Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

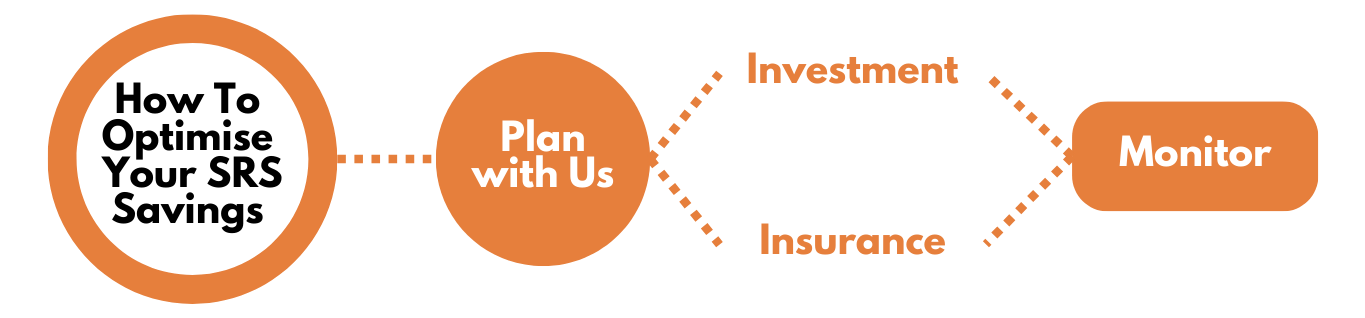

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

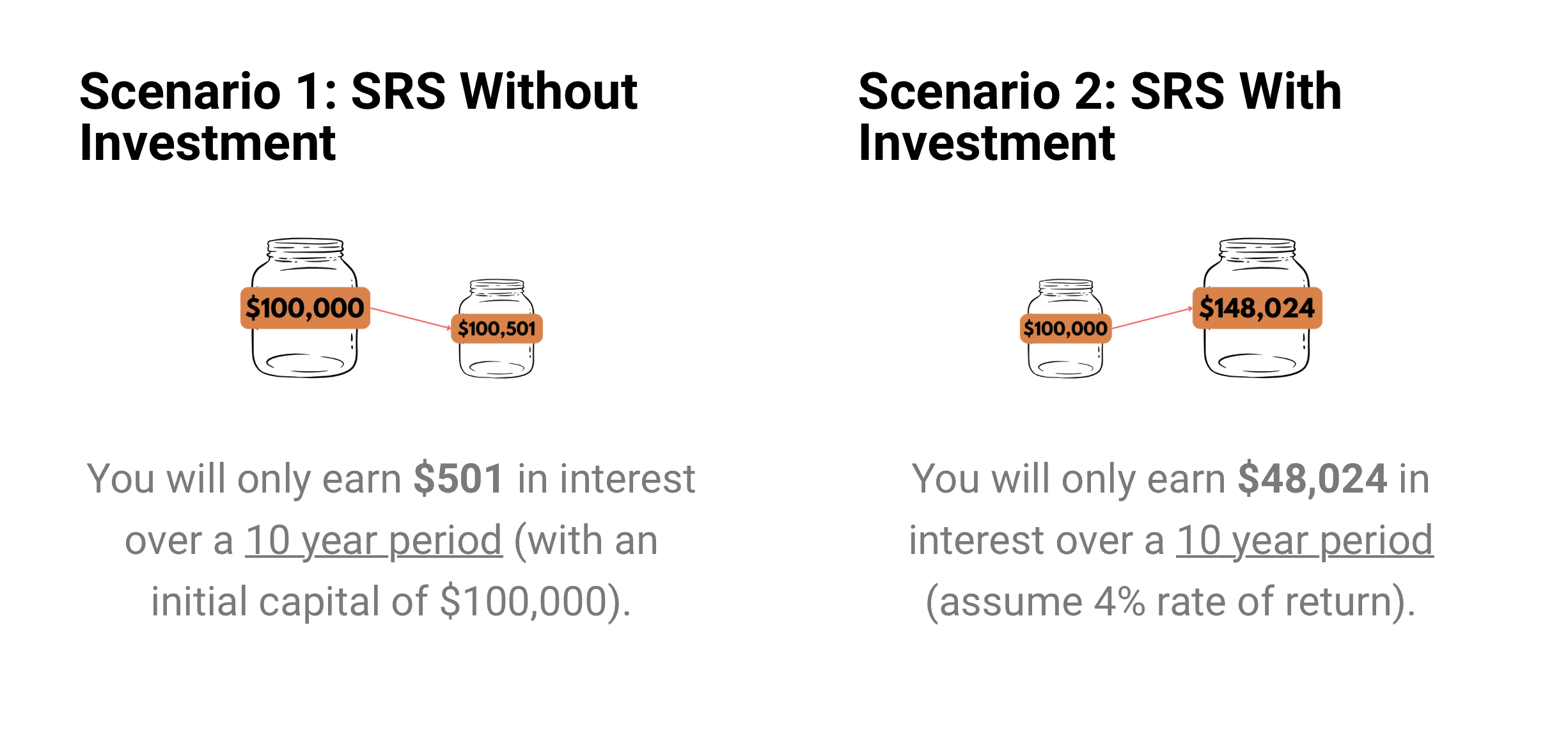

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

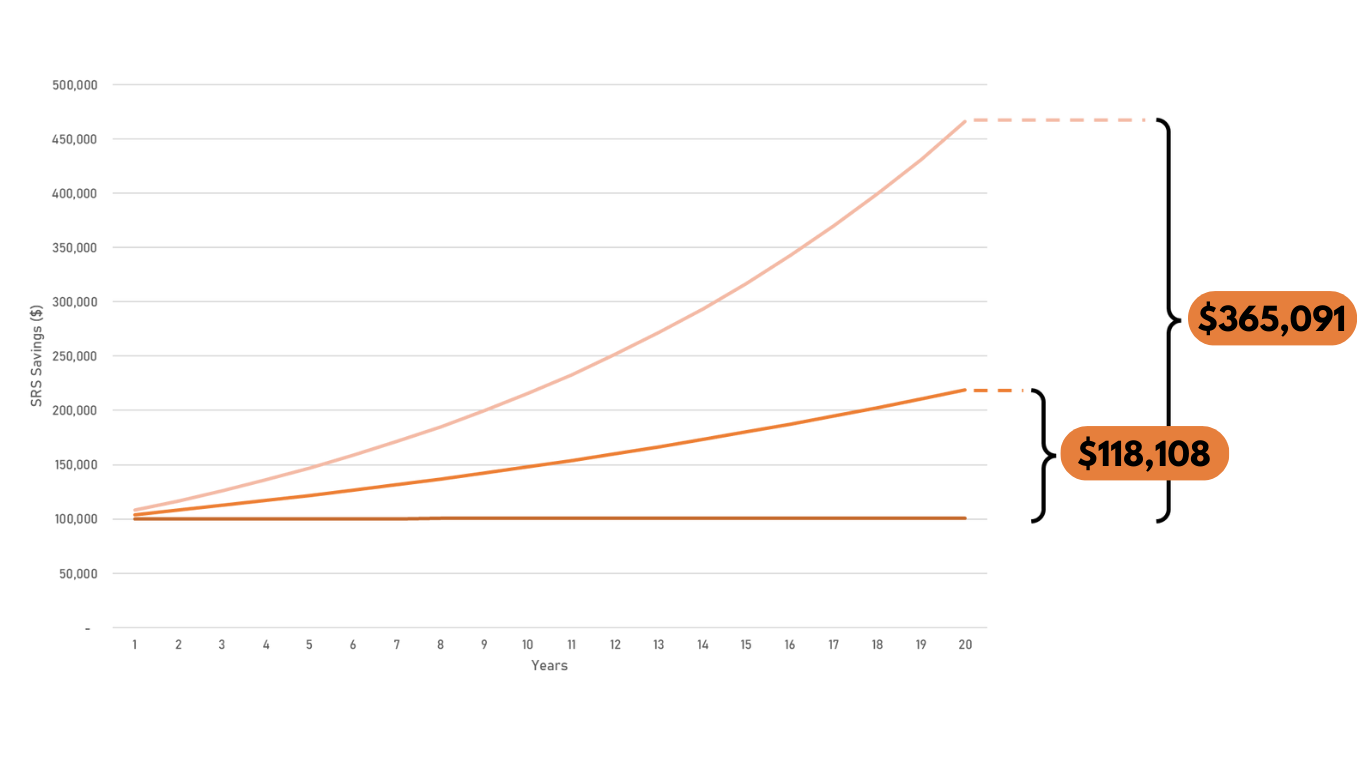

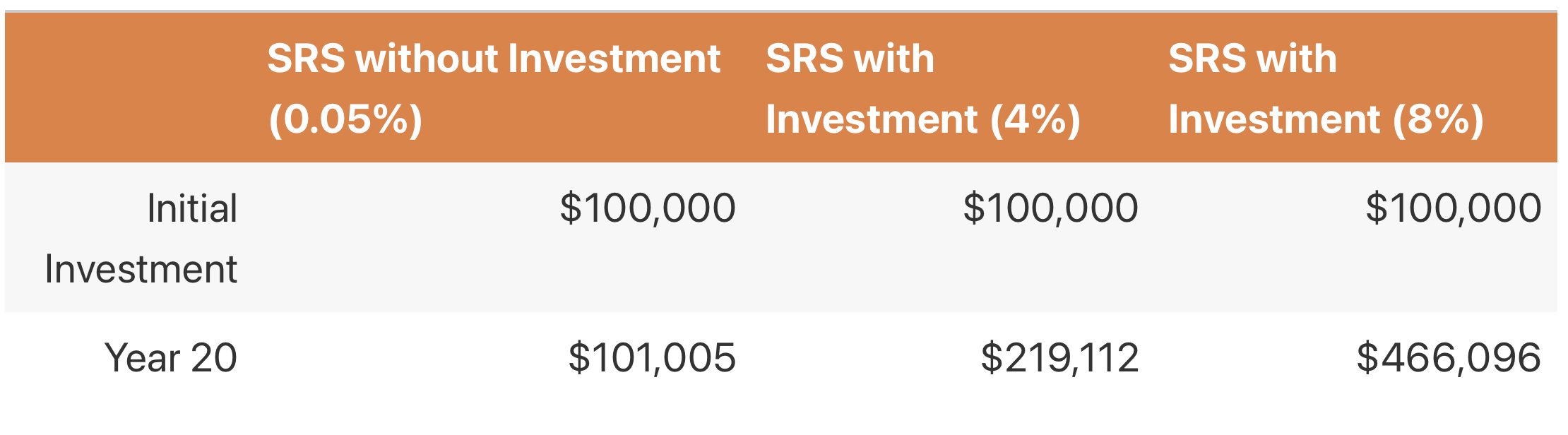

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

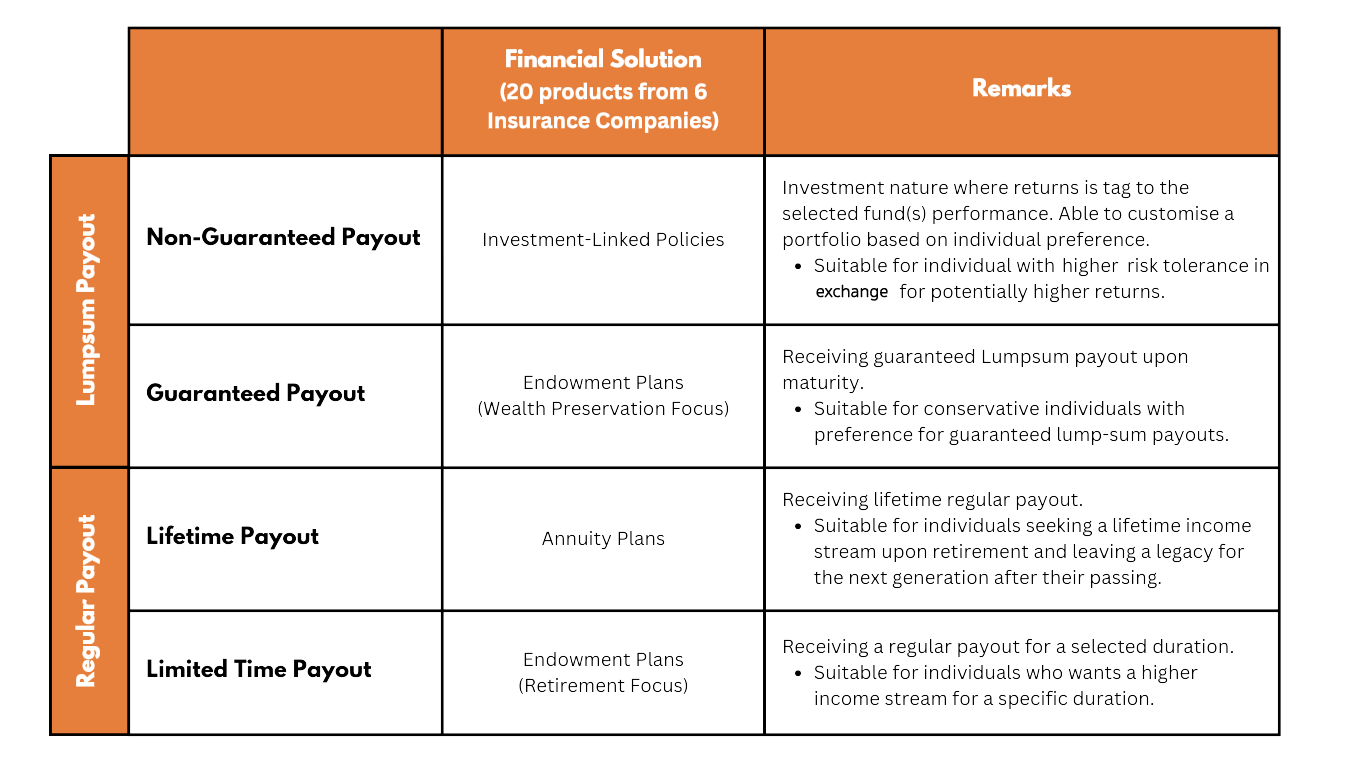

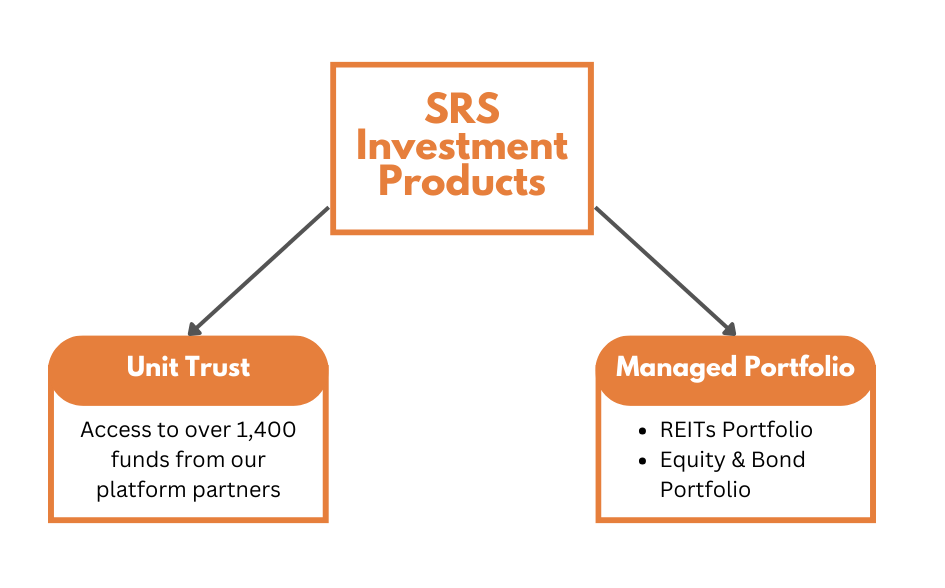

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

殷妮 | 新加坡跨境財富规划师

专业背景

作为 Financial Alliance(新加坡最大独立理财咨询公司)的资深顾问,我拥有15 年新加坡在地经验和丰富的财富管理实践。在加入金融行业前,我曾在全球 50 强科技企业工作 8 年,这段经历让我深刻理解科技精英和新加坡新移民的财务需求和挑战。

过去 5 年,我已成功服务超过 1500+ 家庭的财富规划需求,帮助他们改善财务状态并达成财务目标。我持有多项国际认证,包括新加坡跨境财富规划师、国际金融理财师(AFP®)、国际遗产规划师(AEPP®)和Fee-Based咨询顾问资格。

专业服务

我专注于为客户提供全方位的财富管理解决方案,包括:

- 全球资产配置规划:根据客户风险偏好和目标,设计多元化的全球投资组合

- 家族财富传承方案:通过专业工具和策略,确保财富顺利传承给下一代

- 退休财务规划:量身定制退休策略,优化CPF和SRS,确保退休生活无忧

- 保险组合优化:分析现有保障,消除重复覆盖,填补保障缺口

- 个人所得税筹划:合法优化税务结构,最大化税后收益

服务理念

我的服务建立在三个核心价值观之上:

1. 专业定制:每位客户都获得完全个性化的财务方案,而非标准化产品

2. 长期陪伴:我注重与客户建立长期信任关系,随时调整策略以适应人生变化

3. 简明透明:我以简单直接的沟通风格,确保客户完全理解每个财务决策

客户群体

我目前主要为这些客户群体提供咨询服务:

- 科技行业精英和企业管理层

- 高收入专业人士

- 新移民家庭

- 成功创业者

- 关注财富传承的家庭

- 新加坡本地企业

联系方式

- WhatsApp:+65 92399908

- 电子邮箱:yinni@fapl.sg

- 微信:Yinni-sg

- LinkedIn:https://www.linkedin.com/in/ni-yin/

- 官方主页:https://engage.fa.com.sg/yinni/

- 预约咨询:https://wa.me/6592399908

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.