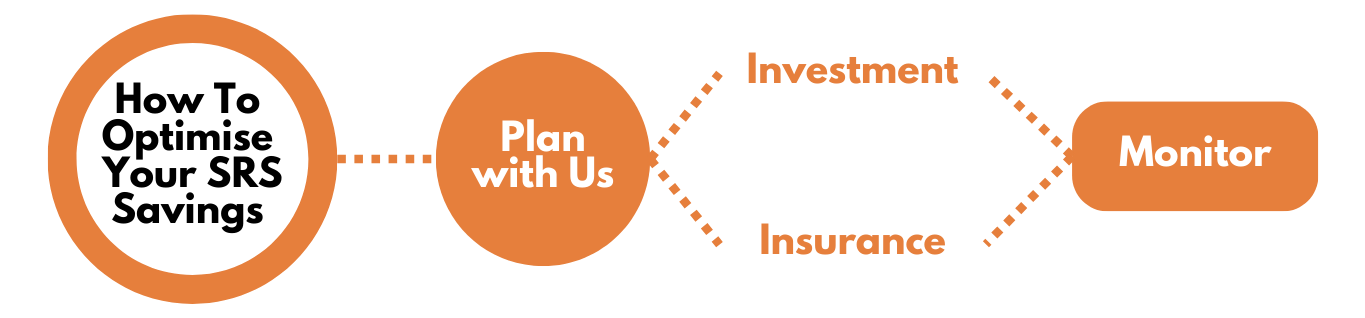

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

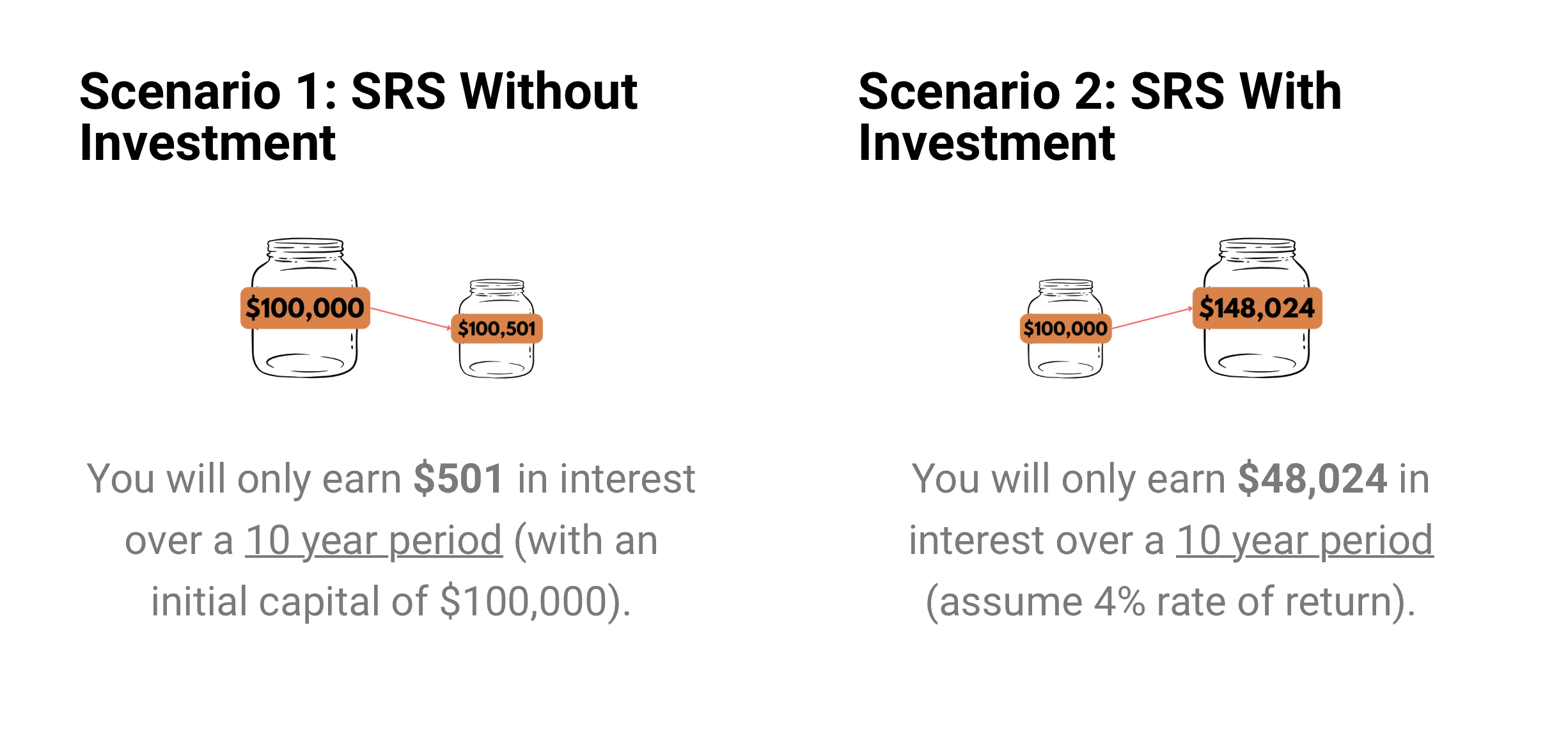

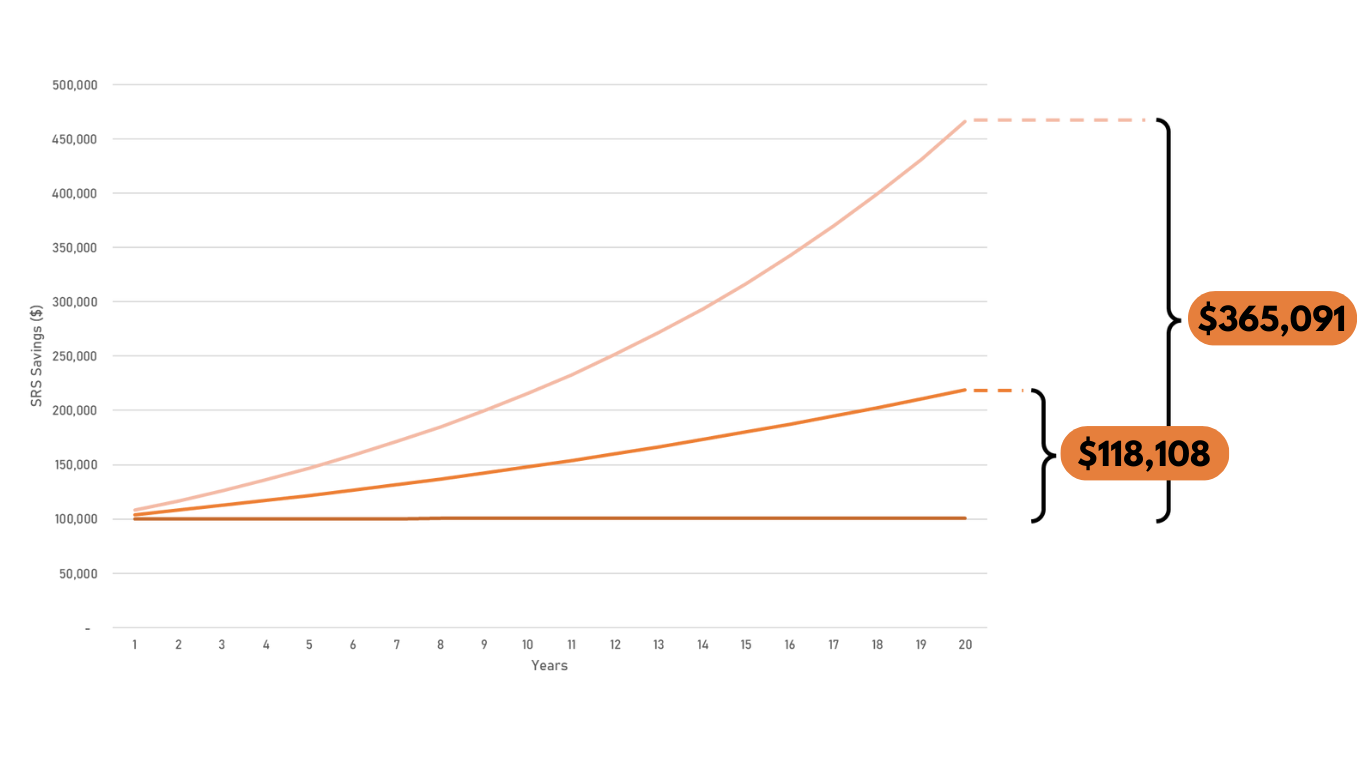

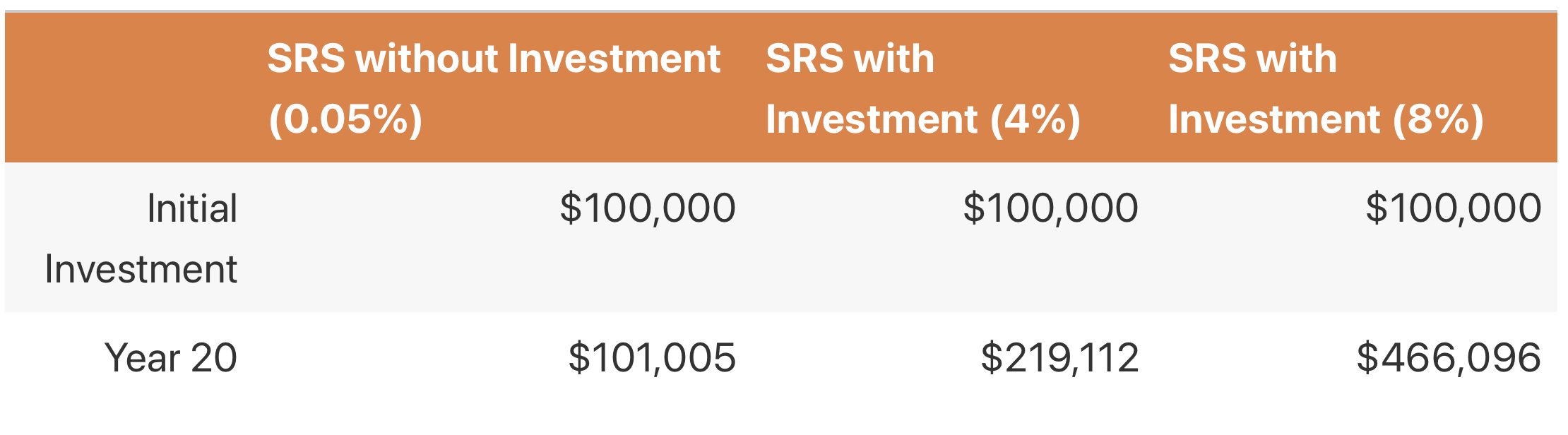

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

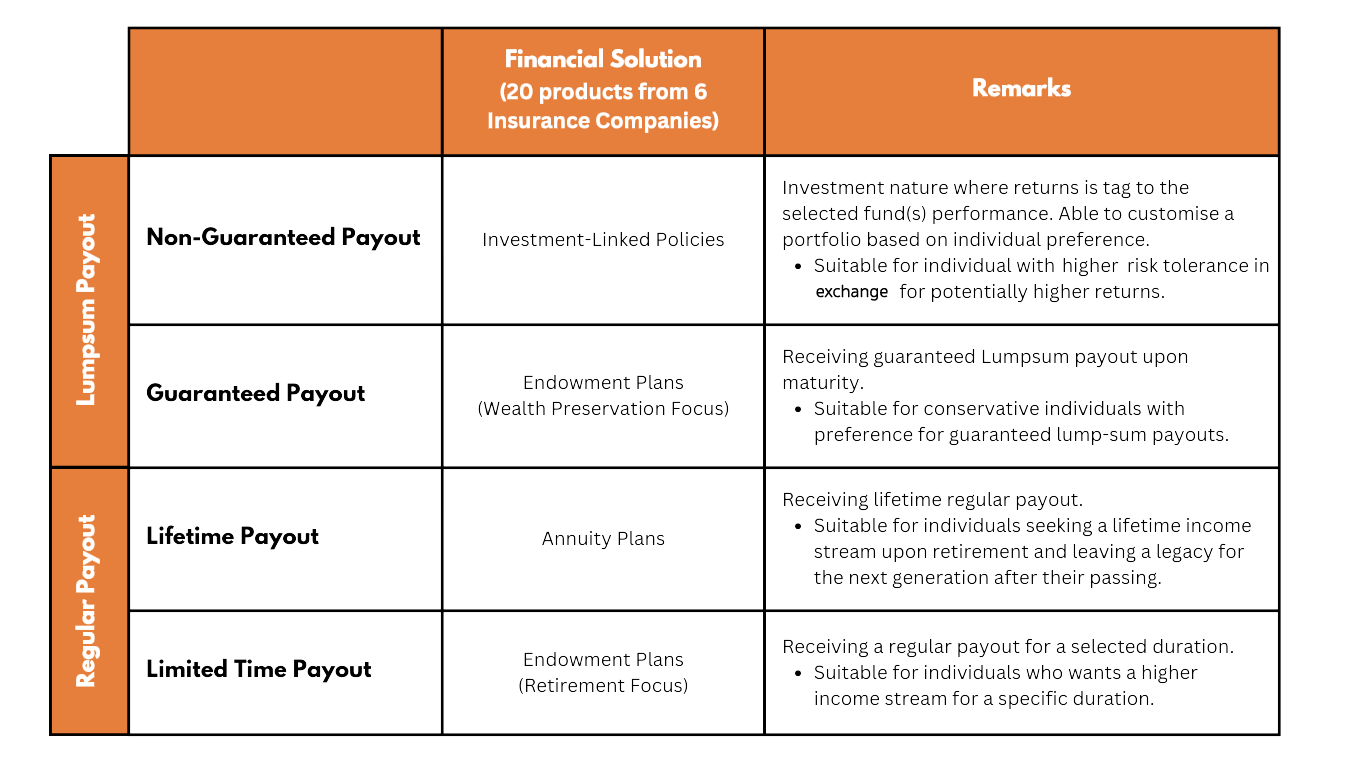

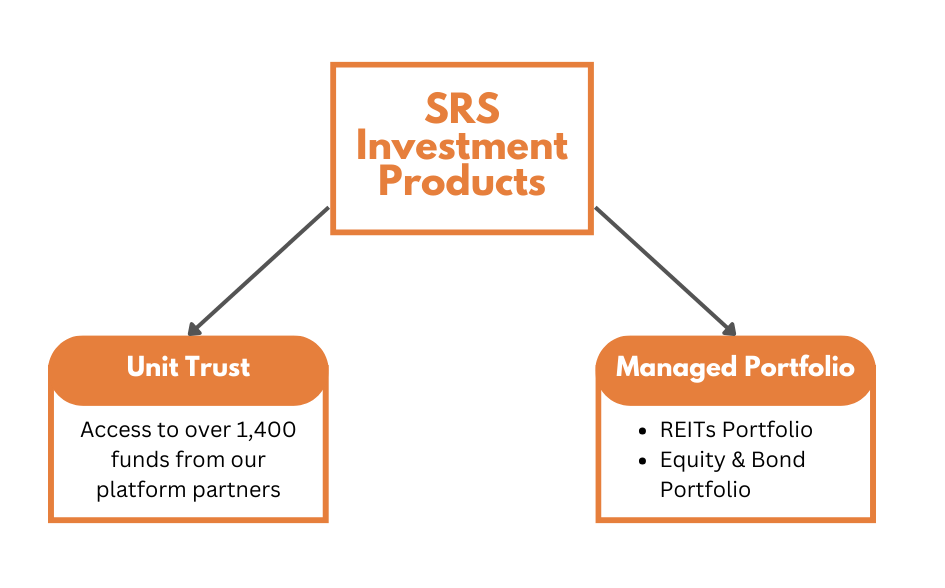

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

A Little about me:

Before switching careers to become a Financial Consultant, I worked in the construction-related land surveying industry and had 11 years of professional experience. I have been responsible for over 100 engineering projects and worked with no less than 30 local and overseas construction industry companies.

Therefore, I understand the importance of professionalism. I maintain a sincere and responsible attitude, serving every customer with heart, because I believe that only by truly striving for perfection in every detail can we win trust and recognition.

在转行成为独立理财顾问之前,我曾从事与建筑相关的土地测量行业,拥有11年的专业经验。 我曾负责超过100个工程项目,并与不少于30家本地及海外建筑业公司合作。 因此,我知道专业精神的重要性。 现在我保持真诚、负责的态度,用心服务每一位客户,因为我相信只有真正做到每一个细节都力求完美,才能赢得信任和认可。

As a mother of two, I know the importance of planning in order to achieve peace of mind. Therefore, I hope to help more people in similar backgrounds to plan and design financial blueprints for their different stages of life.

作为两个孩子的母亲,我知道规划对于实现内心平静的重要性。 因此,我希望能够帮助更多有类似背景的人规划和设计适合自己不同人生阶段的财务蓝图。

Choose me as your exclusive financial consultant. Clearly understand risks, manage wealth clearly, and enjoy life in a down-to-earth manner.

选择我作为您的专属理财顾问。 清清楚楚了解风险,明明白白管理财富,踏踏实实享受生活。

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.