Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

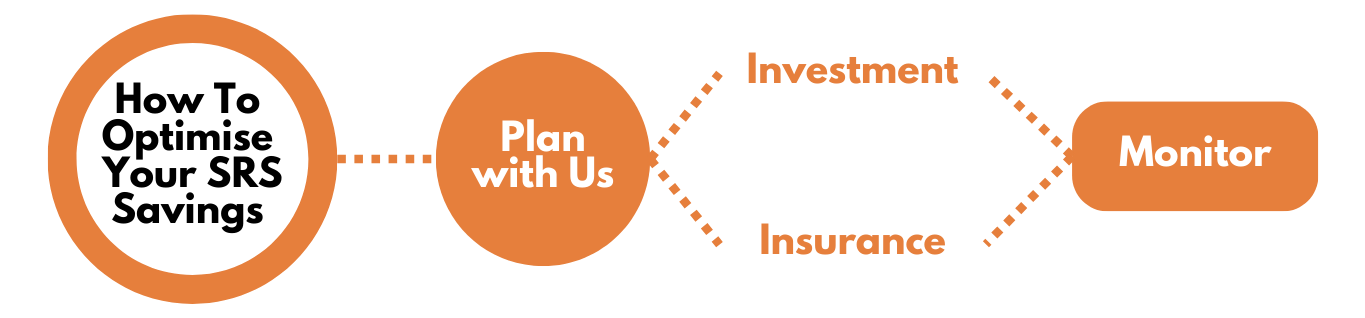

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

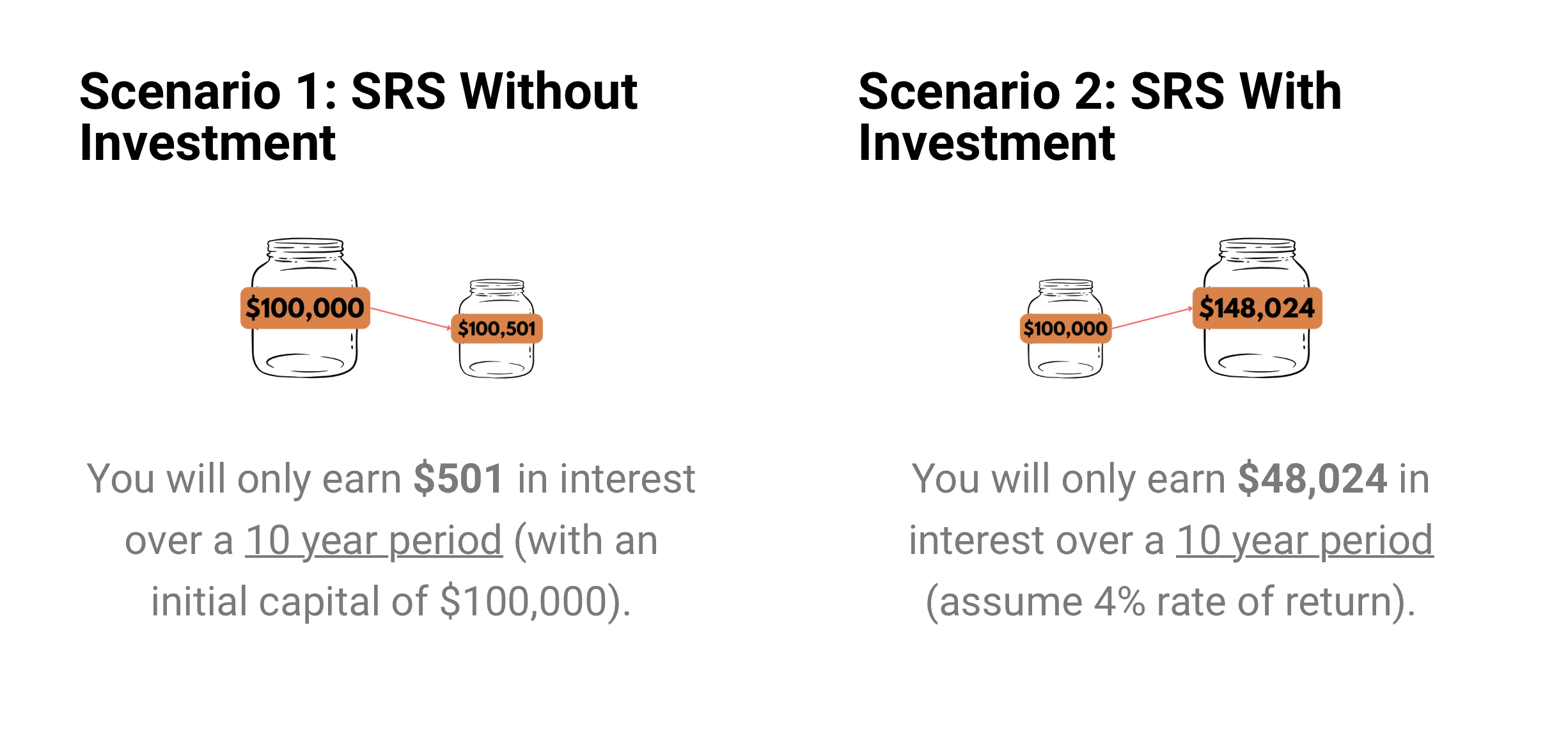

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

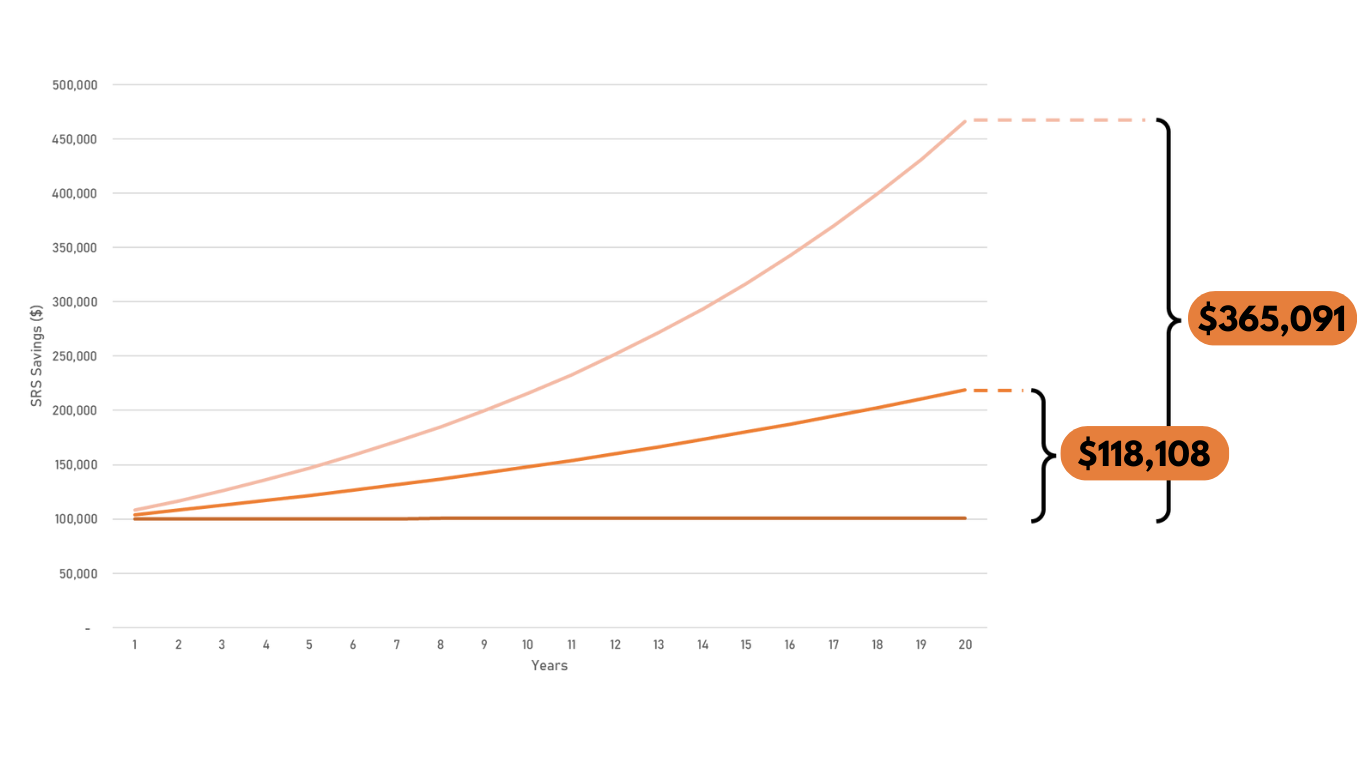

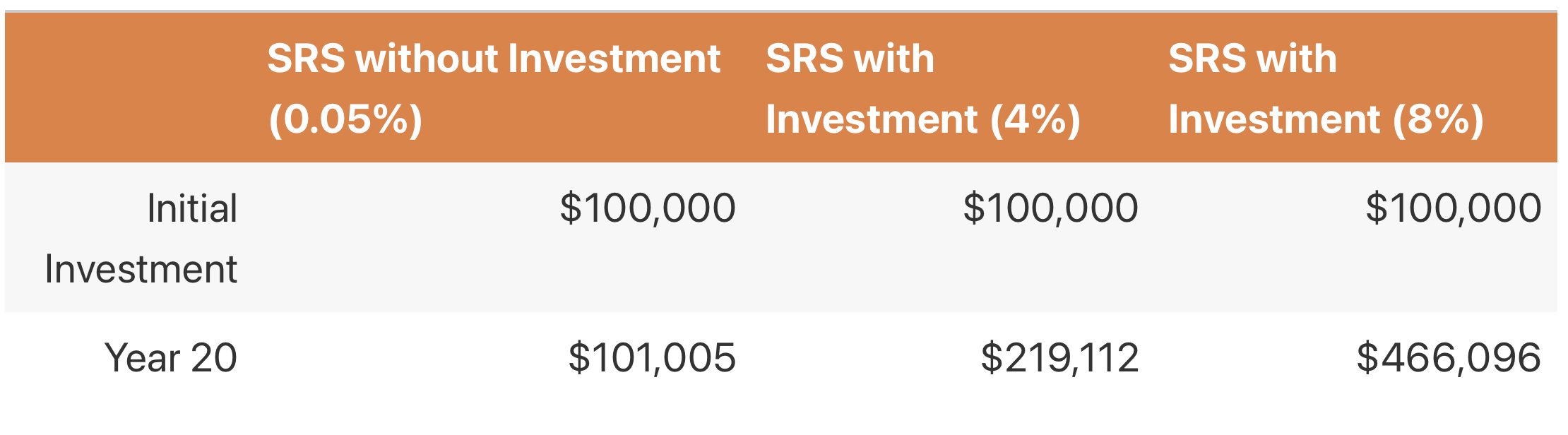

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

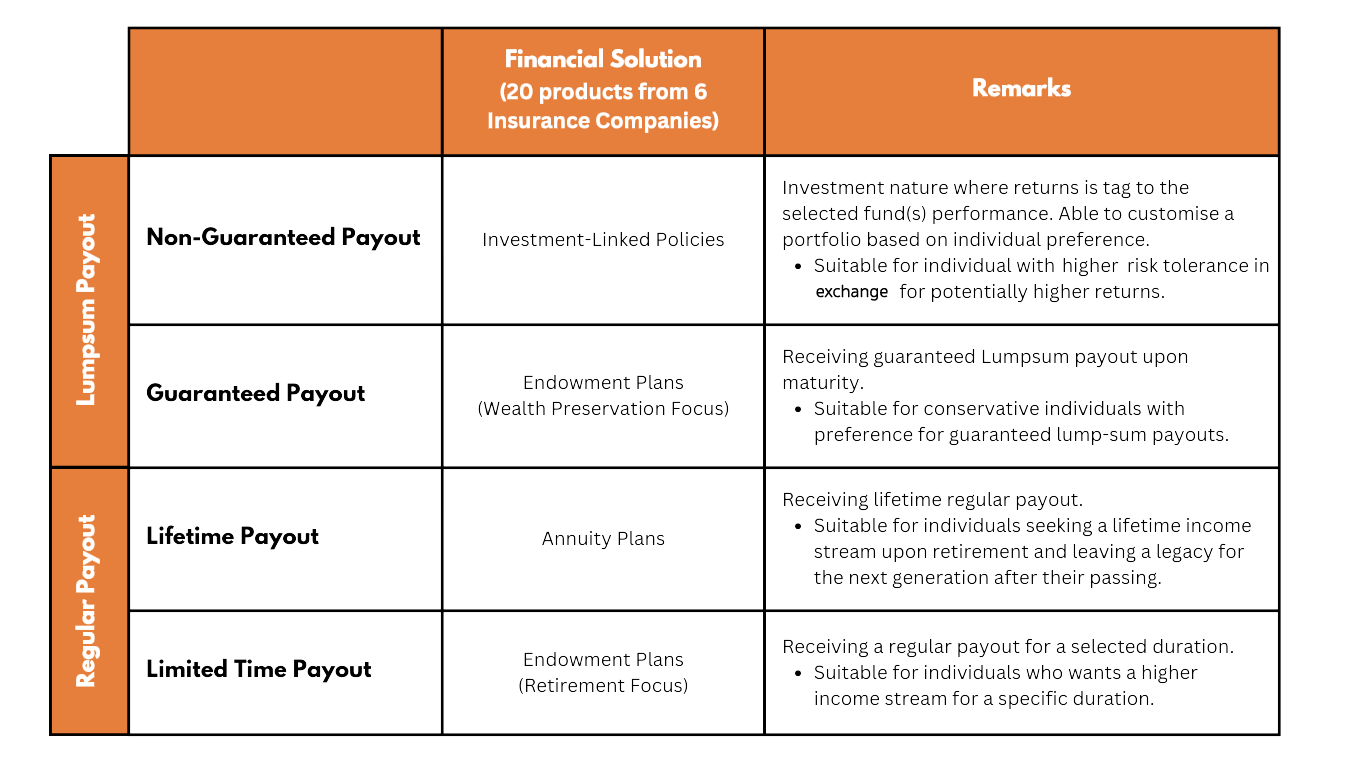

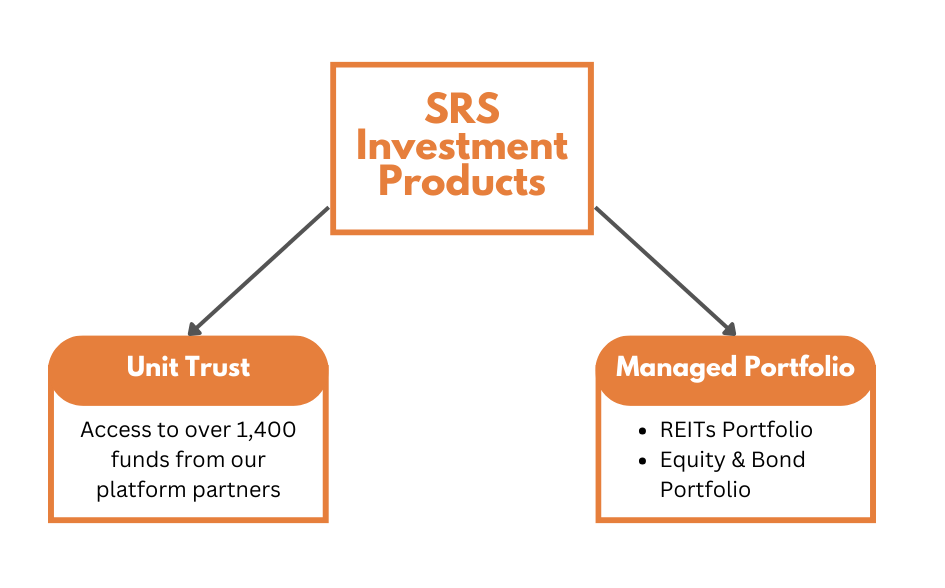

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

Since young, the dream of being a medical doctor has always been in my heart and following closely to my Secondary School mottoes – 礼义廉耻 忠孝仁爱 Courtesy, Righteousness, Integrity, Sense of Shame, Loyalty, Filial Piety, Humanity and Love, that mould my principles and attitude in life. However, life was endless challenge to me. Starting from my late elder brother going through 9 yrs of kidney failure then passing on at age or 30, then my beloved late maternal grandmother who struggled through 20 tormenting years of renal dialysis. In between was my mother who suffered 2 episodes of cancer and father’s business gotten into severe problems. Just like what the wise man’s words, if it did not kill you, it only make you stronger – exactly how I reminded myself to stay positive and engrained in myself that Integrity and Humanity are important aspects I hold tightly in my life along with other 6 values.

Initially, I was an Engineer in a Japanese Company and then after 13 months, I started my career in Financial Services with the objective of being a Financial Planner, instead of just being an Insurance Sales Agent.

I finally got my chance to walk away from the Insurance Industry when I was licensed by MAS to be a Financial Adviser Representative with Financial Alliance, Singapore’s largest Independent Financial Adviser (“IFA”). Now, I can truly render unbiased and genuine financial advice to my clients, friends and their loved ones.

In 2007, I met my mentor. He taught me what is true and genuine Client-Centric Financial Planning. I spent almost 7 years mastering this approach. With my wonderful mentor, I finally learned to be who I have always wanted to be – a Client-Centric Financial Planner.

“Sincere”, “Genuine”, “Honest” and “Helpful” are the common feedback I get from my friends after they have met up with me and later, engage my services to assist them in their Financial Well Being.

With the support of Singapore’s largest IFA Firm, I am able to provide the most comprehensive Financial Services catered to the needs of today’s consumers.

We work with Banks, Insurance Product Manufacturers, Wills & Trusts Companies, Fund Managers and Investment Platforms to address your various concerns throughout your life journey.

We do not replace your lawyer, accountant or anyone else. Instead, we work with them and ensure proper integration of your financial plans.

For a NON-Obligatory Exploratory Discussion (ED), do contact me at tc90056479@yahoo.com.sg.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.