Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

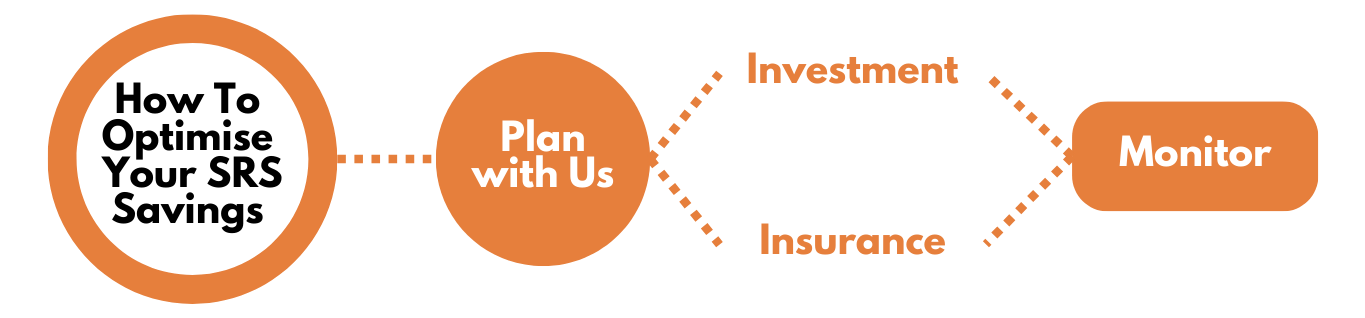

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

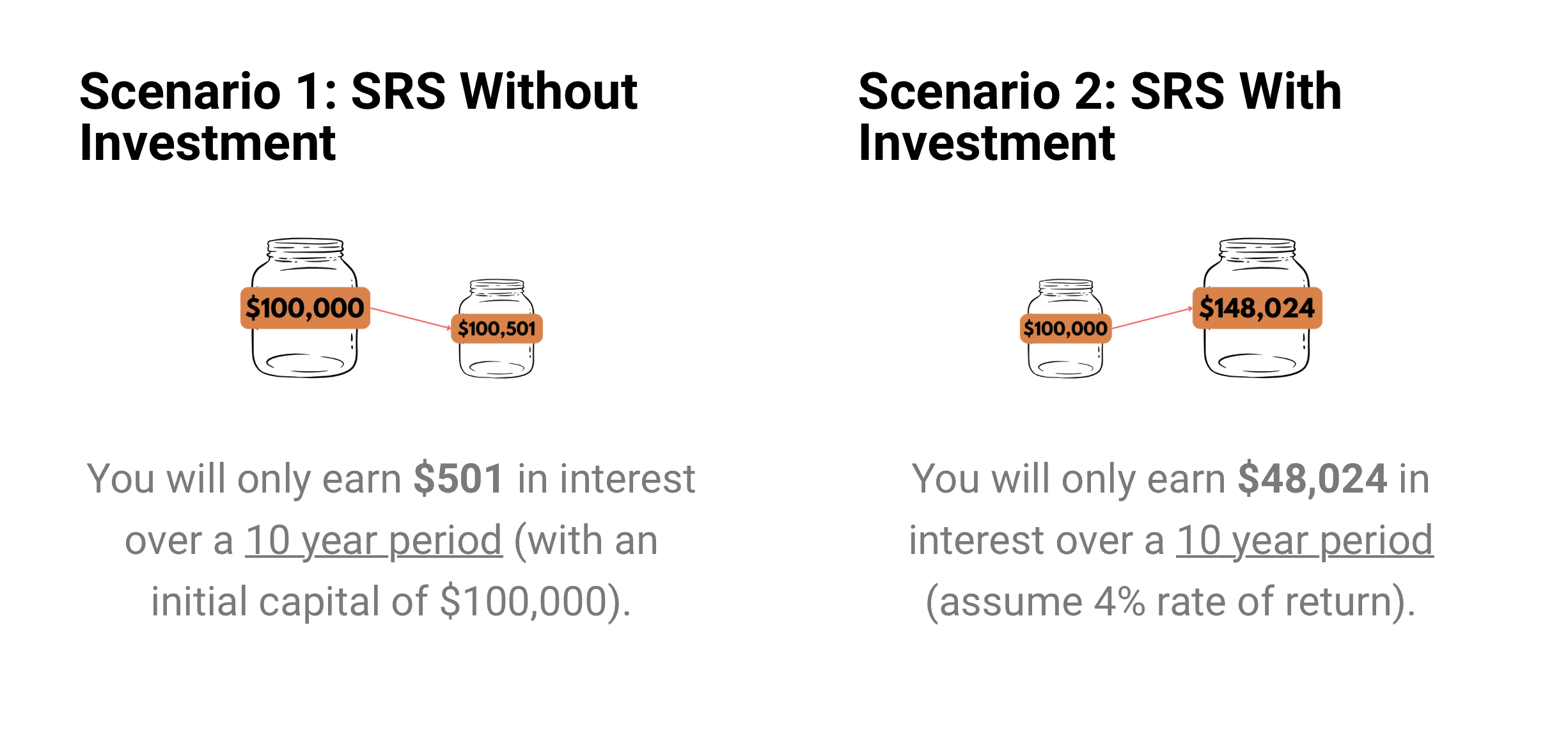

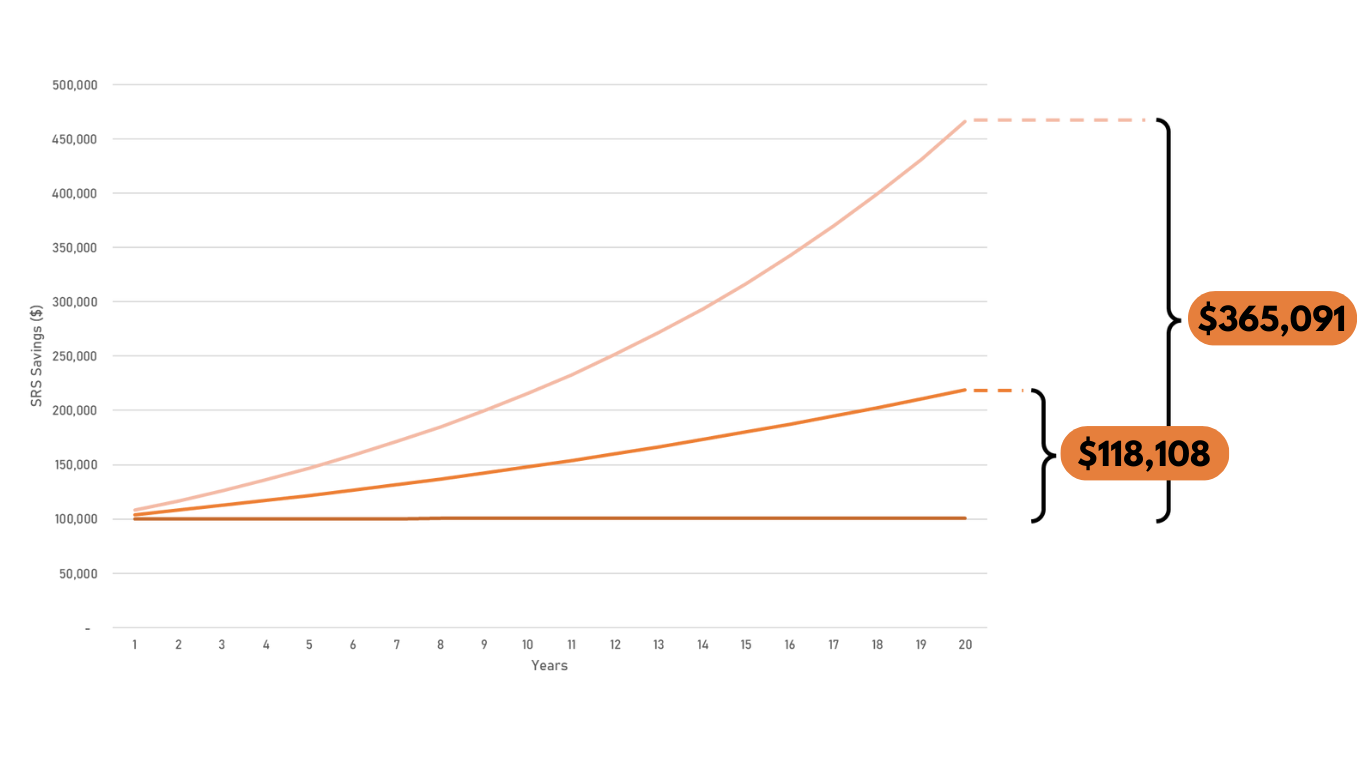

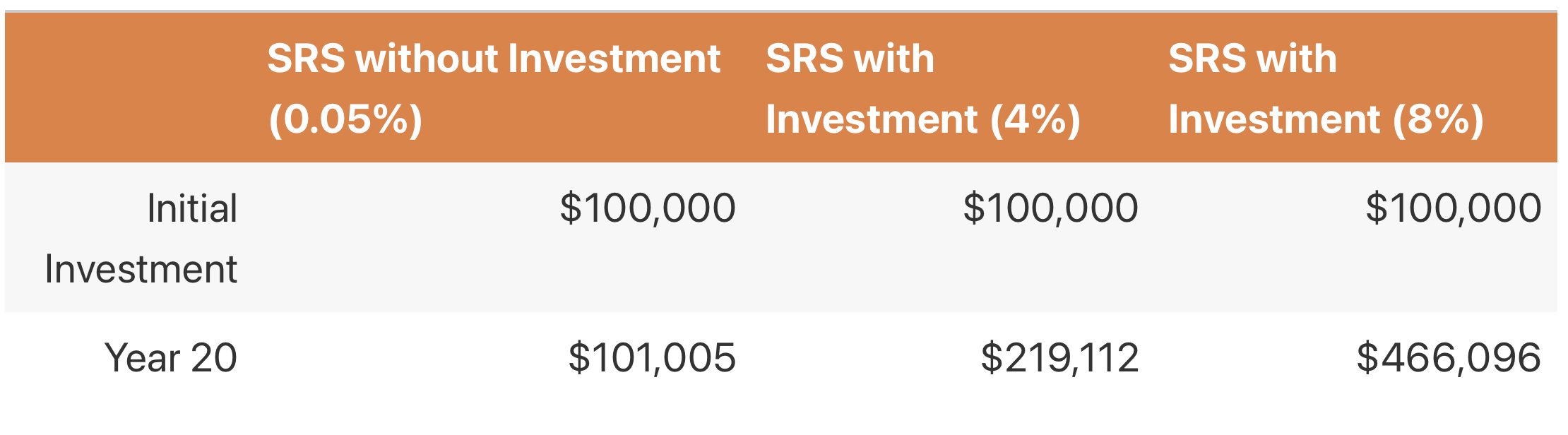

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

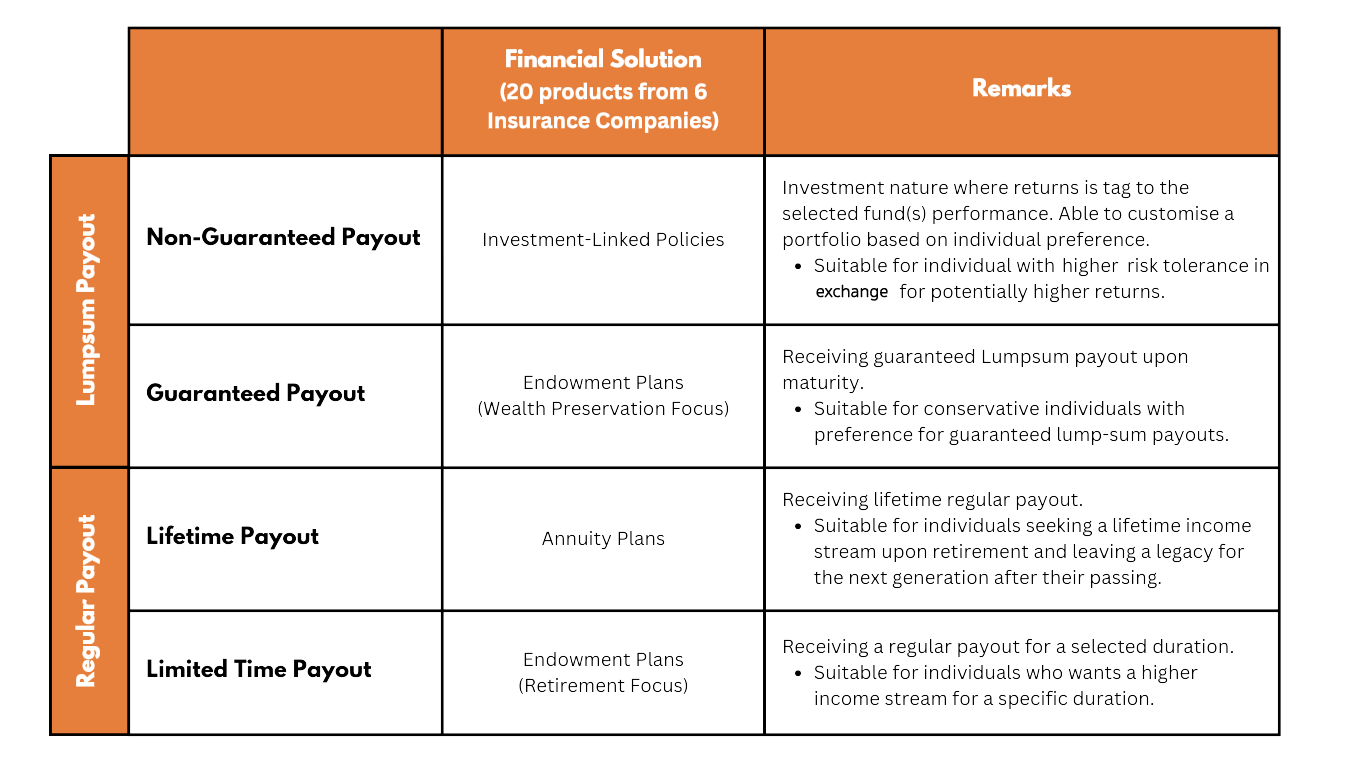

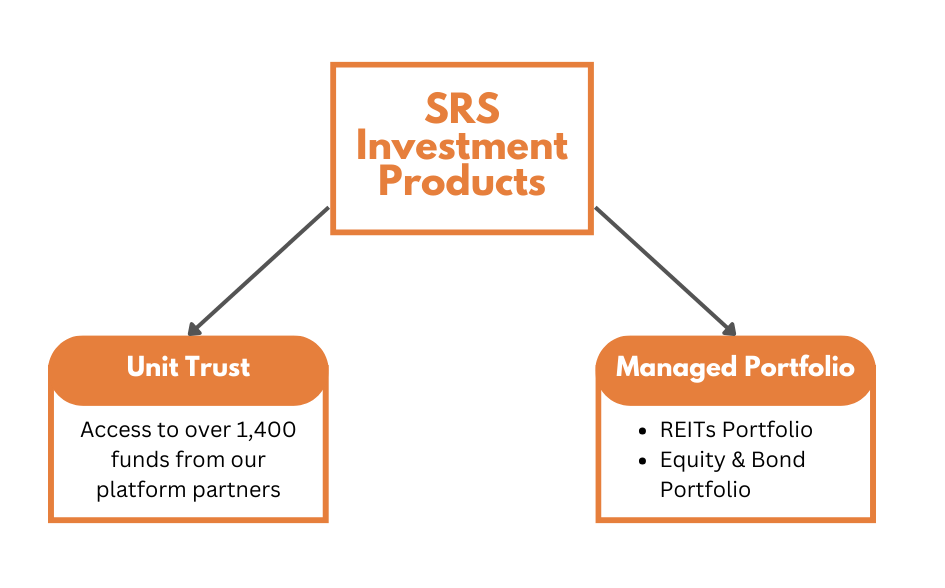

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

Hello, I’m Rachel, an Independent Financial Advisor with Financial Alliance, Singapore's largest independent financial advisory firm.

My Background

As a former frontline social worker, I had the privilege of helping dozens of immigrant families overcome life and financial challenges. I later spent 9 years in the international finance sector, focusing on corporate social responsibility and working on sustainable development projects with the world's leading sovereign-backed investment company, striving to bring positive change to more families and communities.

Fluent in English, Mandarin and Cantonese, and well-versed in the cultural nuances of Singapore, Mainland China and Hong Kong, I’m able to offer personalised, efficient service to new immigrant families, local clients, and those from Chinese-speaking regions.

My Mission

Guided by the belief that "life influences life," I focus on professionally safeguarding each client’s wealth, helping families create, preserve, and pass on wealth.

My Commitment

I provide customised financial plans tailored to each client’s needs, regularly reviewing and adjusting them to ensure their financial goals are met. Always putting clients' interests first, I offer unbiased professional advice to break down information barriers and minimise financial risks, ensuring your long-term benefits.

Feel free to reach out if you have any questions or would like to learn more about my services. Thank you for visiting my website, and I look forward to connecting with you!

********

大家好,我是Rachel,是新加坡最大独立理财顾问公司Financial Alliance鑫盟理财的独立理财顾问。

我的背景

作为曾经的前线社工,我有幸帮助了数十个移民家庭解决生活和财务上的困难。随后,我在国际金融领域工作9年,专注于企业社会责任,并在全球领先的主权投资公司参与可持续发展项目,一直努力推动为更多家庭和社区带来积极的变化。

我精通中英粤三语,熟悉中新文化。这使我能够为新移民家庭、本地家庭以及来自其他华语地区的客户提供更贴心、更高效的服务。无论是在语言沟通还是文化理解上,我都能确保为客户带来更优质的服务和体验。

我的使命

秉承着“用生命影响生命”的信念,我致力于用专业守护每一位客户及其家庭的财富,让更多的个人和家庭实现创富、守富和传富。

我的承诺

我专注于通过个性化的风险管理策略,为每位客户量身定制财务方案,并定期评估和调整,以确保实现您的财务目标。始终以客户的利益和需求为出发点,提供中立的专业意见,助您打破信息壁垒,避免单一规划的财务风险,维护您的长期利益。

如果您有任何疑问或需要进一步了解我的服务,请随时联系我。感谢您访问我的个人网站,期待与您交流!

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.