Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

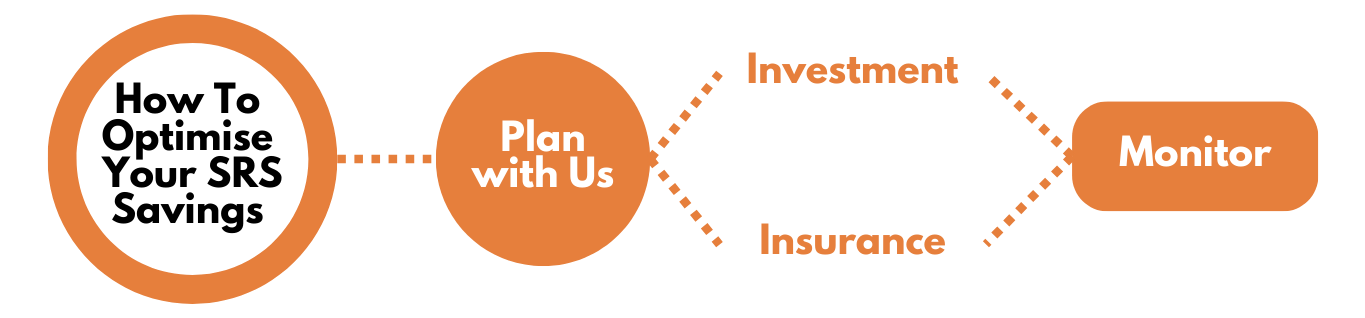

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

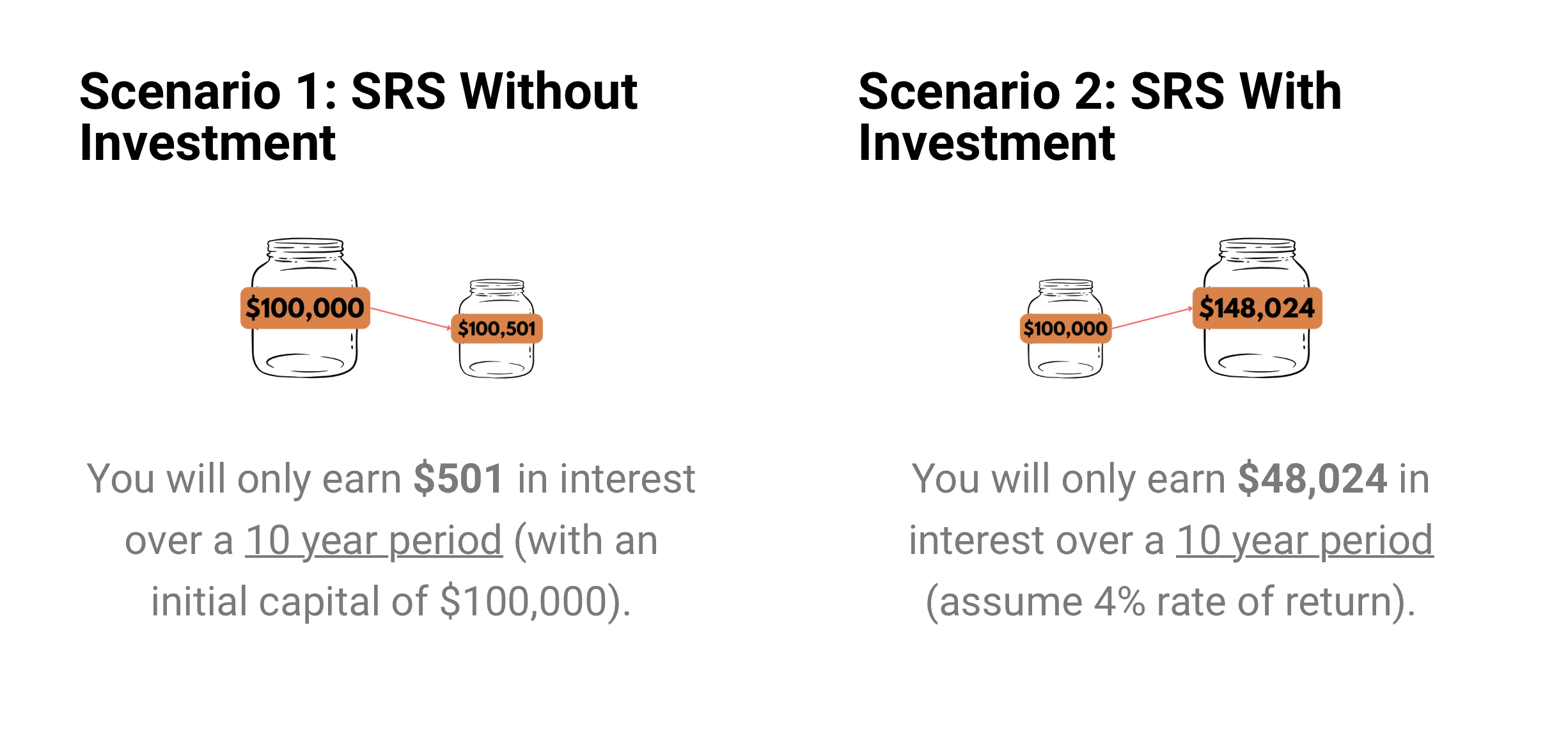

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

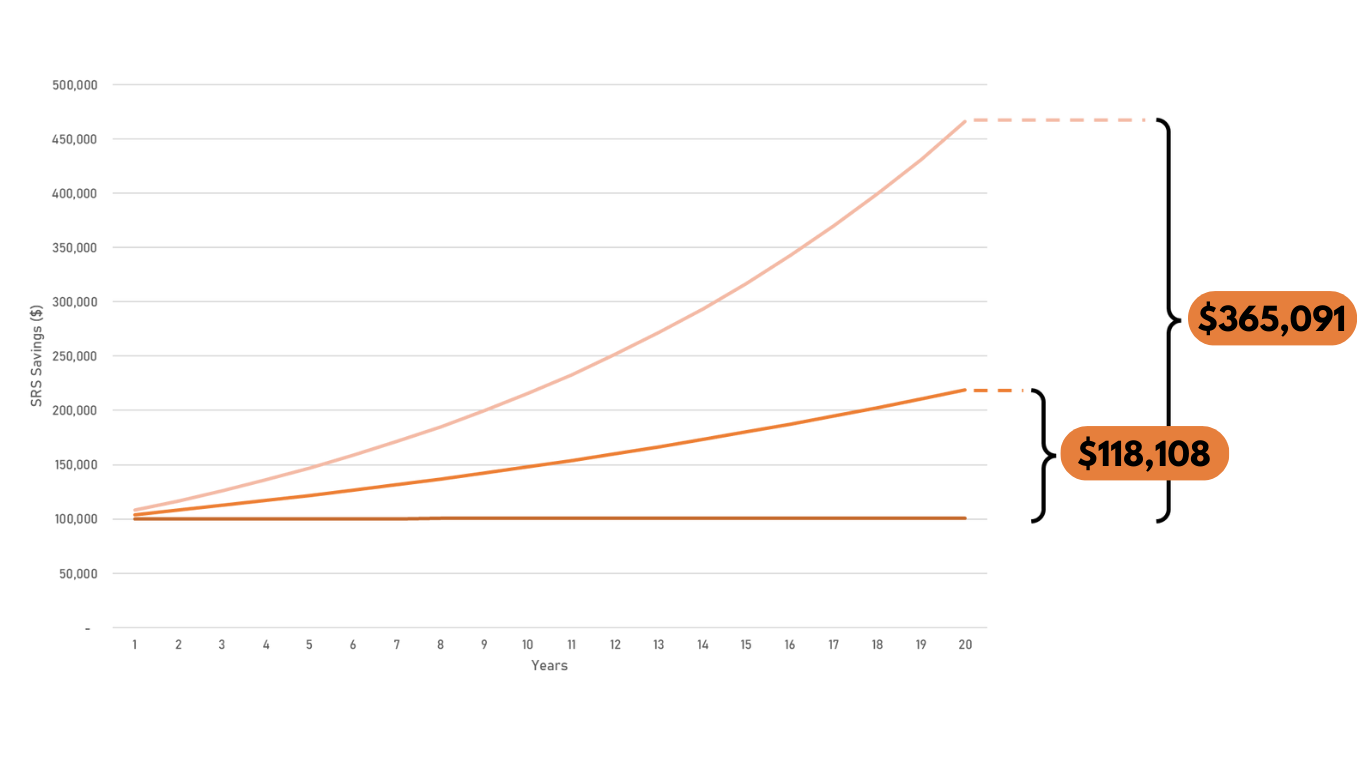

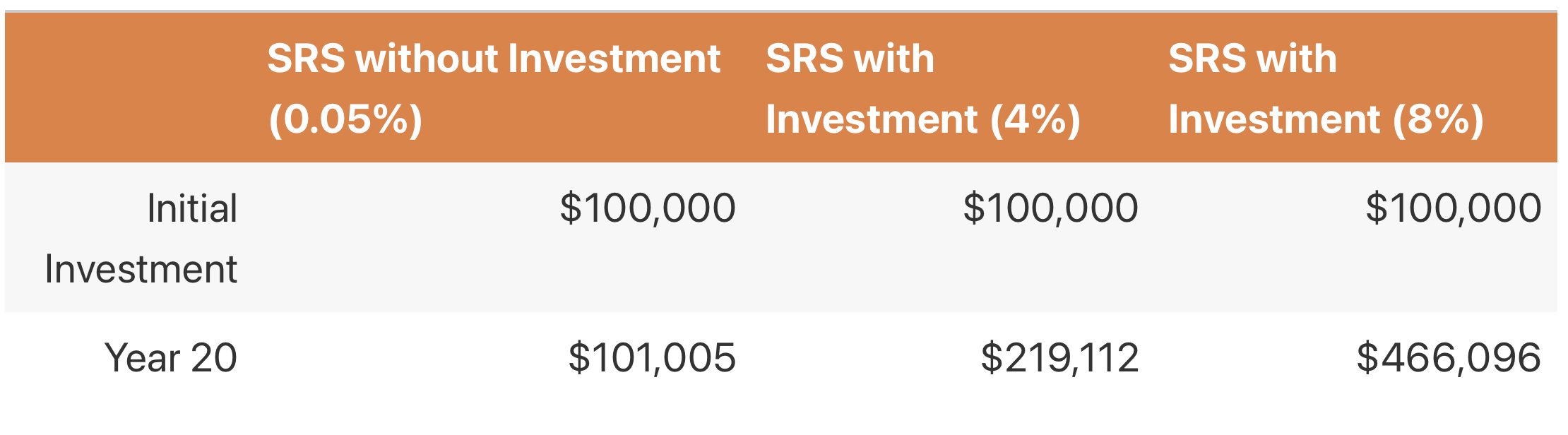

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

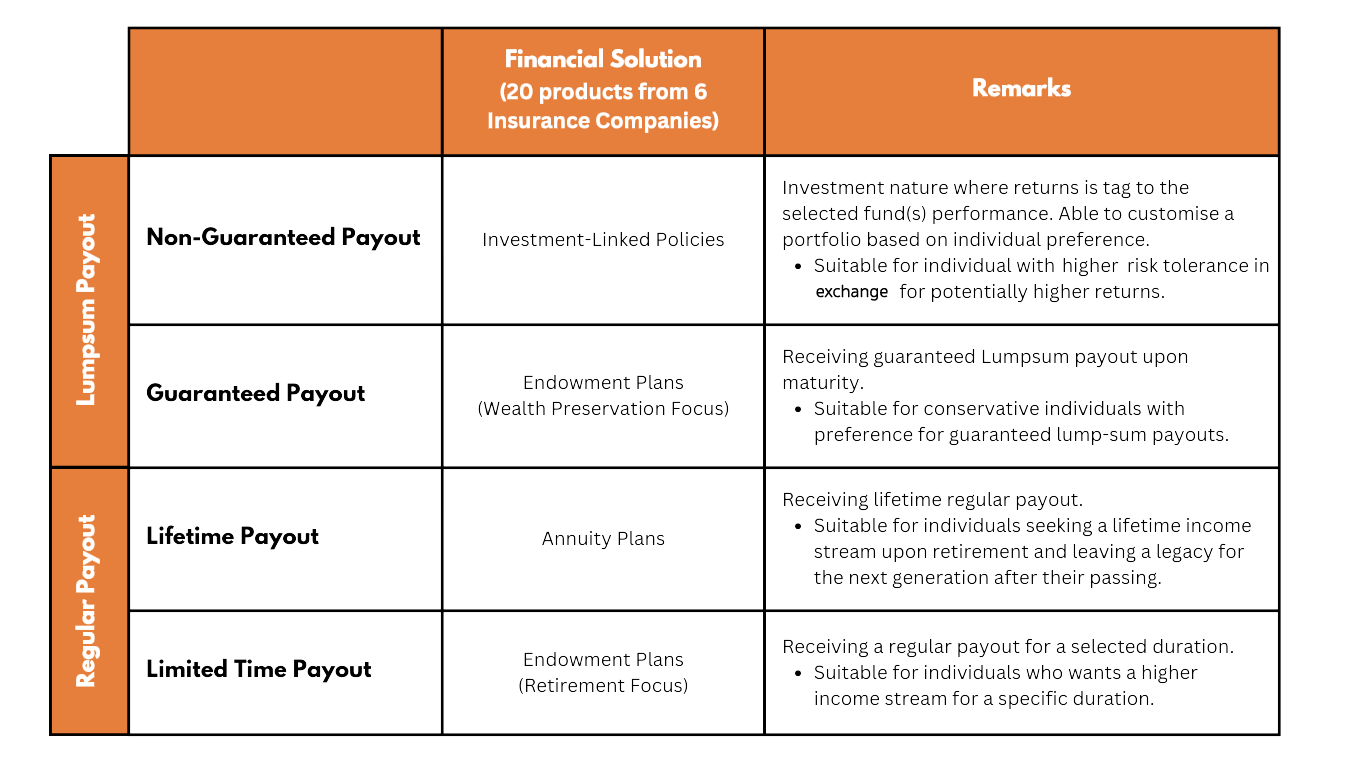

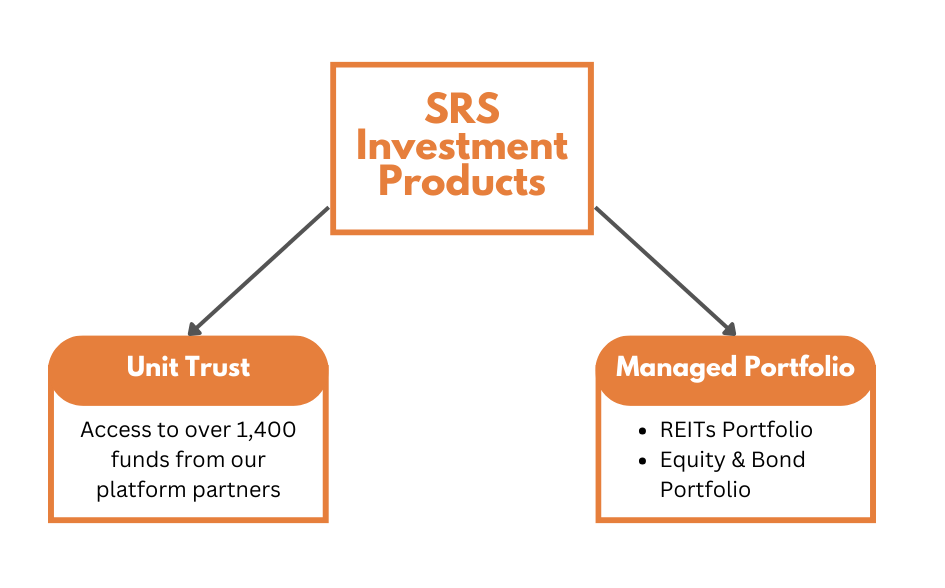

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

大家好,我是一位理财顾问代表,致力于帮助人们为他们的亲人留下珍贵的财富传承。我深信,我们每个人都应该思考如何在我们离开这个世界之后,给我们所爱的人留下一份真正有意义的遗产。

作为理财顾问,我致力于帮助人们制定个性化的财务计划,以确保他们的财富能够持续增长,并为他们的亲人提供长远的福利。我不仅关注投资和财务策略,还注重风险管理和遗产规划,以确保财务目标得以实现。

我相信任何人都可以通过该财务规划实践来取得财务上的成功,并保障爱的人。

我了解每个人的财务需求都是独特的,因此我会与您合作,深入了解您的目标、价值观和优先事项,以制定适合您的个性化解决方案。我将与您建立信任和长期的合作关系,以便您能够安心知道您的财务未来处于专业的指导之下。

我的目标是帮助您建立一个可持续的财务基础,让您的爱人们在您离开后能够继续过上安全、舒适的生活。无论是教育基金、养老金、保险计划还是遗产规划,我都将为您提供专业的建议和全面的支持,确保您的财务遗产能够为您所爱的人提供持久的帮助和支持。

如果您希望为您的家人建立一个有意义的财务遗产,我很愿意为您提供帮助。请随时与我联系,我们可以共同制定一个符合您需求的财务计划,以确保您的遗产能够为您所爱的人留下一个可贵的传承。

联系我 😊

Hello everyone, I am dedicated to helping clients achieve financial security, plan for their future, and preserve their legacies.

I provide comprehensive and personalized advice to help clients navigate the complexities of their finances and make informed decisions.

As a financial consultant, my primary goal is to help individuals like you to achieve your financial objectives and lead a financially stable life.

Secondary, to build a sustainable financial foundation that allows your loved ones to continue living a secure and comfortable life after you're gone. I work closely with you to develop tailored financial plans that encompass short-term and long-term goals. Whether it's retirement planning, investment strategies, or debt management, I offer professional guidance to optimize financial growth and minimize risks with comprehensive support

I believe that anyone can achieve financial success through the practice of financial planning and provide security for their loved ones.

Contact me

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

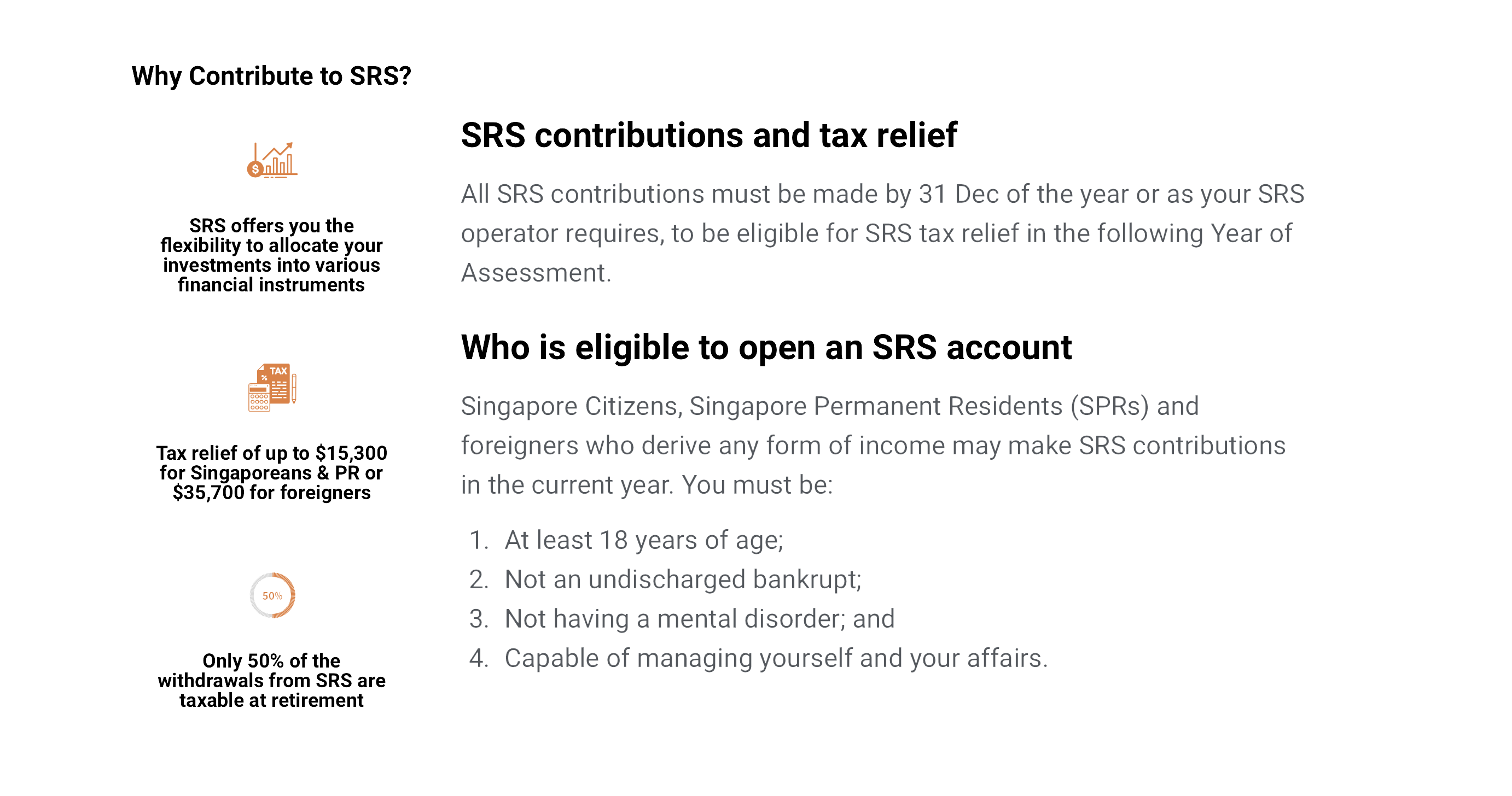

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.