Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

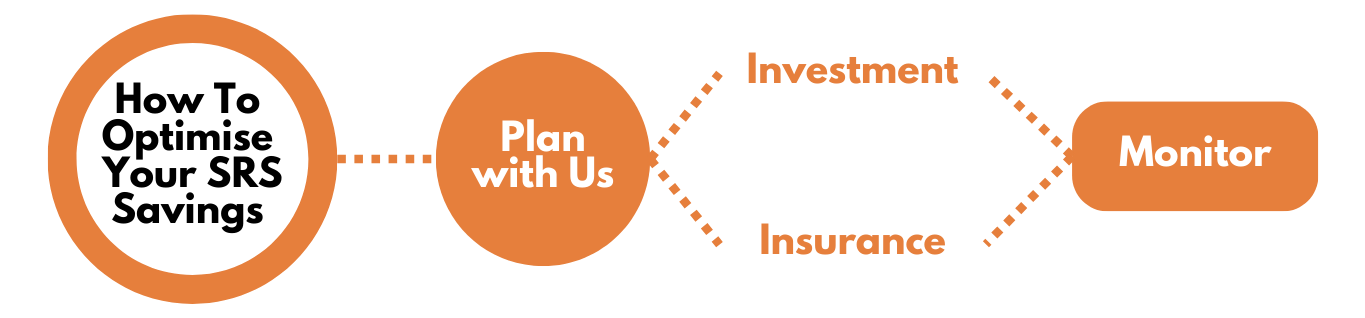

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

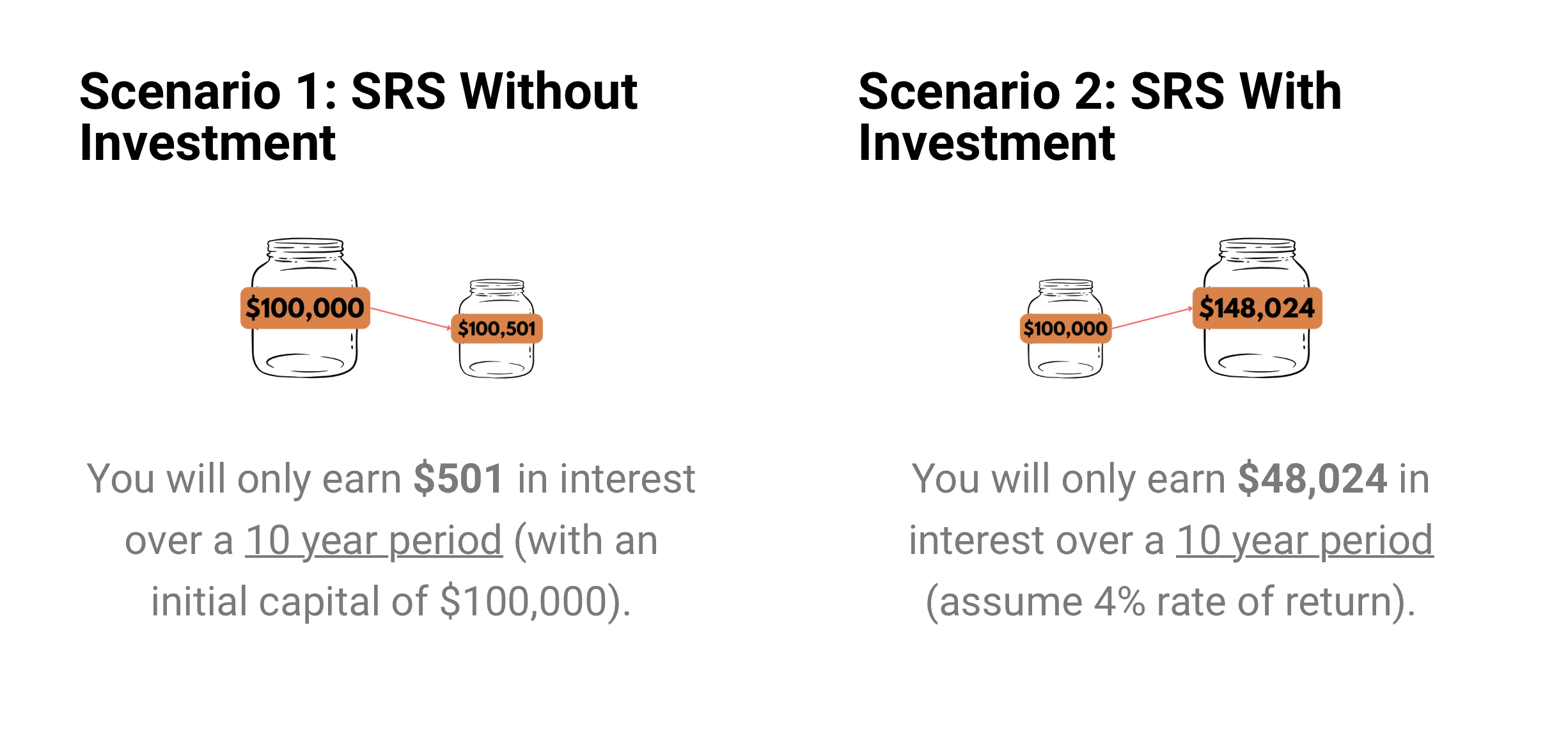

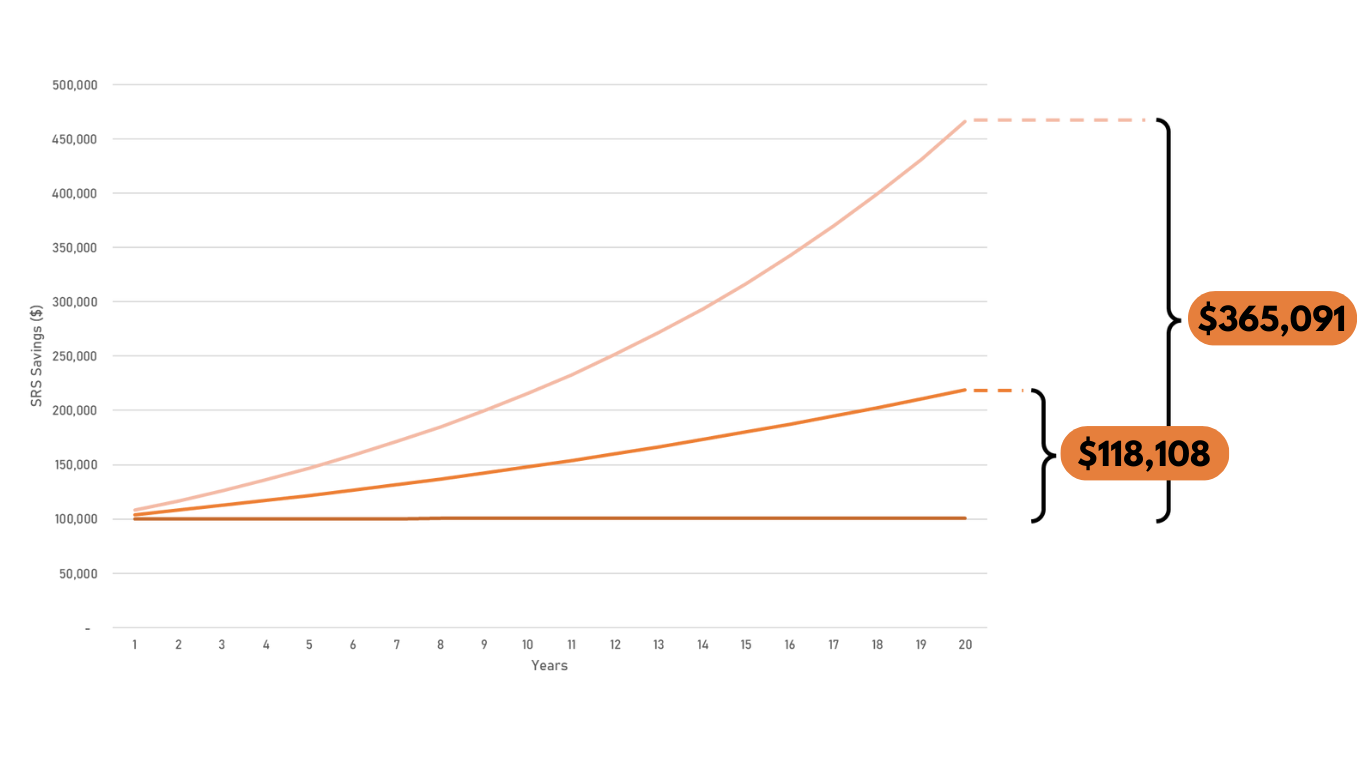

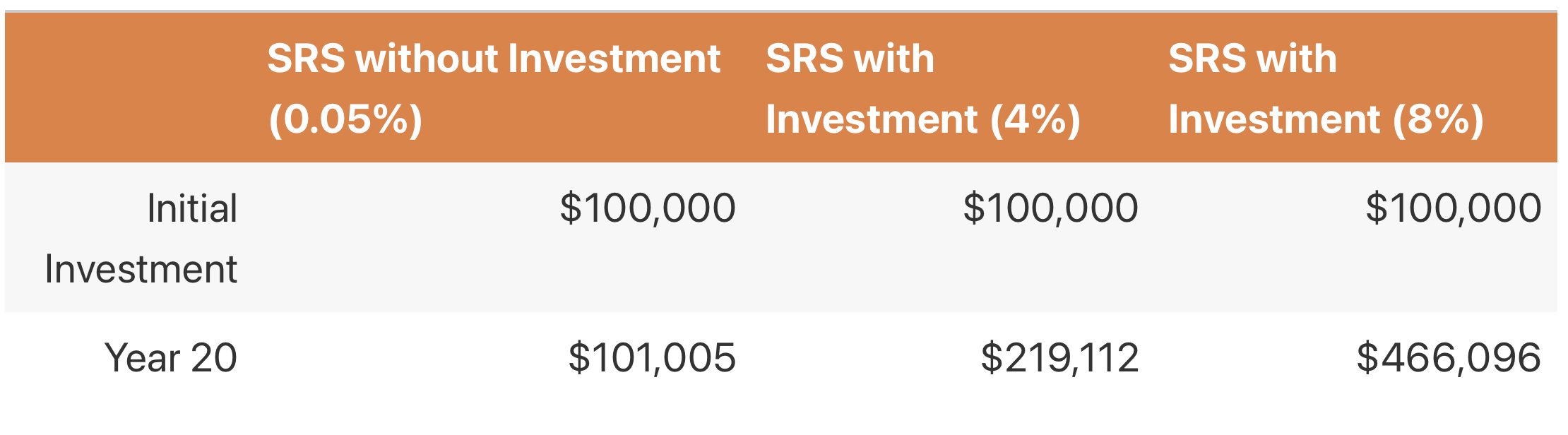

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

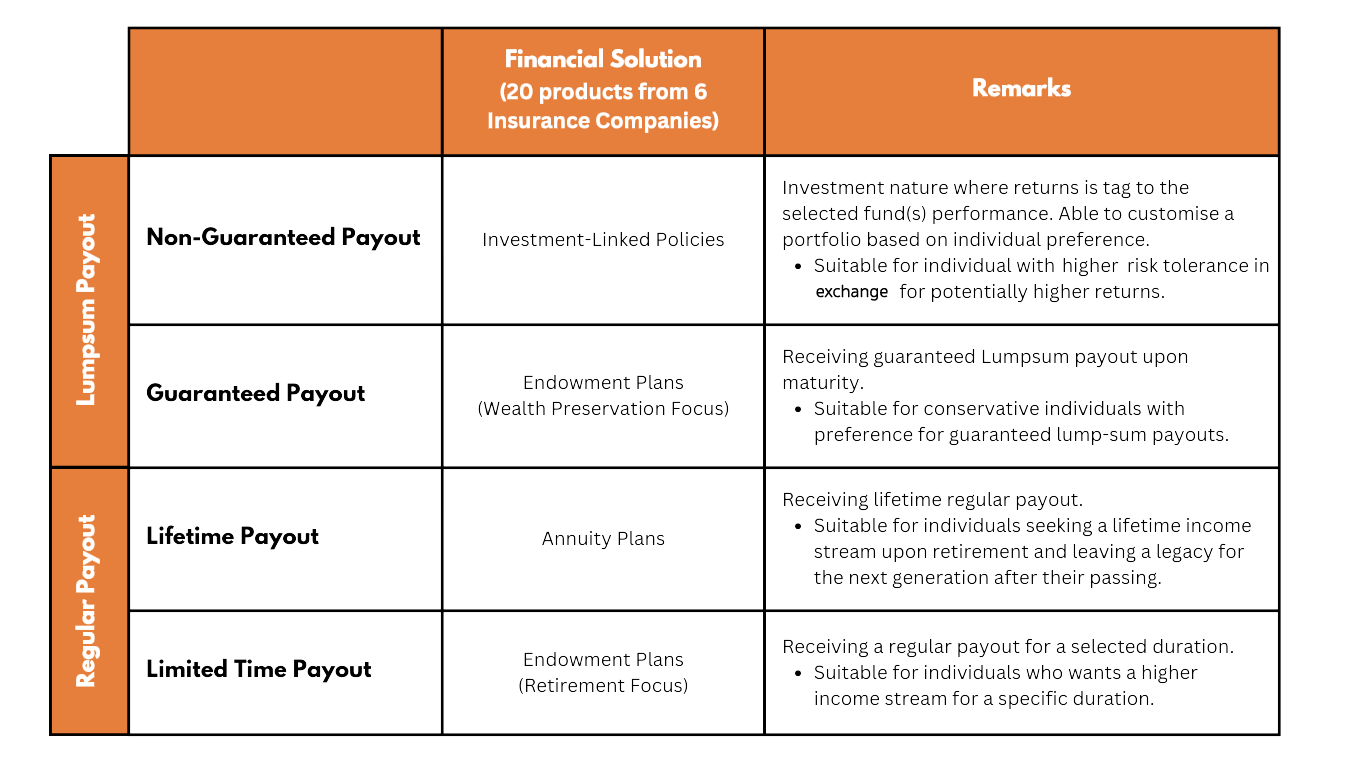

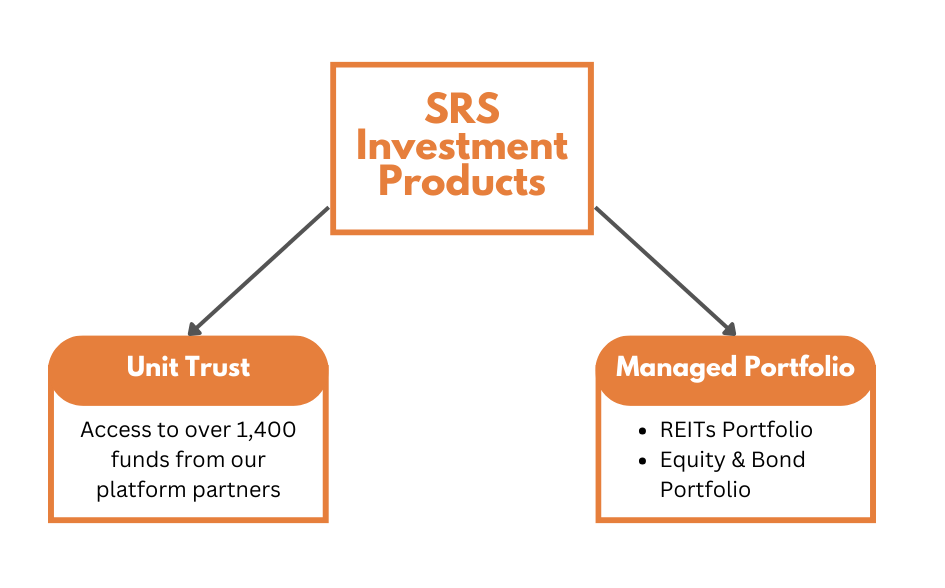

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

👋 Hi, I'm Lawrence Koh from Singapore!

I'm an independent financial advisory practitioner with over 15 years of experience in wealth management since 2009. What I love about my work is that I represent clients' interests, not those of financial institutions. My goal is to help clients find the best solutions to meet their financial goals while minimizing wasted time and money. 💼💡 (Its never about how fast you run, its about whether are you running to the right direction because U-turn is costly in money and time)

What I love about my role is able to represent my clients’ interests, rather than the interest of financial institutions'. My goal? Helping clients achieve their financial objectives while minimizing wasted time and money. 💼💡(Its always comforting for me as a practioner to know that i do not need or be forced to promote any financial product for any particular financial institutions in the course of financial advisory work for my clients.)

Before this, I spent 9 years in the chemical industry 🌿⚙️, honing optimization and account management skills—skillset that now is key to optimizing financial portfolios and solving the living expenses challenge for my clients. 💸📉 (A winner is someone who recognizes his God-given talents, works his tail off to develop them into skills, and uses these skills to accomplish his goals. ~ Larry Bird)

Most people rely on active income (trading time for money 🕒), but this approach isn't sustainable, as our earning years are shorter than our spending years. I help clients reduce resource wastage and use their surplus to generate passive income 💰📈 thru both investment and non-investment strategies, moving them toward financial freedom.. (I have 3 competitors....They are Illness, Retrenchment, Reductant... I have to compete with these 3 competitors to reach my client and help them create passive income before my competitors reached them because my competitors will disable them from selling time for money...)

I believe earning money is a full-time job, and so is optimizing wealth. Many people fall short because they manage their wealth part-time. My mission is to elevate households to million-dollar levels 💼🏡 through my proprietary financial freedom planning. After all, a million dollars is just $50k per year for 20 years—a modest sum considering future inflation 📉. (Have you seen anyone who work part-time in your company and was being promoted to senior position...)

My mantra: "Wealth Optimisation and Life Transformation." ✨🚀

Progression Outperforms Perfection

Financial freedom is possible with proper wealth management. I help PMETs (35-45) generate passive income to secure stability before retrenchment or retirement through a proven 3-stage financial freedom program:

💡 Stage 1: Optimize portfolios (maximize resources, minimize waste).

💡 Stage 2: Build a growth portfolio (balance risk, budget, goals).

💡 Stage 3: Convert it to passive income (sustainably fund living expenses).

If you’re responsible in nature and want to avoid becoming a financial burden to your family or subject yourself to the constant stress of retrenchment risk, let's work together to create alternative income streams and achieve time freedom.

Mentorship for Career Transformation

As an ex-mid-career switcher, I help others transition smoothly into building financial practices that create real value, not just products.

✳️ Mediocre salespeople sell products.

✳️ Good salespeople meet needs.

✳️ Exceptional salespeople offer what clients can’t live without!

What's your offer that clients can't live without? If interested in exploring this career, DM me to learn how to build a successful IFA practice that's fulfilling and rewarding.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's largest independent financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading independent financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are truly independent and MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreThe Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

You will not be allowed SRS tax relief if:

Your SRS account is suspended as at 31 Dec of the year of contribution; or

The amount of such contribution is withdrawn from your SRS account in the same year of contribution.

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits. Let us help you find the best investment vehicle that suit your needs.