Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

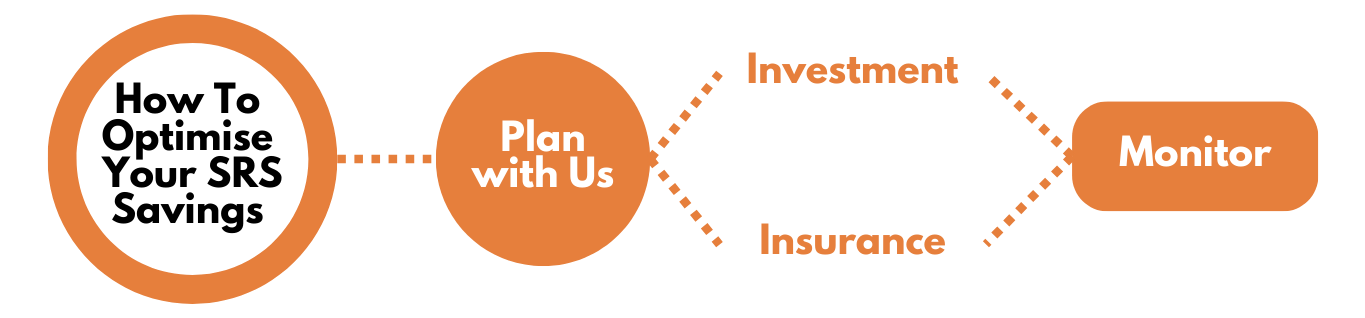

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

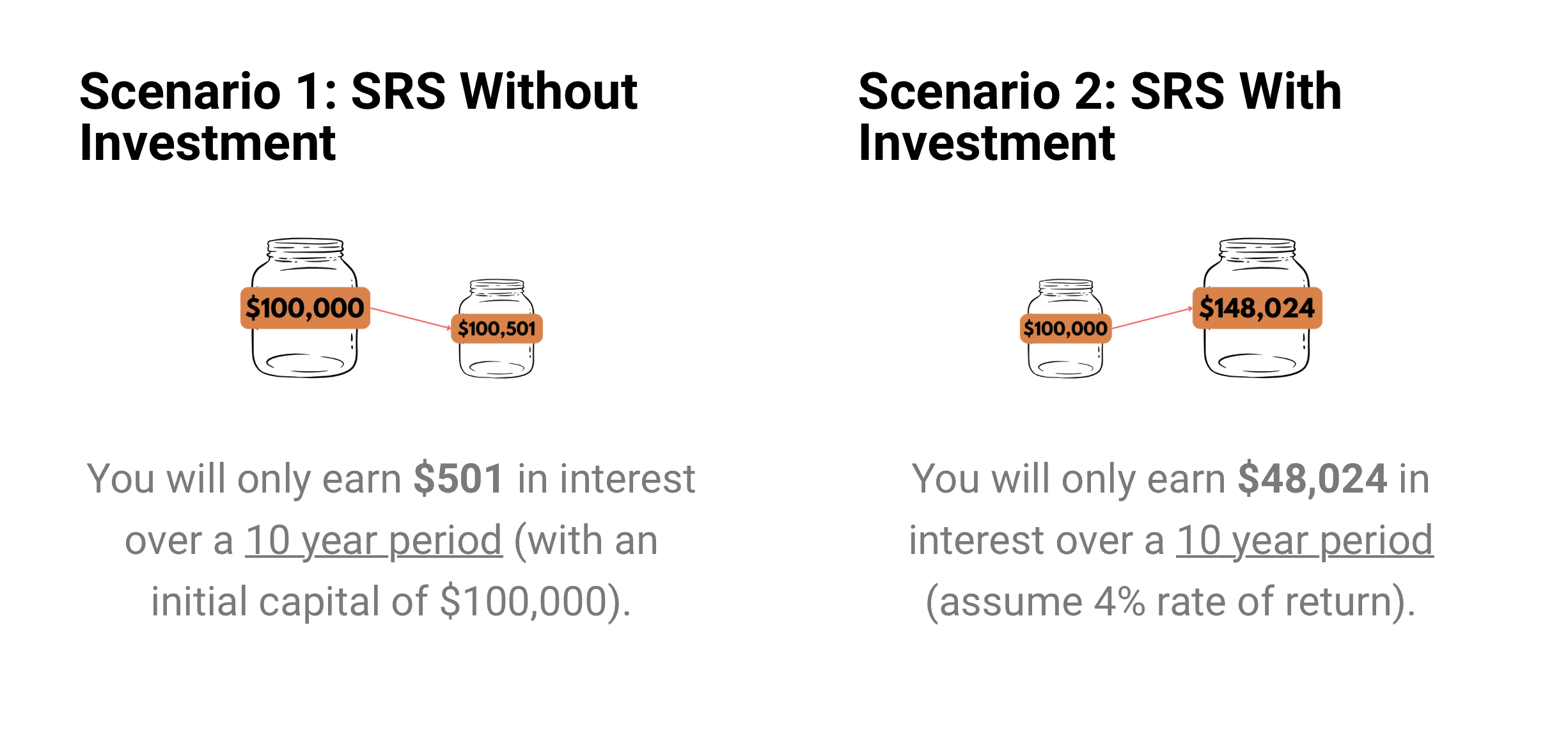

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

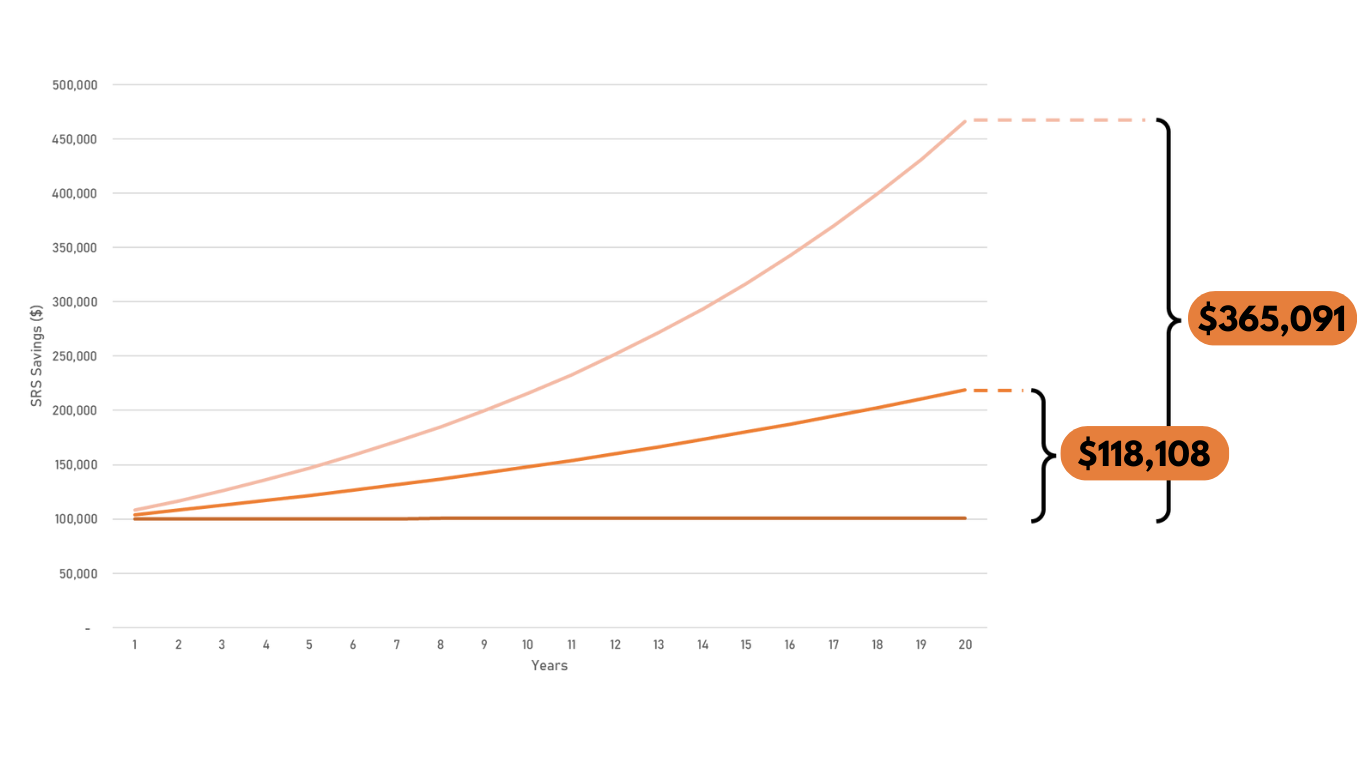

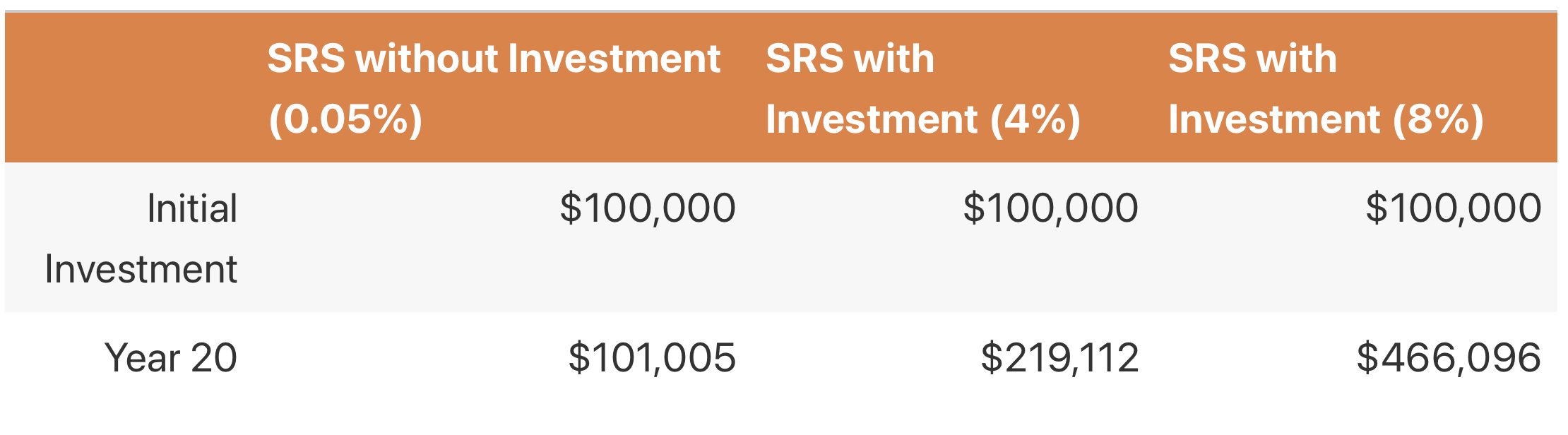

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

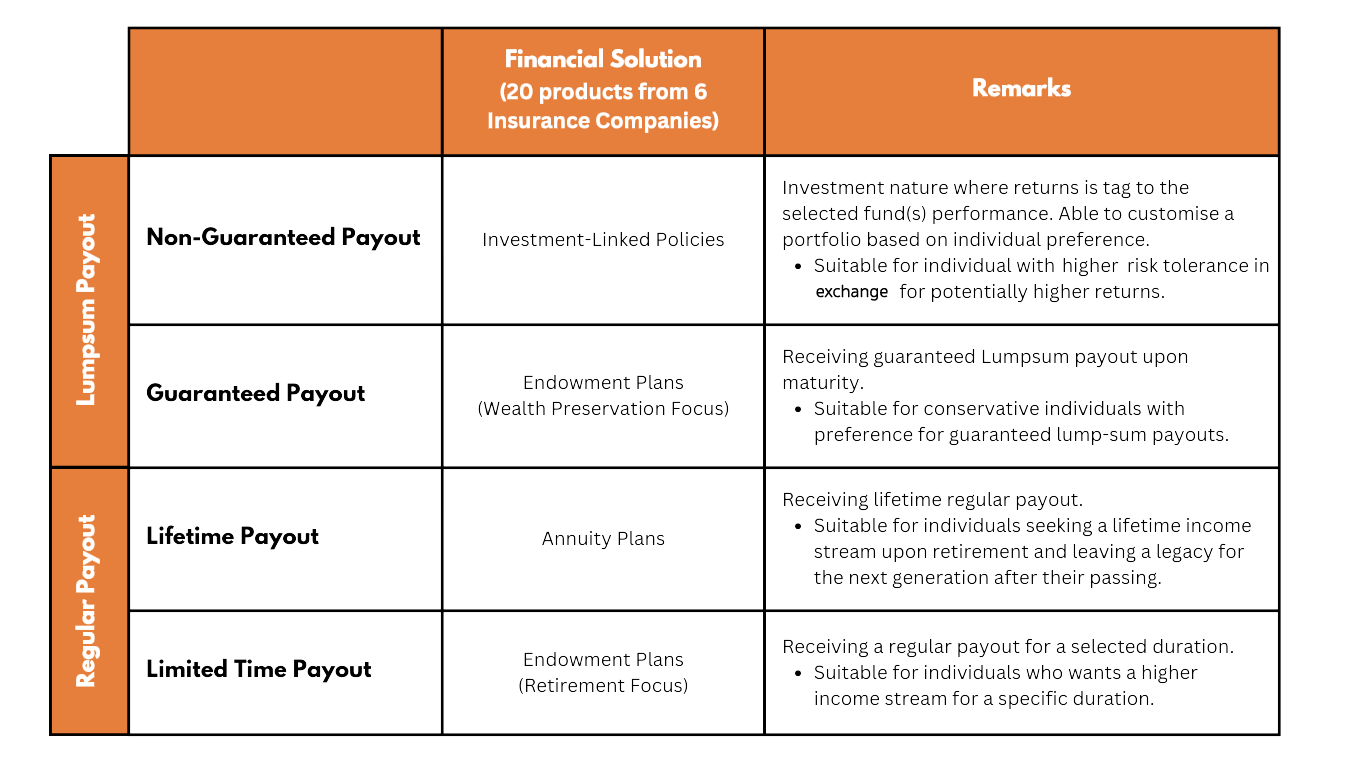

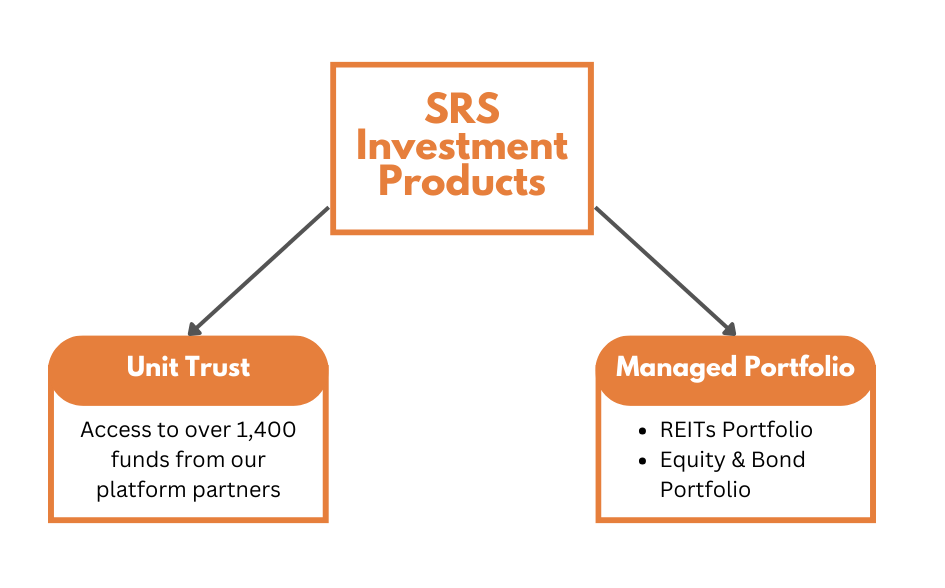

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

My name is Wang Yawei, a Financial Advisory Director at Financial Alliance, dedicated to providing professional financial advice and services to our clients. I am originally from China and moved to Singapore in 2008 after receiving the Singapore MOE Scholarship. I pursued my degree at the National University of Singapore (NUS) before starting my career in the financial industry.

My journey began in 2014 as a financial advisor with AXA. In 2016, I joined AIA Singapore and quickly advanced to the role of Financial Services Manager, where I started building my own team - ANXIN Wealth Group. By 2019, I was promoted to Financial Services Associate Director as my team continued to grow. In 2022, I made a significant decision to transition from a tied-up insurance agency to an Independent Financial Advisor, joining Financial Alliance, which is where I am today. Currently, I lead a team of 21 advisors as the Financial Advisory Director.

What sets us apart is our genuine care for our clients' interests and our commitment to providing professional advice and services. Our focus is not just on product knowledge, but also on financial planning knowledge and skills. As a team leader, I care deeply about my advisors, prioritizing quality over quantity. My goal is to see them grow and achieve their dreams while building meaningful careers.

We find joy not just in the money we make, but in the fulfilling work we do, and the positive impact we have on our clients' lives. Feel free to explore my website and don't hesitate to contact me to learn more about our team, our services, and how we can help you.

--

安新财富管理:安居新加坡,安心规划未来

我叫王亚威,现任鑫盟理财(Financial Alliance)的理财团队总监,致力于为客户提供专业的金融建议和服务。我来自中国,2008年获得新加坡教育部SM2奖学金后移居新加坡,在新加坡国立大学(NUS)攻读学位。毕业后,我开始了我在金融行业的职业生涯。

我自2014年加入AXA,担任理财顾问。2016年,我加入了AIA新加坡,并迅速晋升为金融服务经理,开始组建自己的团队-安新财富管理。到2019年,随着团队不断壮大,我晋升为金融服务副总监。2022年,我做出了一个重要的决定,从与保险公司捆绑的代理商转为独立财务顾问,加入了鑫盟理财,也就是现在的公司。目前,我作为财务顾问总监领导着一个由21名顾问组成的团队。

我们与众不同之处在于,我们真诚关心客户的利益,并致力于提供专业的建议和服务。我们不仅注重产品知识,还注重财务规划知识和技能。作为团队领导者,我非常关心我的顾问们,优先考虑质量而非数量。我的目标是帮助他们成长并实现他们的梦想,同时建立有意义的职业生涯。

我们的幸福感不仅来自于赚钱,更来自于充实的工作、对客户生活产生积极影响的事业。请阅览我的网站,了解更多关于我们团队、我们的服务以及我们如何为您提供专业服务的信息。如有任何问题,请随时与我们联系。

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.