While we work hard and do our best to give our loved ones the very best life possible, we also need to acknowledge that there are some things beyond our control.

If the worst were to happen, we want to make sure that we have done everything in our power to make sure that our loved ones will still be well taken care of – even if we are no longer around.

Thus, ensuring that we are adequately protect against the risk of death is an important part of responsible financial planning. One of the most effective and cost-effective financial instruments favoured by financial advisers is the known as term life insurance policies.

This resource seeks to explain how term life policies work, what features to look out for, and a premium cost comparison to better understand how much such coverage would cost you.

What is the Purpose of Life Insurance (and Do You Really Need It)

A life insurance policy provides a cash payout when the life assured passes away during the period the policy is in force. This money is typically meant to help beneficiaries cope with the loss of income of the deceased and settle any outstanding liabilities.

Common examples of what people buy life insurance to cover include the cost of their child’s education, funds needed for parents’ retirement, outstanding mortgages, as well as household expenses to help tide the family through and give them sufficient time to adapt to a new lifestyle or establish alternative income sources.

Beyond pragmatic financial reasons, some people see life insurance as a way to leave a legacy for people or causes that matter to them, such as their families or charities. In this way, they will be still be able to make meaningful contributions for years to come through their gift.

Even though the insured event is primarily death, it is common to see term life insurance policies have riders that make an early payout in the event the insured person is diagnosed with a severe chronic illness or suffers from total permanent disability (TPD).

How Much Life Insurance Coverage Should You Get?

One important decision you need to make is to decide how much coverage you need. This decision should be carefully considered.

If your coverage is too low, those who depend on you may find that they are still in a financial pinch – especially after deducting your existing liabilities and fees from your estate.

If your coverage is too high, then you may be dedicating too much of your existing financial resources to something that is highly unlikely to happen, thus handicapping your other financial goals.

There is no one-size fits-all answer to the question of how much life insurance coverage you require, so we recommend you speak to a trusted financial advisor representative to get trusted advice.

After a proper deep dive into your assets, liabilities, aspirations and values, you will be able to get a better sense of how much life insurance you can afford and how much coverage it makes sense for you to buy.

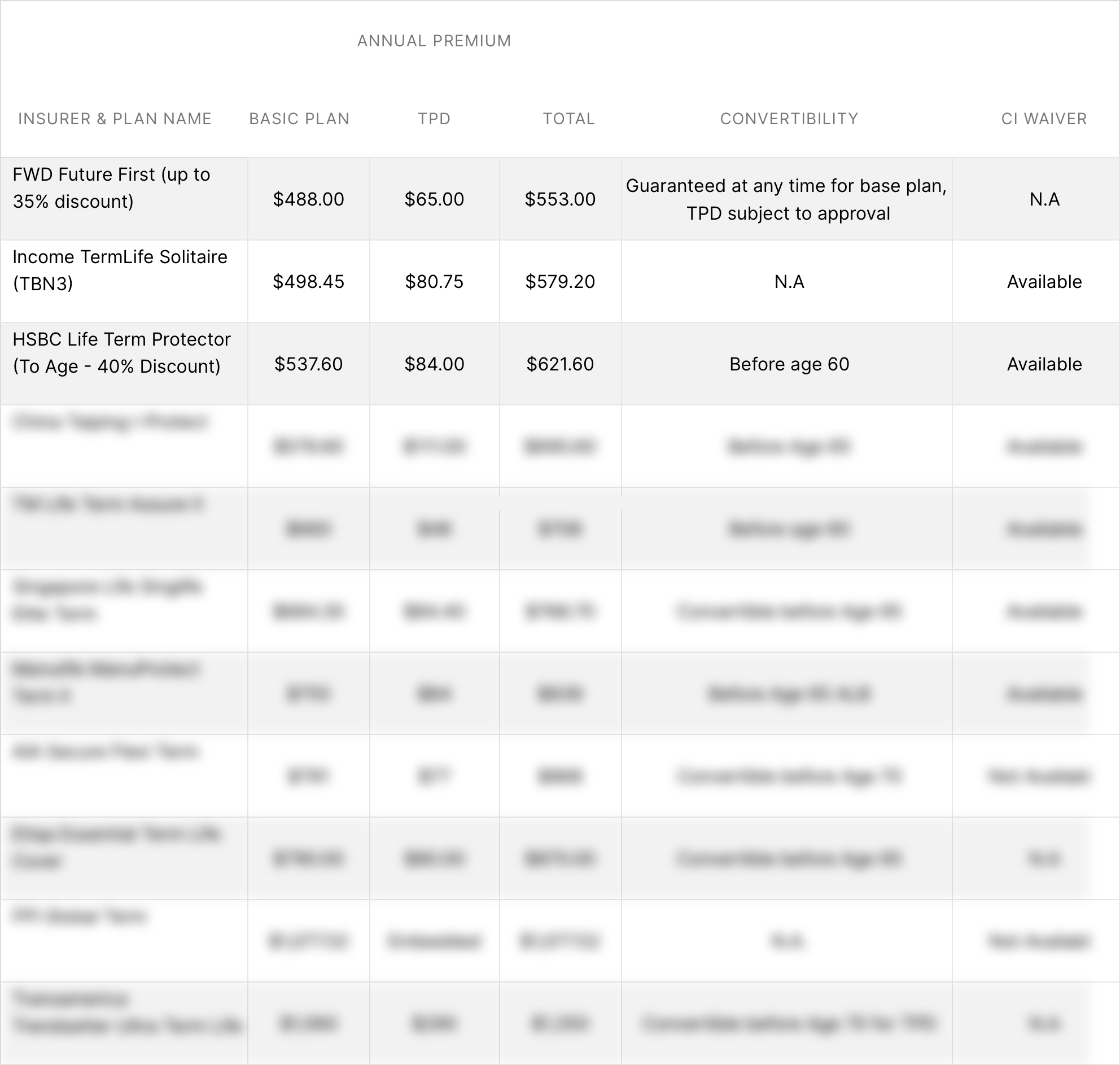

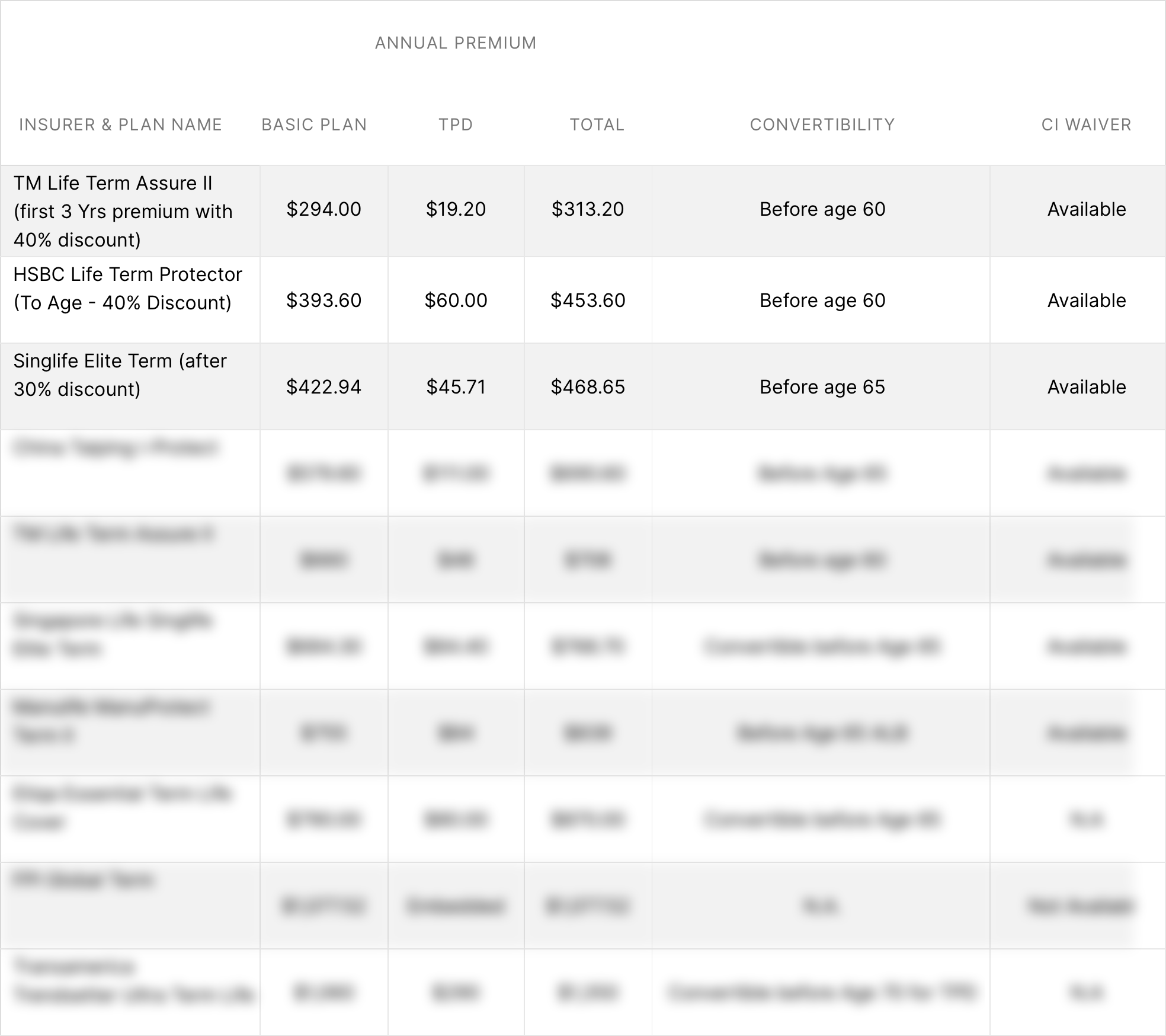

How Much in Premiums Do Term Life Insurance Polices Cost?

Price is undoubtedly a key consideration when choosing a term life plan. After all, it is something you would be paying for years (and even decades) to come. As you will see, these costs do add up and can amount differences of thousands of dollars over the plan’s lifespan – of years, if not decades

As a basis of comparison, the following parameters have been set.

Sum Assured: SGD $1 million for Death and Total Permanent Disability (TPD)

With growing prices of property prices and rising cost of living, a sum assured of $1 million is increasingly a need, rather than a good-to-have in order to ensure that one’s dependants would not be saddled with a huge amount of debt in the event of one’s untimely demise.

For all plans presented, there is 100% payout of the sum assured in the event of total permanent disability (TPD). This is provided by riders on top of the basic plan, some of which are mandatory.

Policy Coverage: Until 65 Years of Age

Many policies do not offer coverage beyond the age of 65, and even those that do charge an exorbitant price for doing so. Aside from cost, we also assume that at this age, much of one’s financial obligations would have already been fulfilled, and thus there might not be a strong need for as much term life protection.

No Premium Loading or Discounts

The prices shown assume no loading due to increased pre-existing risk, and omits time-limited discounts that insurers sometimes provide. This is because while these discounts can be substantial, they might not always be available, and thus might skew the comparisons unfairly.

MALE Non-Smoker ANB 30 / Policy Term: Till age 65 / Sum Assured: $1,000,000

Renewability only for Income TermLife Solitaire (TBN3) of up to ALB100 for basic plan and ALB 70 for TPD rider, and Transamerica Trendsetter Ultra Term Life of up to ALB100 for basic plan and ALB 70 for TPD rider,

FEMALE Non-Smoker ANB 30 / Policy Term: Till age 65 / Sum Assured: $1,000,000

Renewability only for Income TermLife Solitaire (TBN3) of up to ALB100 for basic plan and ALB 70 for TPD rider, and Transamerica Trendsetter Ultra Term Life of up to ALB100 for basic plan and ALB 70 for TPD rider,

Term Life Policy Features and Riders You Should Look Out For

While cost is undoubtedly the most eye-catching – and thus the focus of many online articles comparing various term life policies – it is important to keep in mind that while they are more similarities than differences, there are still nonetheless significant between policies offered by various insurers.

For example, some plans have unique features that might not be easily captured by a comparison table, and so we have endeavoured to highlight some of these features below.

Insured Event: For life insurance, the primary insured event is the death of the insured. However, it is common to have riders that provide payout when the insured suffers from Total Permanent Disability (TPD). Some plans also provide full/partial payouts upon diagnosis of a terminal illness or terminal cancer.

Renewability: This feature means that the policy can be renewed after the initial policy term expires. However, note that even if a plan might be renewable, the premiums might go up and the insured might be required to undergo underwriting and medical screenings.

Coverage Amount: Even if you are willing to pay for it, the coverage amount an insurer is willing to grant you may be lower than what you hope for, especially if there are factors like age and poor health.

Minimum and Maximum Entry Age: This refers to the age of the insured has to be when purchasing a new policy. Some plans allow entry from as young as one year old, while others require the insured to be of age 18.

Riders: Total and Permanent Disability, Advance Stage Critical Illness, Early-Stage Critical Illness, Disability Income, Multiple Claim Critical Illness, Personal Accident, Payor Waiver, Convertibility

Payment Terms: Monthly and annual premium payments are common payment terms, but some plans allow you to finish paying premiums for the whole policy sooner, such as in five or ten years, and then enjoy worry-free coverage for the remaining duration of the policy term.

Currency Denomination: Most term insurance policies sold in Singapore are denominated in SGD, in which premiums and payouts are made in SGD. However, there are also some plans that are denominated in a range of foreign currency, such as USD and GBP.

The Best Way to Buy the Best Term Life Policy For You

It should be clear by now that even for a seemingly ‘simple’ product like a term life insurance plan, there are still differences across what is offered by insurers.

If you are considering a term life insurance policy, we suggest you #ChooseQuality by speaking with a financial adviser representative who can provide you with trusted advice that is detailed, cost-efficient plan tailored to your life goals.

All information on premiums and product features are correct as of 12 June 2023.