Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

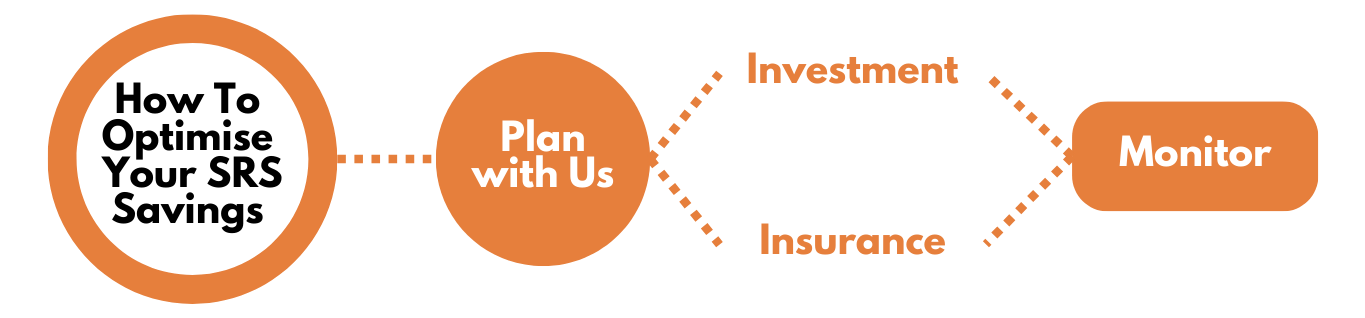

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

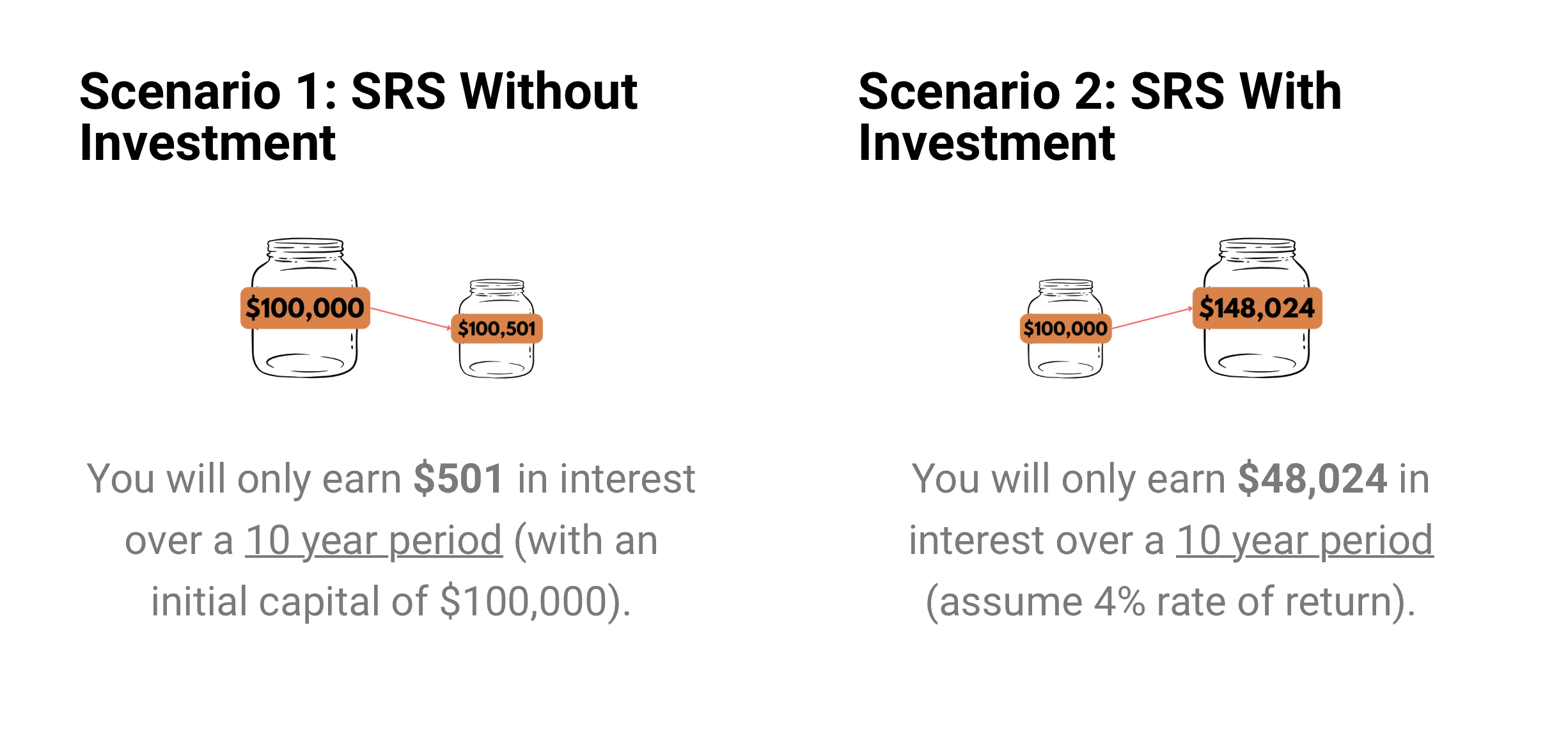

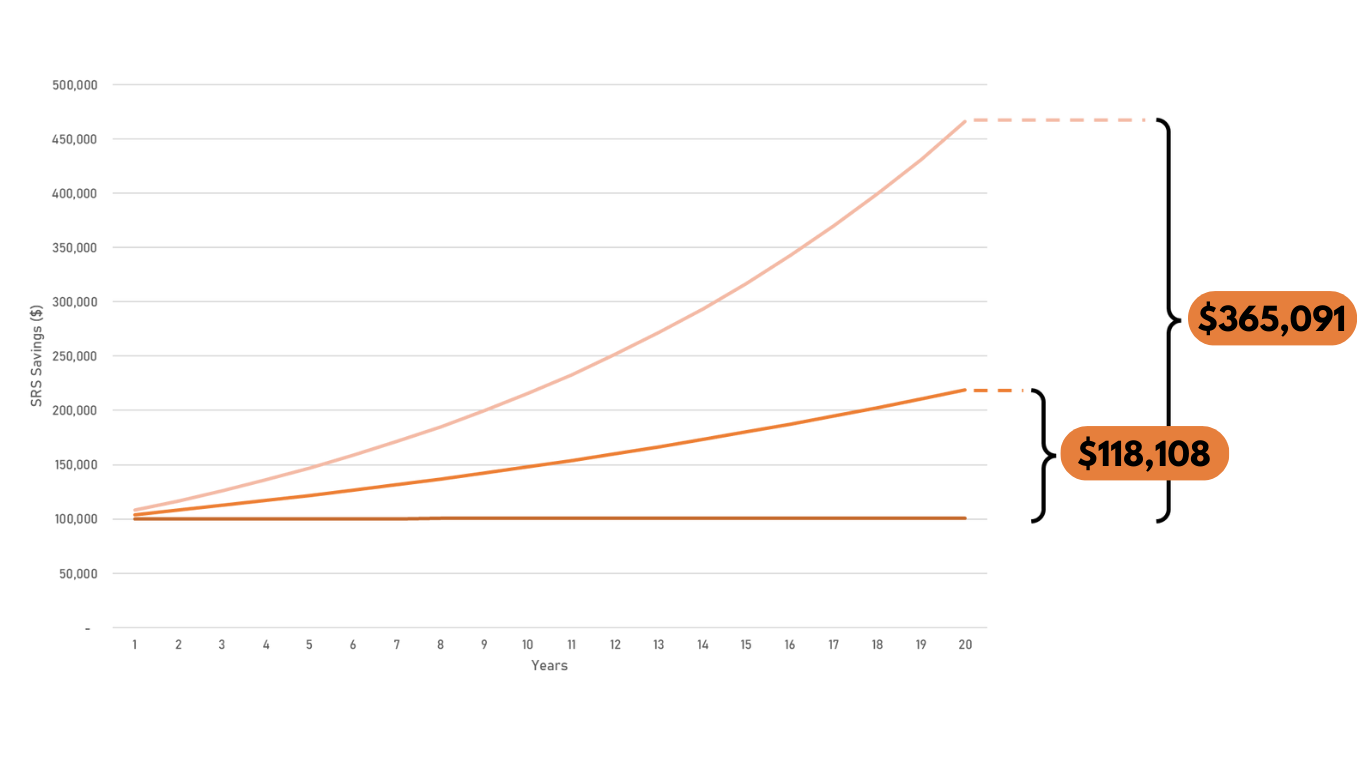

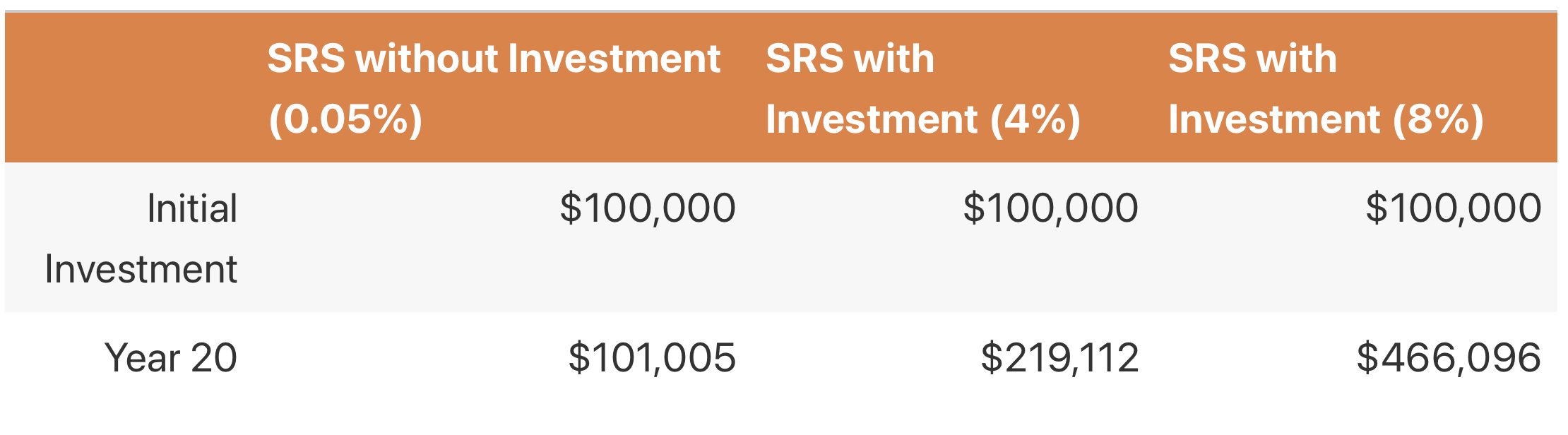

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

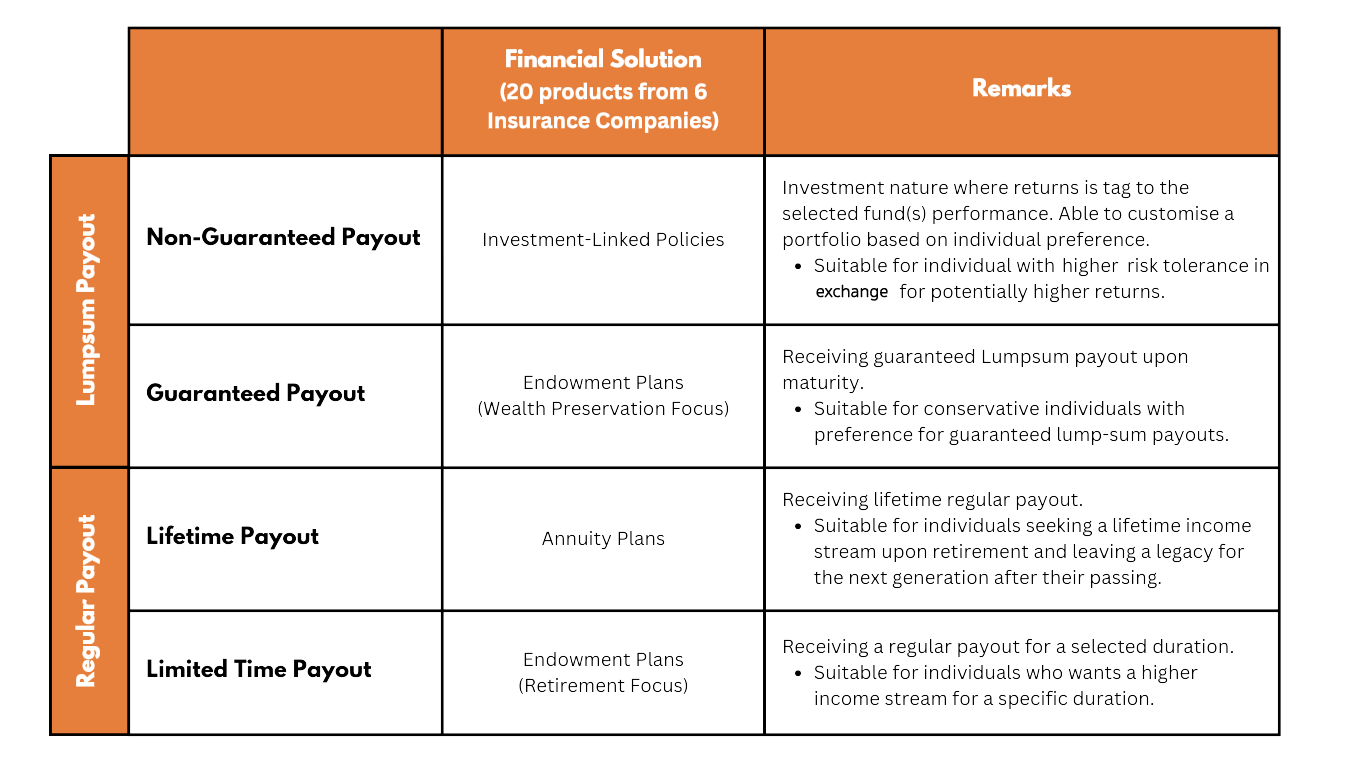

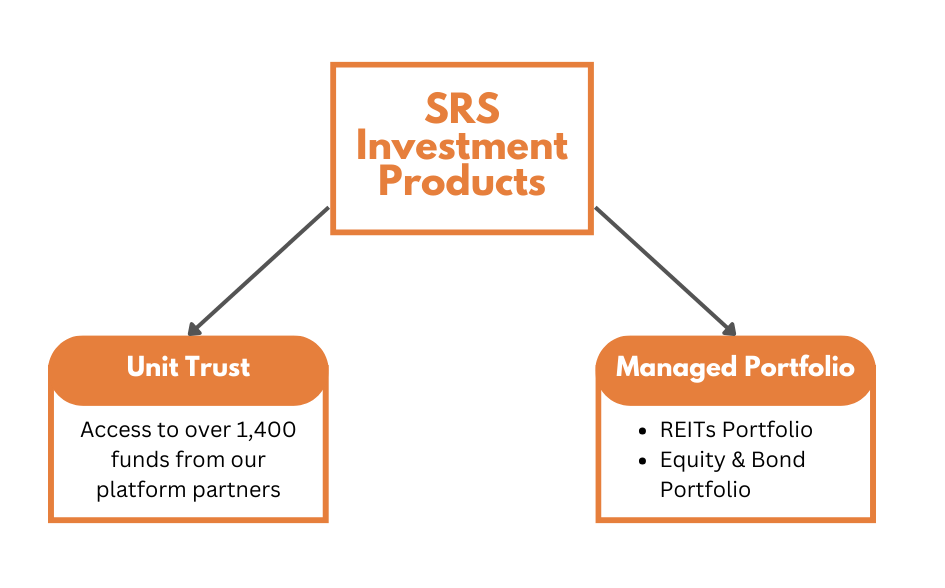

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

I am glad to introduce myself as an established Financial Advisor at Financial Alliance, with over a decade of experience in the field of financial advice services. I are dedicated to helping individuals and families like yourself to achieve financial abundance and security. As a financial advisor in the largest independent financial advisory firm in Singapore, I take pride in offering objective and personalized solutions tailored to your unique needs. My commitment to continuous learning ensures that you receive the most up-to-date and informed advice.

I specialize in holistic financial planning, addressing every aspect of your financial well-being. My comprehensive approach covers meticulous risk management through insurance solutions, as well as intelligent investment strategies utilizing a diverse range of options such as stocks, ETFs, UTs, REITs and bonds. I believe in providing you with a complete financial toolkit that empowers you to make informed decisions.

My expertise extends to portfolio management and estate and legacy planning, ensuring that your financial future is secure and prosperous. I understand that each individual and family has unique goals and aspirations, and I work closely with you to develop personalized strategies that align with your vision.

My business thrives on referrals, which serve as a testament to the trust and satisfaction my clients have in my services. I take pride in building long-lasting relationships with my clients. My approach combines professionalism with genuine compassion, ensuring that every client feels heard, understood, and cared for.

If you are looking for a financial advisor who not only possesses expertise but also empathy, then I am here to assist you. My mission is to help you reach your financial goals and empower you to make informed decisions. I understand that financial well-being is about more than just numbers; it's about achieving peace of mind and creating a legacy for future generations.

I am excited about the opportunity to make a postive difference in your life. To learn more about how we can collaborate on this financial journey, please contact me via WhatsApp or email, and I will be sure to get back to you promptly.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.